Updated January 2023

This is a comprehensive guide to investing in gold in Australia.

In it we cover:

- The history of gold and Australia’s special relationship with gold…

- Is gold a good investment?

- Steps to consider before you invest in gold

- Factors influencing the gold price (in particular the gold price in AUD terms)

- ‘Paper’ gold versus physical gold — pros and cons

- An introduction to ASX gold stocks

- Where to buy gold in Australia

- Where and how to store gold in Australia

- Where and how to sell your physical gold

Gold is one of the oldest forms of trading wealth, and is known to be a bit of a long game.

There are times it may appear less relevant as newer forms of investing come along, and particularly when rising rates strip away gold’s allure.

That doesn’t mean you can’t potentially see big swings in price, particularly with some ASX gold stocks. But what it does mean is that investing in gold requires a certain long-term perspective — one that recognises the shiny metal’s unique history. With markets more chaotic than ever — we think understanding gold’s place in the monetary system is absolutely vital.

So, let’s dive in…

The history of gold and Australia’s special relationship with gold…

The history of gold and Australia’s special relationship with gold…

If you are a hardened gold bug, what follows may not be for you.

But if you are just getting started on your gold journey, then you’ve got some catching up to do.

A lot comes down to the fact that history has taught us that humans are magpies — plain and simple.

The gold story is far more complex than a simple affinity for shine…

It involves war and power and goes to the heart of where the monetary system is today.

The story started around 2600 BC, when the ancient Mesopotamians started forging gold jewellery.

Both buildings and people suddenly became adorned with the metal.

In 1223 BC the construction of Tutankhamun’s tomb was primarily done with gold — the richest man in the graveyard, indeed.

Some 500 years later, gold became the basis for the concept of money itself.

In 700 BC the first gold coins were created.

Now, instead of relying on barter arrangements (I’ll give you this for that), gold became a way to pay for things without actually handing over the goods in question.

In 564 BC King Croesus of Lydia started to improve refining techniques and the first international currency was born.

Gold suddenly became a way to fund conquest and in turn, organise ever more complex social arrangements.

Skipping ahead, after more than four millennia since its initial use in jewellery, the Gold Standard came about in 1871 after the end of the Franco-Prussian war.

During the period just before the Franco-Prussian war and the end of the Gold Standard, Australia established itself as a major source of gold.

Like the California gold rush, which started in earnest in 1849, between 1850–70 a flood of new immigrants reached Australia’s shores seeking fortune.

Significant deposits were later found in WA in the 1890s.

Subsequently, in 1899 the Perth Mint was founded — Australia’s third mint.

Australia then left the Gold Standard in 1931 along with Britain.

Over in Europe just before the end of the Second World War (1944), the Bretton Woods Agreement was struck — defining the post-war order.

After this agreement, countries fixed the dollar to gold at US$35 per ounce, while all other countries’ currencies had fixed — but adjustable — exchange rates to the dollar.

Gold via the US dollar was the arrangement.

The agreement lasted just 27 years.

Faced with domestic economic uncertainty, US President Nixon made his move.

In August 1971, President Nixon announced that the US would end on-demand convertibility of the dollar into gold for other countries.

Gold has traded freely on markets ever since.

Australia remains one of the largest gold producers in the world, as you can see in the chart below (data as of 31 December, 2022):

Source: gold.org

So — if you are into gold — Australia is probably the place to be.

A low-risk political environment coupled with a long history of mining experience and massive reserves are all part of the picture.

But let’s take a look at gold from an investment perspective…

Is gold a good investment?

Markets have a long memory, and gold is often viewed as a safe haven in times of financial distress.

While it may not play a role in the standard financial system anymore — it retains its value, especially to central banks.

Central banks use gold as part of their foreign currency reserves because it is highly liquid and its proven long-term returns.

If it’s good enough for the US Federal Reserve, it’s good enough for the Average Joe, right?

Now you may be thinking, how has gold held up against inflation?

