You probably already know Australia is a country full of valuable resources.

Australia has the second-largest accessible reserves of iron ore in the world, and the fifth-largest reserves of coal.

This great, dusty land also boasts some highly significant gas resources too.

So, as an investor, there’s certainly a lot to choose from. In fact, the ASX is home to a myriad of commodity-related investments and stocks, making it an attractive option for investors looking to diversify their portfolios.

If you’re a commodities greenie, you can explore the basics of investing in commodities on the ASX with this guide.

We’ll lay out the benefits and risks of investing in commodity-related assets, the different types of investments available, and give you some valuable strategies for evaluating and selecting them.

By the time we’re through, you’ll be reeling off names of key commodity players and better equipped to know what to do, what not to do, and how best to do it!

Please note that none of the commodity asset types or companies mentioned in this report should be considered as investment recommendations, but ideas for consideration and further research.

So let’s begin…

Understanding commodities

Before we get stuck into the nitty gritty of what makes a good investment and all the options out there, it’s always a good idea to get a feel for the basics.

So first off, what are commodities really?

Generally speaking, commodities are basic goods that are used in the production of other goods or services. It’s a tangible product that meets the demand of the market and remains constant no matter where it is sold.

Commodities can be raw materials (or ‘feedstocks’) and can be plant and tree-based materials such as fruits, veg, wood, and resins, animal products like wool, meat, milk, and leather, or mining materials, metals like coal, ore, minerals, and crude oil.

The ASX offers a range of commodity investments — essentially spoiling investors for choice!

Possibly the most popular commodity investing categories fit into the genre of precious metals and energy, but there are also those more in the agricultural vein.

Pricing is determined by supply and demand and is very important for commodity companies. This can be influenced by a variety of factors that may include geopolitical events like the war between Russia and the Ukraine, weather patterns like the flooding of Australia’s east coast and (more recently in New Zealand), or even technological advances like the ongoing ramp-up of Artificial Intelligence (AI).

Fortunately for us, Australia is a major player in the global commodity market. In fact, it houses a wide variety of commodity-related investments and stocks.

An overview of the Australian commodity market

For many years, commodities have made up a vast share of Australia’s export industry — and from the 2000s prices really soared, a surge in activity driven by global demand.

In fact, demand surged to the point where supplies just couldn’t keep up.

Much of that urgency came from a push in the steel industry, as well as the energy industry, especially as China chased greater urbanisation and industrialisation goals.

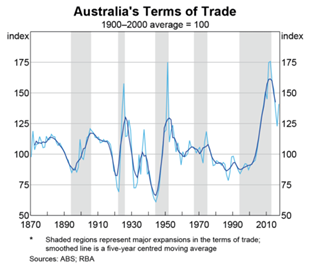

Australia’s trade terms rocketed to extreme levels and by 2011, terms of trade were 75% higher than they had been in the 20th century.

Source: RBA

The boom in Australia’s terms of trade saw a huge rise in investments in the mining and resources infrastructure industry.

Prices for commodities kept climbing higher and companies kept upscaling their production volume in a mad rush to meet demand — and capitalise on the market.

Our workforce strengthened, the Australian Government was raking it in through tax and revenue. All the while shareholder profits just kept growing.

As demand in China and other developing economies slowed, Australia hit more of an even keel.

And yet the Australian commodities industry remains strong. Throughout the pandemic, boosted commodity prices again lifted terms of trade, and producer profits fed the government during those long and costly lockdowns.

Commodity prices still remain historically high, and ‘transition commodities’ needed to boost the world to Net Zero will only continue pushing demand, albeit of a certain kind.

Still, Australia has many avenues to choose from when it comes to commodity types. Investors can choose any of them, depending on what they’re looking for.

To give you a basic run down, we’ve provided some information on some of the most significant commodities both produced and exported by Australia:

Iron ore

Australia has the world’s largest estimated reserves of iron ore, reaching around 52 billion tonnes. That’s about 30% of the whole world’s estimated 170 billion tonnes.

It’s no surprise then that iron ore is Australia’s largest exported commodity, especially as it accounts for a significant proportion of the country’s total exports.

Australia exports most of its iron ore to China, Japan, and South Korea, with China taking a huge chunk of it (around 70%!).

