It’s official.

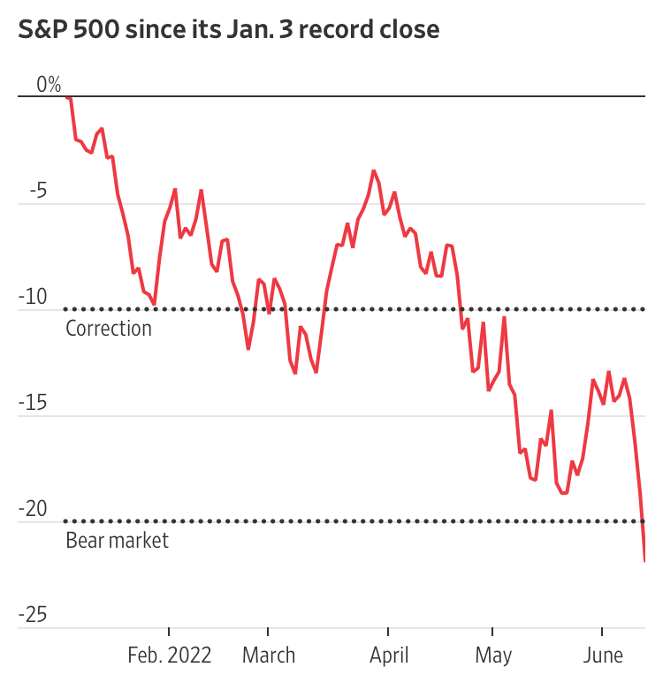

The widely followed S&P 500 has entered a bear market overnight as investors digested (or failed to) the latest inflation data.

The index fell 3.9% on Monday, with 495 of its 500 component stocks ending the day lower.

Even the energy sector — the S&P 500’s only sector in the black this year — fell 5.1%.

The benchmark index is now down 21% year-to-date and down 11% over the past 12 months:

|

|

|

Source: Wall Street Journal |

Apple, Microsoft, Amazon, Meta, and Tesla all fell by more than 3% overnight.

In turn, the ASX 200 opened 4.5% lower on Tuesday.

Cryptocurrencies weren’t immune either.

Bitcoin [BTC] plunged below US$23,000, trading 65% below its November 2021 high. Ethereum [ETH] was down 14% at the time of writing and down 65% year-to-date.

The sharp crypto falls also follow news that Celsius Network — a large crypto lender — was pausing all withdrawals and transfers between accounts, citing ‘extreme market conditions’.

Markets worry about interest rate hikes

The extreme market conditions stem from the latest US CPI print, which came in hotter than expected.

US inflation rose 1% in May and 8.6% year-on-year, the largest gain since 1981.

Inflation isn’t cooling off at the desired pace, and investors are now contemplating a more aggressive response from the Federal Reserve.

Overnight, futures bets showed that traders are currently assigning an 85% chance that the Fed will raise rates to at least 2.5% by the end of the year.

The fear is that the Federal Reserve’s rate hike path will be longer and steeper than envisaged.

Kiran Ganesh, multi-asset strategist at UBS, told the Wall Street Journal:

‘It seems as though inflation is staying for longer than expected. People are now beginning to fear that the Fed will have to go further or faster in terms of interest rates.’

Last month, Fed Chairman Jerome Powell said the central bank’s rates policy would be guided by the economic data:

‘What we need to see is clear and convincing evidence that inflation pressures are abating and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively.’

Well, the latest data would hardly convince Powell that inflation is abating.

Will the Fed then consider a more aggressive rate hike of 0.75%?

Investment banks Barclays and Jefferies think so, predicting the Fed will raise rates by 0.75% later this week.

The fear of a more aggressive Federal Reserve is leading investors to unload risk.

The fear is also boosting bond yields.

The yield on the benchmark 10-year US Treasury note rose to 3.371% overnight, its highest closing level since 2011.

Is the fear warranted?

Clearly, with 495 of the S&P 500’s constituents finishing the day lower on Monday, the market is in an indiscriminate mood.

But do rising rates and persistently high inflation mar all stocks equally?

Inflation and stock market returns

Stocks represent part ownership of a business.

And it’s the performance of the underlying business that matters in the long run.

So what happens to businesses during inflationary periods? And are all businesses affected equally?

For instance, how badly would we say Apple is affected by inflation?

In April, the tech giant released its March quarter results.

Apple announced that it posted a March quarter revenue record of US$97.3 billion.

Net income also rose to hit US$25 billion.

Despite the inflationary pressures, Apple was able to grow its revenue and earnings.

And as we covered a few weeks back, over the long run, stock prices tend to follow earnings, not economic regimes.

This point was reiterated in a recent white paper from Polen Capital:

‘Though higher inflation and the anticipation for rate hikes could spark volatility in the near term, we believe that long-term earnings growth — and not macroeconomic forces — will eventually determine the success or failure of a company.

‘This focus illustrates that, in our view, the best way to hedge against inflation is by investing in competitively advantaged companies that can contribute continuous and robust earnings growth to the Portfolio under any economic environment.’

In Polen’s view, inflation doesn’t impact all stocks equally…

‘However, we also think that not all companies could be impacted equally. In our view, high-quality companies that possess durable economic moats tend to be better positioned to thrive even in the face of macroeconomic headwinds.’

Great businesses like Apple have the tools to handle inflationary times. They usually have pricing power and a captured market.

Even though living costs are rising, people are unlikely to abandon iPhones.

But average businesses — ones in highly competitive sectors with fungible products — won’t have the same tools.

For these businesses, costs tend to rise with inflation more than output prices. If you don’t have pricing power, rising input costs eat away at your margins.

Stocks and the economy: area of control

If you were a majority shareholder of a firm, what would you want the company to focus on right now?