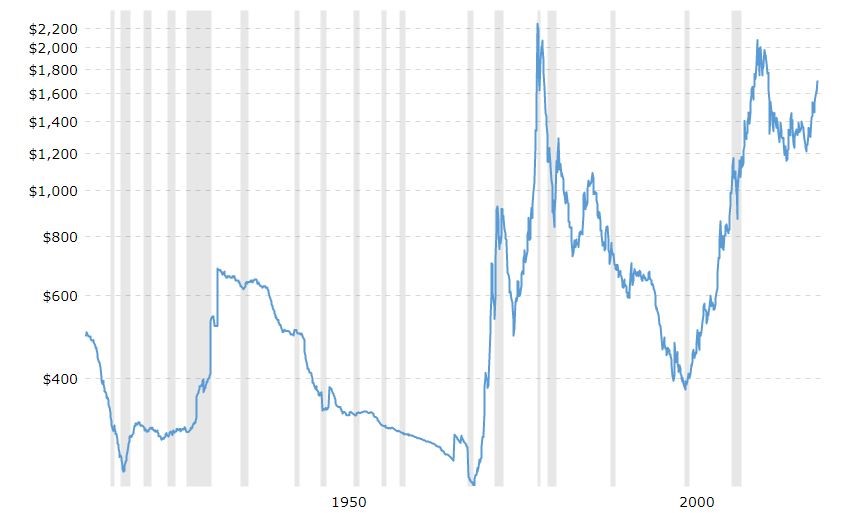

Well below is the long-term value of gold in inflation adjusted terms, with recessions marked in grey:

Source: macrotrends.net

As you can see, recessions don’t guarantee a rise in the gold price if you take a long-term view.

But the last three recessions have preceded a rise in the gold price, and that’s important to remember.

Thinking in terms of an investment, it’s important to think of gold as a long-term hedge against market chaos.

For many people, gold makes up a small part of their portfolio — and some hold none.

For us, gold is not necessarily about quick returns, but more about building wealth over a longer investment horizon.

We encourage you to have this mindset too.

Steps to consider before you start investing in gold in Australia…

As with any investment, set aside only what you can afford to lose.

Here are some important steps to think about:

- Consider your circumstances — i.e., how much do I have in cash right now?

- Am I prepared to lose some cash to invest in gold?

- Am I informed about the risks?

- Do I have the patience to see out my investment horizon?

With these in place, now for a bit about the factors influencing the gold price…

Factors influencing the gold price (in particular the gold price in AUD terms)

Here are some common factors influencing the gold price:

- Investment demand

- Value of the US dollar

- Jewellery, industrial, and consumer demand

- Central bank reserves

- Wealth protection

- Production

- Geopolitical events

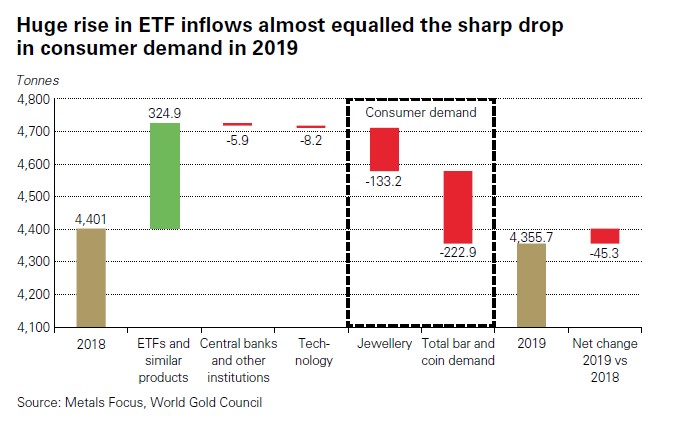

In good times, jewellery, industrial, and consumer demand takes hold as these luxury goods or practical applications are favoured.

But when things start to go wrong, wealth protection and investment demand comes into focus.

You can see that in 2019, ETFs were one of the major forces driving gold demand:

Source: kitco.com

And production of gold globally is starting to level off. It’s been hovering between 3,100–3,300 metric tonnes per year since 2015.

Remember, there is a finite amount of gold in the world.

As more and more of the ‘easy’ gold gets mined, production costs can influence the gold price.

Meanwhile, central banks like to hold gold as a guard against swings in the value of currency.

Low interest rates can cause currency to devalue, hence the move to buy gold as a hedge.

The value of US dollars also remains important because gold is valued in dollar terms.

A stronger USD generally puts downward pressure on gold prices and a weaker USD frequently spurs the gold price.

And similar to investment demand, wealth protection can drive spot prices of gold higher as more people turn to the safe haven in times of financial distress.

The last factor worth mentioning is geopolitical events.

This is the big one in our eyes.

The world is getting messier and more complex by the day, it seems.

Whether it’s the long-simmering US-China trade war, various threats to the big banks’ solvency, the development of CBDCs — there are a number of factors out there in the world that could drive people to gold.

The case for gold seems clear to us.

Which brings us to the ways you can invest in gold in Australia…

‘Paper’ gold versus physical gold — pros and cons

There is a form of gold known as ‘paper gold’ that some precious metals investors prefer to the physical stuff.

These are things like Exchange Traded Funds (ETFs) that have 100% exposure to gold price movements.