Major players in the Australian iron ore mining industry include the big three; Rio Tinto [ASX:RIO], BHP Group [ASX:BHP], and Fortescue Metals Group [ASX:FMG], all of which are located in the Pilbara region of WA.

Other ion producing companies worth looking into would include Mineral Resources [ASX:MIN] and Roy Hill Holdings [ASX:RHI]. You’ve also probably heard of Hancock Prospecting, which is a key player in the mining sector, though it’s not listed on the ASX.

Coal

Now, let’s talk coal. Coal mining and export has also played a significant role in Australia’s economy, and it has done so for decades. It remains the world’s largest exporter of the charred black rock.

Most of Australia’s coal is of the thermal variety, which is used for power generation, but we also produce coking coal, which — like iron — is very important in the production of steel.

Of course, coal has been a source of hot debate in recent times, as the globe spins it focus on the impact of climate change and reducing carbon emissions that will cause less harm to the environment. This has meant many companies have already begun to pull away from coal and other emission-heavy fuel production, and open renewable energy divisions to make that pivot in the near future.

The top dogs in coal mining include Whitehaven Coal [ASX:WHC], which is one of the largest coal producers in Australia and operates several open-cut mines, New Hope [ASX:NHC], and Yancoal Australia [ASX:YAL]. Coal stocks can be considered particularly risky, particularly due to the impending net zero carbon-emissions crackdown, so please do your own research prior to considering.

Gold

Australia is the second-largest producer of gold in the world, with most of it produced in Western Australia. Gold is considered a safe haven asset and is often used as a hedge against inflation and economic uncertainty.

Investing in gold can be done in several ways — buying the physical form (think a nice hefty slab of bullion or a treasure chest of coins and jewellery), investing in gold centred exchange-traded funds (ETFs), or in gold mining companies.

Some top-tier gold production companies in Australia include Newcrest Mining [ASX:NCM], which operates in Australia, Papua New Guinea, and Canada, Northern Star Resources [ASX:NST], primarily based in Australia and Alaska, and Evolution Mining [ASX:EVN].

Natural gas

Australia is one of the world’s largest producers and exporters of natural gas. The country exports natural gas to Asia, with Japan being the largest buyer.

Leading players in the natural gas game and who are also listed on the ASX, include Woodside Petroleum [ASX:WPL], which focuses on natural gas exploration and product, Santos [ASX:STO], which also holds a significant portion of the market share, and Origin Energy [ASX:ORG], an integrated company that also explores, produces, and manages the own retailing of its own products.

Copper

Coming to copper, Australia also happens to be a significant producer of this reddish, highly versatile metal, with the majority of its production coming from Western Australia and South Australia.

Copper is used in a wide variety of applications, including electronics, construction, and transportation — so its usefulness doesn’t appear to be dying down anytime soon.

A big copper company in Australia include Sandfire Resources [ASX:SFR], a copper and gold producer with operations in both WA and Botswana, and while BHP mines iron ore, it’s also a big player on the copper front too, as a diversified miner with its finger in lots of pies. The same can also be said of RIO Tinto and Fortescue Metals, who are also in the copper game.

Agriculture

Australia is a major producer and exporter of agricultural commodities that cover a wide range of crops and livestock, particularly in wheat, beef, and wool. As you would expect, these types of commodities are used in a variety of applications, including food production and clothing giving them an integral role in everyday staples and demand.

Agriculture-based investing is pretty closely linked to some topsy turvy movement in supply and demand, which can be linked to such things as bad weather events, labour, and shipping issues, and geopolitical risks. However, the same can be said for much of the commodity industry. A lot of it comes down to the challenges of doing business.

Some major agriculture commodity stocks in Australia would include Graincorp [ASX:GNC], which deals in grains, oilseeds, and pulses, Select Harvests [ASX:SHV], an almond growing and processing company, and Tassal Group [ASX:TGR] farmers of salmon goods.

Benefits and risks

You may by now be wondering, ‘OK, so I know what commodities are, and I like the sound of these companies — but are the pros and cons?’

Let’s start with the good stuff. You would be happy to hear that there are several potential benefits to investing in this ‘real asset’ class.