The macroeconomy? Interest rates? Statements from central banks?

Or would you want the firm to focus on its key business competencies?

Individual stocks can’t do much about inflation or interest rates, but they can do something about the operation of their businesses.

Yet stocks that focus too much on external factors may indicate businesses that have lost touch with what matters.

This is well illustrated by hedge fund manager Scott Fearon in his book Dead Companies Walking:

‘Back in 1991, the first year I started my hedge fund, I paid a visit to a tech company in San Jose called Consilium (stock symbol: CSIM).

‘Consilium built a software product that controlled automated factory operations—the robots that soldered components to computer motherboards and painted new cars on assembly lines, things like that.

‘I’d been studying the numbers and noticed that its debt levels were getting dangerously high at the same time as its revenues were flattening out, so I got in my car and tooled down the peninsula to its headquarters. I met the company’s chief financial officer, Mark, who had a ready answer for Consilium’s troubles.

‘“It’s very simple, Scott,” he said. “It’s all about M-1.”

‘“M-1?” I asked. “What do you mean, M-1?”

‘“M-1,” Mark repeated. “The aggregated monetary supply. The Federal Reserve has been constraining it over the last two quarters so factories aren’t spending like they used to. That’s why sales have been flat.”

‘“Hold on,” I said. “M-1 is literally trillions of dollars. You guys do like ten million a quarter in sales. You don’t think your problems might have something to do with the quality of your products or what your competitors are doing?”

‘“Oh no, absolutely not, Scott,” he said. “We’re rock solid. It’s the Fed. I’m telling you. They’re killing our business.” I shook his hand, drove back to my office, and immediately shorted Consilium’s stock.’

During hard times, watch out for companies attributing all the blame for their current troubles solely to external factors.

Inflation and your portfolio

How should investors approach their portfolios in these inflationary times?

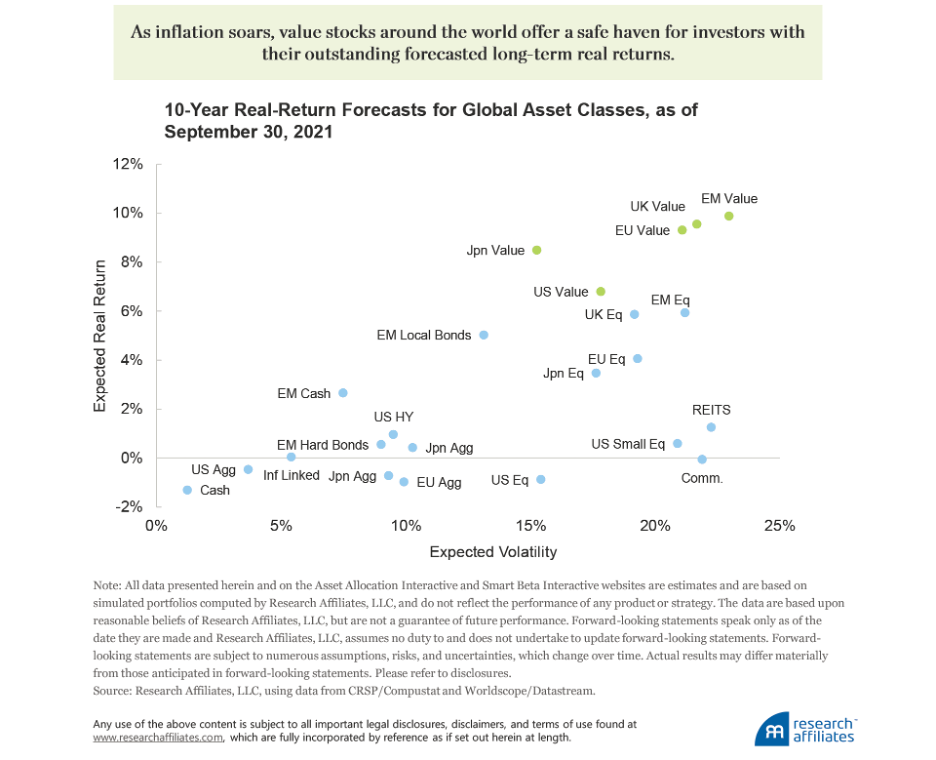

In January 2022, Research Affiliates chief investment officer Chris Brightman wrote:

‘Given this likely scenario, how should investors reposition their portfolios for today’s inflationary regime?

‘Informed investors may begin by paring back positions in mainstream stocks and bonds, particularly interest rate-sensitive growth stocks, borrowing at long-term fixed rates, and diversifying into real assets such as real estate, commodities, and resource stocks.’

Since January, rate-sensitive growth stocks have plummeted, with the Nasdaq Index down 31% year-to-date, and resource stocks have risen.

If we look at the ASX, for instance, resource stock Whitehaven Coal [ASX:WHC] is up 90% year-to-date, and New Hope Corp [ASX:NHC] is up 60%.

Commodities often do well in inflationary times.

As a 2021 research paper focused on US inflationary regimes found:

‘We find that traded commodities have historically performed best during high and rising inflation. In aggregate, they have a perfect track record of generating positive real returns during our eight US regimes, averaging an annualized +14% real return. This contrasts with normal periods when the commodity aggregate returns low single digits.’

Research Affiliates’ Brightman also noted that his firm forecasts value stocks to ‘deliver long-term real returns exceeding 6% in the US market and 8-10% range for the Japanese, European, and emerging markets.’

|

|

|

Source: Research Affiliates |

With inflationary pressures persisting, markets will likely continue offloading risk-on assets and turn to capital-preserving hard assets or cash-generating assets like competitively-advantaged quality stocks.

The era of easy money is over.

Regards,

Kiryll Prakapenka,

For Money Morning