The reason why it is called paper gold is that ownership transfers of these ETFs were once completed on paper and you actually had a slip which conferred ownership.

These funds are required to hold gold assets in based on the amount of shares they issue.

‘Paper gold’ can be a useful tool to trade the gold price.

Now that gold can be freely traded on most major markets, its price experiences volatility at times, as with any other asset.

Sometimes swings in the gold price are as big as US$100 per ounce in a day.

Not all investors have the stomach for this type of gold investment.

Yet if this is something that interests you, gold-backed ETFs have been created for this purpose.

There are many ETFs listed in Australia now.

Here’s two examples of ETFs backed by 100% physical gold holdings:

- ETFS Physical Gold [ASX:GOLD]

- BetaShares Gold Bullion ETF — Currency Hedge [ASX:QAU]

These ETFs are priced in Australian dollars, meaning they include a currency hedge. A currency hedge means that the value of gold in US dollars has been automatically converted to Aussie dollars for an ETF.

That’s one of the benefits of buying gold ETFs listed in Australia as opposed to overseas exchanges.

The reason for this is simple: gold is priced in US dollars.

Australian investors have the double whammy of being exposed to gold price movements AND US dollar price fluctuations.

While this is part of the risk associated with buying and selling gold, it can add an unnecessary complication for investors.

By choosing ETFs with a US dollar hedge, the AUD/USD exchange rate has already been calculated for you.

In other words, what you see is what you get. Meaning you don’t have to fiddle around with your own calculations to figure out what the gold ETF is worth in Aussie dollars.

Here are the pros and cons of ‘paper’ versus physical gold:

| Pros | Cons |

| Easier to exchange (i.e., no need to visit a bullion dealer | Volatility and risk |

| Ability to trade geopolitical events | The gold is not directly ‘yours’ |

| More exposure to price movements | Counterparty risk — what if the fund goes bankrupt? |

And of course, investing in gold ETFs carries the same risks as any stock market investment. The value of your investment can go up or down at any time.

| Pros | Cons |

| Easier to exchange (i.e. no need to visit a bullion dealer | Volatility and risk |

| Ability to trade geopolitical events | The gold is not directly ‘yours’ |

| More exposure to price movements | Counterparty risk — what if the fund goes bankrupt? |

An introduction to ASX gold stocks

If you have a greater risk appetite, ASX-listed gold stocks offer another way to trade the gold price.

Movements in the share prices of these companies can magnify gains and losses on the gold price, as well as sink or swim on their own merits.

So, it’s important to understand what makes a gold stock successful.

There are more than 200 gold stocks on the ASX, so there’s plenty to choose from.

You have a mix of established giants, mid-tier producers, near-term producers, larger explorers, and junior explorers.

These can broadly be grouped into producers and explorers.

It’s important to understand the differences between the categories and what they do.

There’s a food chain in the Aussie gold stock world, and each company is trying to carve out their niche.

Run your operation well, or at least identify a significant resource, and takeover bids can ensue.

Now for the breakdown. Keep in mind, these market capitalisations are subject to change over time.

The biggest of the lot is Newcrest Mining [ASX:NCM] (soon to merge with Newmont Corporation [NYSE:NEM] to become the world’s largest gold producer, with a massive market cap of just over $23.3 billion at time of writing.

Newcrest’s operations span NSW, WA, PNG, and Canada.

The next step down is Northern Star Resources [ASX:NST], which has a market cap of $13.6 billion.

Their operations are located primarily in WA, but they do have the Pogo project in Alaska.

These two make up the ‘major’ category producing over 1 million ounces of gold a year.

A further step down, is a collection of what you could call large producers that deliver 500,000–1 million ounces of gold each year.

There is Evolution Mining [ASX:EVN], which has a market cap of $6.8 billion.

Their operations are located primarily in Australia, with a major operation, Red Lake Complex (the mine that turned Goldcorp into a multi-billion dollar giant) in Canada.

Other large producers include SSR Mining [ASX:SSR] ($4.7 billion), Perseus Mining [ASX:PRU] ($2.6 billion) and Regis Resources [ASX:RRL] ($1.2 billion).

Next is the mid-tier producers, which the ASX has several. These companies produce 150,000–500,000 ounces a year. Personally, this is my favourite class of producers as they offer the best reward to risk ratio.

They include Gold Road Resources [ASX:GOR] ($1.9 billion), Ramelius Resources [ASX:RMS] ($1.4 billion), Resolute Mining [ASX:RSG] ($800 million), Red 5 [ASX:RED] ($800 million), Silver Lake Resources [ASX:SLR] ($920 million), West African Resources [ASX:WAF] ($880 million) and Westgold Resources [ASX:WGX] ($780 million).