Major benefits would include diversification, inflation hedging qualities, and potential for solid returns. However, it must also be noted — as always in the spirit of investing — that there are also the fair share of risks to consider as well, and its best to be across as much of these are possible. Always conduct your own research prior to investing.

Here are some details on the benefits and risks of commodity investing:

Benefits:

- Diversification: Commodity investments can provide diversification benefits to an investment portfolio. This is due to their prices not always being so closely correlated with the prices of other assets — like stocks and bonds, for example. By working off their own pricing framework, they can help to reduce portfolio risk and potentially improve returns.

- Inflation protection: Many commodities are often viewed as a hedging tool against inflation, as the prices of many commodities tend to rise during periods of inflation, protecting the companies producing them with nice sales buffers. This can also provide some protection against the erosion of purchasing power over time.

- Potential for solid returns: It’s worth being hyper aware that commodity prices can be pretty volatile, which, looking on the bright side of the coin, can create opportunities for investors to earn good returns over a short period of time when they start charging upwards. This can be especially attractive for investors who are willing to take on higher levels of risk. However, all investing carries risk and returns can never be guaranteed.

Risks:

- Price volatility: Commodity prices can be highly volatile and are generally at the mercy of fluctuations caused by a wide range of factors. Supply and demand, geopolitical events, and global economic conditions can all have their hand in the erratic trends that may occur in pricing. This can make commodity investments riskier than other asset classes, but there is a see-saw element, which means it can just as easily swing into ‘benefit territory’.

- Political and regulatory risks: Commodity investments can be subject to political and regulatory risks, particularly in emerging markets where governments may choose to change policies or, which could then impact production or trade — like with the renewable energy deadline that’s fast approaching (Net Zero 2025!).

- Currency risk: Many commodities are priced in US dollars, adding the wonderful layer of complexity that can occur in currency exchange rates, adding or taking value as they themselves fluctuate.

- Liquidity risk: Some commodity markets may be less liquid than others, which can make it more difficult to buy or sell commodity investments when desired. That said, the type of investment you’re making may also have its role to play (i.e. ETFs are much easier to sell than a gold bullion, for example).

Investors should carefully consider these factors and conduct their own thorough research before jumping in. It’s important to have a clear understanding of the risks and potential rewards before making any investment decisions. Seeking professional advice can also be helpful for investors who are new to commodity investing. Of course, we aim provide you with as much information as possible across our many guides, free articles, and subscriptions services.

Commodity investment types

There is a plethora of commodity-related investments available to investors on the ASX, for those who may not want to keep the physical asset under lock and key. These investment types include exchange-traded funds (ETFs), futures, options, and contracts for difference (CFDs).

ETFs have become quite the popular option as they can provide exposure to a diversified portfolio of commodities while keeping the trading journey relatively simple, with as little or as much control as an investor may like.

On the other hand, there are futures and options, which are investment types that allow investors to trade specific commodities at a predetermined price.

CFDs are another worthwhile choice, these are a leveraged product that allows investors to gain exposure to commodities without having to own the underlying asset — much like stocks and bonds. However, CFDs carry a great deal of risk and are not for everyone. You should seek financial advice and ensure you understand these risks prior to considering.

ASX-listed commodity stock examples

This brings us to commodity stocks listed on the ASX. As discussed, ASX commodities stocks relate to companies that are involved in the exploration, mining, production, or distribution of raw materials — this really gives investors a lot of options and diversity.

Please see below a list of some historically well-performing commodity stocks found on the ASX (you will note some of the best performers tend to be part of the volatile, high risk — but potentially highly rewarding — mining industry):

- BHP Group [ASX:BHP]: BHP is a multinational mining company that is one of the largest producers of iron ore, copper, and coal in the world. The company also has interests in oil and gas production. BHP has a strong financial position and has consistently paid dividends to its shareholders. BHP had an 8.75% annual dividend yield for 2022, and its diluted EPS (earnings per share) went up 190% in its last quarter.

- Rio Tinto [ASX:RIO]: Rio Tinto is another multinational mining company that is a major producer of iron ore, aluminium, copper, and other metals. The company also has interests in diamonds and minerals. Rio Tinto has a strong balance sheet and has delivered consistent earnings growth in recent years. RIO Tinto’s annual dividend yield in 2022 was 6.15%.

