I’m sitting in a lush courtyard, eating a boiled egg and drinking orange juice.

A fellow traveller says to me, ‘Oh dear, one of the monkeys has got into a room!’

We laughed. That’s India!

Nearly 20 years ago two buddies and I went through the north Indian state of Rajasthan.

There were castles, elephants, crowded streets, beggars and…of course, monkeys. Days were hot and dry. It was hard to get a cold beer.

Some aspects were a bit grim.

Pollution in New Delhi was a shocker. My fingers would show black if I wiped my face.

Once I opened the door to the toilet on a third class train carriage. It was a hole in the floor onto the tracks below.

We all got food poising at one point.

Such are the demands of travel in India.

Here I am in front of the Taj Mahal with my best friend Luke nearly 20 years ago…

|

|

| Source: Callum Newman |

2005 was a long time ago now, and so is my slim waistline.

India then was a tumultuous land of epic history and vibrant culture.

Economically it was lagging badly behind the rising giant of the East — China.

However…

20 years later the opposite is true!

Everybody knows that China’s economy is slowing down from the rapid pace of its breakout years.

The good news for Australia is that India is now rollicking along! Indian GDP is up 70% over the last decade.

In 2023 India became the most populous country in the world…and will keep adding people for the next century.

Indian growth is running at an annualised rate of over 7% this year — the fastest rate among major economies.

Think of the grinding market we’re seeing on the ASX currently.

Now look below at how Indian stocks have surged over the last three years, especially relative to Chinese equities…

|

|

| Source: FactSet, WSJ |

Now that’s a bull market!

My friend Chris Mayer wrote a book called The World Right Side Up about 12 years ago.

The idea was that the world economy was flipping back to ‘normal’ and away from the Western dominance of the last few hundred years.

Today we’re still struck by the poverty in India. That’s a legacy of British colonisation.

Previously, India was the biggest economy in the world, and for a time, the richest.

It was called the Golden Bird and the Mughal emperors sat on the Peacock Throne.

The Jagat Seth family that dominated Indian trade and finance in the 17th century may have been the richest family in history.

India is now rising up again…just as Chris predicted.

Even China, for example, is now losing investment to India because cheap Chinese wages are gone.

And we know that geopolitical trends are causing Western firms and investors to diversify.

There’s big opportunity here! We’re talking big figures.

It’s possible India will add $1.5 trillion to its GDP by 2026.

By 2030 India will likely overtake Germany and Japan to be the third biggest economy in the world.

Unlike the West, India has great demographics. The median age in India is 29. There’s an astonishing 500 million people under 20.

Look at the big lift in capital spending going on now as Indian railways and highways get a massive upgrade:

|

|

| Source: The Economist |

This is going to continue for a long time.

India needs to spend nearly US$1 trillion on infrastructure in the next 15 years just to keep up with its population growth.

India is also urbanising — and that means it’s hungry for commodities.

Rio Tinto came out with their latest analysis on this in October.

What did they tell us?

As many people will urbanise in the next 10 years that have done so in the last decade.

Point being: emerging markets are picking up resource demand as Chinese demand plateaus.

That’s great news for Australia and our mining industry!

The great clash coming to commodity markets

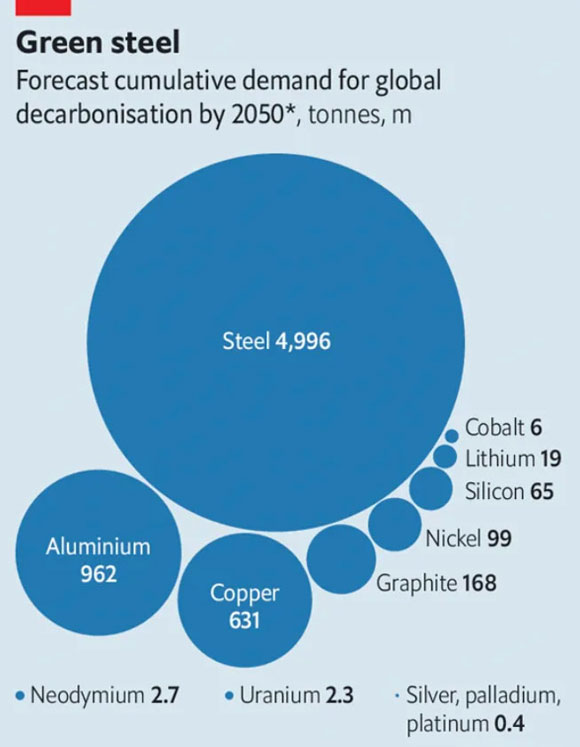

Indian commodity consumption is set to soar at the same time demand for minerals is skyrocketing as the world transits towards Net Zero.

We’ve all heard the statistics around exploding need for lithium, rare earths, copper and nickel for electric cars, renewable energy and decarbonisation.

You can see it here:

|

|

| Source: The Economist |

What nobody knows is how the mining industry can meet this demand.

BHP boss Mike Henry said earlier in the year:

‘That is going to require significant multiples of metals and minerals in coming decades compared to the last few — two times as much copper, four times as much nickel, twice as much steel, twice as much potash — and so on for the other critical metals and minerals.’

Over the last few years, it has taken only modest supply issues to see spikes in oil, lithium, rare earths and now uranium.

Demand will keep lifting if there’s little future supply to meet it. The rise of India alone almost guarantees it.

Then we add in potential further Chinese stimulus and the march to Net Zero (decarbonisation).

Thus…the only question, to me, is when further commodity price rises begin.

Now’s the time to position for this…

But how?

Want the Full Picture? Subscribe to Australian Small-Cap Investigator Today!

The rise of India and its implications for miners and commodities is just a taste of the in-depth insights and opportunities you’ll discover in my premium research service Australian Small-Cap Investigator.

Each month, I reveal small-cap stocks perfectly positioned to ride huge demographic and geopolitical shifts. Stocks which require a high tolerance for risk, but ones which I believe have blue sky potential, which many investors overlook.

Subscribe to Australian Small-Cap Investigator today and supercharge your portfolio with our best of Aussie small caps!

I look forward to welcoming you aboard!

Best wishes,

|

Callum Newman,

Editor, Money Morning