Then you have a smattering of larger explorers, that is companies that have latched onto a resource and are looking to grow it.

This includes companies like De Grey Mining [ASX:DEG] and Chalice Mining [ASX:CHN].

Finally, there are a large cohort of junior explorers, which we also cover.

A recent name in this category for example is Southern Cross Gold [ASX:SXG].

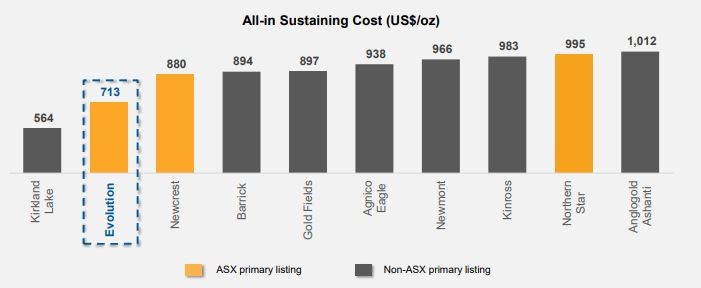

While they are not the only metrics by which to assess an ASX-listed gold company.

It is important to have a grasp on all-in sustaining cost (AISC) and ore grades.

AISC is similar to CODB or cost of doing business.

The price in USD/AUD gives you an idea about the efficiency of a company’s production.

Basically, what price in USD terms is needed to keep the business going.

Here is an example of how AISCs can be measured up against other companies:

Source: Evolution Mining Ltd

As for ore grades, it can all get complex quite quickly.

And geology is not the easiest of fields.

But as a rule of thumb, it is desirable to have gold closer to the surface as it is easier to mine.

Ore grades refer to the amount of gold per tonne of ore or g/t.

The World Gold Council says that for an underground mine, an 8-10 g/t grade is considered high quality, while 1-4 g/t is considered low quality.

These are just two ways of assessing producers and explorers respectively.

If you are considering investing in any of the above listed or other gold miners, it is important to do your own research and assessment and importantly, understand the risks involved with such investments.

How to buy gold in Australia

Getting gold in your hands can be daunting. For some, buying physical gold is taking that step into the unknown.

For you, it might be new. To your ancestors, however, gold was crucial to preserving wealth. So, where should you start?

You may be surprised to learn that there’s a thriving gold market on eBay!

And if you’re a first-time gold buyer, steer clear of eBay and stick with recognised bullion dealers.

Reliability is what counts with this kind of transaction.

There are many dealers spread across Australia, including:

- ABC Bullion — Sydney

- Gold Stackers Australia — Melbourne

- Australian Bullion Company — Melbourne

- Gold de Royal — Brisbane

- Ainslie Bullion — Brisbane

- As Good As Gold — Adelaide

- Perth Mint — Perth

Please note we are not affiliated with any of these dealers. These are just the largest bullion dealers in Australia.

The best way to get started is to visit your local bullion dealer, either in person or through their website. You don’t have to buy from a bullion dealer in your state.

Most of them will ship to any address, as long as you can sign for the delivery in person.

You can buy from a bullion dealer in Brisbane even if you live in Melbourne. Bullion dealers offer gold from various mints around the world, so shop around to see what you can find.

Be warned though: All bullion dealers must adhere to the same anti-money laundering as banks.

Which means that if you are buying online for pick-up in person OR courier delivery, your identity will need to be confirmed by a bullion dealer. Generally, a passport or driver’s licence is sufficient.

In addition, the AUSTRAC Anti-Money Laundering and Counter-Terrorism Financing Act 2006 applies to transactions over $10,000 (including equivalent foreign currency amounts).

Which means that you should be prepared. If you walk in with wads of cash over $10,000, the bullion dealer will have to report the transaction to AUSTRAC.

Where and how to store gold in Australia

Source: Evolution Mining

As for ore grades, it can all get complex quite quickly.

And geology is not the easiest of fields.

But as a rule of thumb, it is desirable to have gold closer to the surface as it is easier to mine.

Ore grades refer to the amount of gold per tonne of ore or g/t.

The World Gold Council says that for an underground mine, an 8–10 g/t grade is considered high quality, while 1–4 g/t is considered low quality.

These are just two ways of assessing producers and explorers respectively.

If you are considering investing in any of the above listed or other gold miners, it is important to do your own research and assessment and importantly, understand the risks involved with such investments. Investing in gold stocks can be high risk and you should never invest more than you can afford to lose.