- Woodside Energy [ASX:WDS]: Woodside is an Australian oil and gas exploration and production company. The company has a diversified portfolio of assets in Australia and overseas and has a strong track record of delivering shareholder returns. Woodside had a dividend yield of 8.71%, and saw its diluted EPS boosted 323% after reporting record output in 2022.

- Fortescue Metals Group [ASX:FMG]: Fortescue is an Australian iron ore mining company that is one of the largest producers of iron ore in the world. The company has a low-cost production model and has been successful in expanding its operations in recent years. Fortescue’s dividend yield remained high in 2022 at 9.42%.

Note: Company dividends can change or cease at any time.

According to Morningstar’s 2022 best-performing stocks, commodity stocks were the heroes of the year, taking six of the top 10 slots.

Whitehaven Coal [ASX:WHC], New Hope Corp [ASX:NHC], and Woodside Energy [ASX:WDS] were rated four stars by Morningstar, along with AGL Energy [ASX:AGL] the Australian electricity and gas retailer.

Analysing commodity investments and stocks

Once you have a list of ASX-listed commodity companies you’d like to look into, it’s a good idea to carefully evaluate them using a variety of factors, including market trends, financial health, and company management.

It is important to conduct due diligence and research before throwing your money at any investment. Investors should also monitor their investments on an ongoing basis and be prepared to adjust their portfolios as needed.

So, before you jump in, we have a few tips for things to consider when analysing commodity investments and stocks:

- Commodity price trends: The performance of commodity investments and stocks is highly dependent on the price trends of the underlying commodities. Investors should monitor the price movements of the relevant commodities and assess whether the prices are likely to rise or fall in the future. This can be done by analysing supply and demand trends, global economic conditions, and geopolitical factors that may impact commodity prices.

- Company financials: Investors should assess the financial health of the companies that they are considering investing in. This can be done by analysing financial statements, including balance sheets, income statements, and cash flow statements, and evaluating key financial ratios such as return on equity (ROE), debt-to-equity ratio, and EPS. It is important to consider the company’s exposure to commodity prices and any potential risks associated with fluctuations in prices.

- Company operations: Investors should also assess the operational performance of the companies they are considering investing in. This can be done by evaluating factors such as production volumes, exploration activities, and capital expenditures. It is important to consider the company’s growth prospects and any potential risks associated with their operations, such as regulatory or environmental risks.

- Management team: The quality of the management team can have a significant impact on the performance of a company. Investors should assess the experience and track record of the company’s management team and evaluate their ability to effectively execute the company’s strategy.

- Market dynamics: It is important to consider the broader market dynamics that may impact commodity investments and stocks. For example, investors should consider the overall market conditions, the competitive landscape, and any regulatory or legislative changes that may impact the industry.

This is only the start of the journey

We hope we’ve given you the foundations you needed to get yourself in the mindset of commodity stock investing.

The big question is: Will you continue the journey? If this all made sense to you, chances are your journey has only just begun and you have a lot more to look forward to.

But let’s just sum up together first; investing in commodity-related investments and stocks can be a profitable and effective way to diversify a portfolio. But they can be high risk and it is important for investors to carefully evaluate the risks and benefits of each investment before committing funds.

By conducting thorough research, monitoring investments on an ongoing basis, and implementing appropriate investment strategies, investors can make informed decisions and achieve their investment goals.

By considering the various factors, investors can gain a better understanding of the potential risks and even the opportunities associated with potential investments.

There are several strategies that investors can use when investing in commodity-related investments and stocks, including diversification, dollar-cost averaging, and value investing. You may like to look into our Diversification Guide for more on that topic.

Diversification involves investing in a range of commodities to reduce risk, while dollar-cost averaging involves investing a fixed amount at regular intervals, and value investing involves identifying undervalued commodities or companies and investing in them for the long term.

At the end of the day, make sure to do the research — don’t be afraid to get stuck in, ask all the questions and search for as many of the answers as you can. Enlist the support of a broker or similar professional, and in the meantime, why not subscribe to one of our curated publications for exclusive access to stocks, news, and ideas?