How to buy gold in Australia

Getting gold in your hands can be daunting. For some, buying physical gold is taking that step into the unknown.

For you, it might be new. To your ancestors, however, gold was crucial to preserving wealth. So, where should you start?

You may be surprised to learn that there’s a thriving gold market on eBay!

And if you’re a first-time gold buyer, steer clear of eBay and stick with recognised bullion dealers.

Reliability is what counts with this kind of transaction.

There are many dealers spread across Australia, including:

- ABC Bullion — Sydney

- Gold Stackers Australia — Melbourne

- Australian Bullion Company — Melbourne

- Gold de Royal — Brisbane

- Ainslie Bullion — Brisbane

- As Good As Gold — Adelaide

- Perth Mint — Perth

Please note we are not affiliated with any of these dealers. These are just the largest bullion dealers in Australia.

The best way to get started is to visit your local bullion dealer, either in person or through their website. You don’t have to buy from a bullion dealer in your state.

Most of them will ship to any address, as long as you can sign for the delivery in person.

You can buy from a bullion dealer in Brisbane even if you live in Melbourne. Bullion dealers offer gold from various mints around the world, so shop around to see what you can find.

Where and how to store gold in Australia

Before you buy any physical gold, you need to think about how you will store it.

This is very important.

You may be tempted to keep it at home.

In fact, there’s a large range of web pages that come up with ideas on how to hide gold.

While we understand the desire to keep your precious metals close, storing it at home is highly risky.

For starters, you can’t insure gold kept at home.

Basically, if your bullion is lost or stolen, you’ll never be able to recoup it. Remember, gold is money…you need to treat your gold exactly as you would cash.

Once it’s gone, it’s gone for good.

If you do decide to keep your bullion at home, it’s advisable to install a top-quality safe.

Ideally not an off-the-rack safe. There are countless YouTube videos available to show you how to crack open one of these with only a little bit of force.

Another popular — and probably more secure option — is to organise secure storage for your gold. Banks do offer safety deposit boxes for hire. But then your gold would be stored with a bank.

And you may decide that you don’t want to have it anywhere near the financial system.

Indeed, the point of converting fiat dollars into gold is to get a portion of wealth out of the financial system.

Many Australians are often surprised to find out that the contents of their seemingly private bank safety deposit boxes aren’t as safe as they may believe.

In certain circumstances (say a liquidation), Aussie banks can exercise their right to the contents of your safety deposit box.

For this reason, consider private storage companies. Firms like Guardian Vaults, Kennards Self Storage, Custodian Vaults, and Fortis Vaults all offer personal safety deposit boxes for a small fee.

Even better, they are privately owned. So you won’t be storing your gold with a bank or government authority. Again, we have no affiliation with any of these storage companies.

The other and often cheaper option is to have a bullion dealer store your gold for you. Many bullion dealers offer to store gold on your behalf.

This means that when you buy your gold, you don’t take physical delivery of it. The bullion dealer holds it for you.

If you plan on buying large quantities of gold, this may be the best option for you.

Now, when you ask a dealer to store it for you, there are two types of storage available: allocated and unallocated.

Allocated storage is simple. Each gold bar (no matter what the size) is given a unique serial number for bullion dealers to track.

If you choose allocated storage, the bars you buy go into a pooled storage unit. In allocated storage, the serial numbers of each bar will be noted down on a ledger, and they will be taken off the market and ‘allocated’ to you on the dealer’s ledger.

In other words, while all your bullion bars will be stored in one collective vault, no one will be able to buy the bars you have because they have been allocated to you — and only you. The alternative is unallocated storage.

Unallocated storage is also pooled. However, you don’t have serial numbers of bullion bars written down next to your name. Instead, you have a set number of bars (or ounces) allocated to you on the ledger, with no claim on any particular bar in the vault.

Put another way, say you buy five one-ounce gold bars, giving you a total of five ounces of gold. If you select unallocated storage, you will have a claim to five ounces of bullion in storage.

But you don’t ‘own’ any particular bars in storage. Unallocated storage costs are often slightly cheaper on a yearly basis. However, whichever method you choose, make sure it’s right for you.

How to sell your gold

We prefer to use a respected local bullion dealer to cash out from our gold holdings.

You can shop around for prices and, importantly, it provides a layer of security for the transaction.

Conclusion

We hope you’ve enjoyed this comprehensive guide to investing in gold in Australia.

Remember, if you want to stay clued up on all things gold-related, be sure to subscribe to Fat Tail Daily. It’s a unique publication that aims to keep you ahead of the curve when investing in the precious metals space.