Incitec Pivot [ASX:IPL] enjoyed a ‘record’ first-half performance due to an upswing in commodities.

IPL shares rose in early morning trade on the positive half-year results.

However, IPL shares then dipped after the company announced its intentions to separate its fertiliser and explosives businesses — Dyno Nobel and Incitec Pivot Fertilisers.

Source: Tradingview.com

Incitec announces record performance and intention to split businesses

Incitec delivered two big ASX updates for its shareholders on Monday — and it appears investors are not sure how to react.

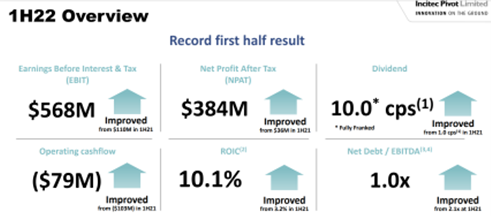

Incitec reported a ‘record first half performance’.

NPAT increased from $36 million to $384 million.

EBIT rose from $110 million to $568 million.

The earnings jump saw Incitec’s return on invested capital (ROIC) rise from 3.2% in 1H21 to 10.1% in 1H22:

Source: IPL

Jeanne Johns, IPL’s CEO, commented:

‘Our record first half result reflects the quality of our two category leading businesses and our sharp focus on executing in a high demand, highly disrupted market. Our team has done an excellent job navigating operational complexity to deliver for our customers.

‘This has enabled us to capture the very strong commodity price environment and foreign exchange tailwinds, as well as successfully manage inflationary pressures and supply chain disruptions. Our supply chain teams in both the Americas and Australia have done an outstanding job in responding to these challenges.’

Incitec splits in two

In a separate announcement on Monday, IPL outlined the plan to separate Incitec Pivot Fertilisers and Dyno Nobel and place both as separate listings on the ASX.

Incitec hopes this move will drive significant shareholder value.

IPL believes the move will streamline capital strategies at the initial cost of an estimated $80–105 million to execute the split.

$25–35 million per year is expected to be incurred in ongoing costs.

Chairman Brian Kruger said:

‘The Board sees significant value enhancement through the separation of two industry leading businesses and brands in Dyno Nobel and Incitec Pivot Fertilisers.

‘Our explosives and fertilisers businesses will continue to provide attractive exposure to the essential minerals and agriculture industries that are underpinned by important global megatrends.’

IPL share price outlook

Investors have had an emotional ride today, initially buoyed by the strong financial performance in the company’s trade update, only to be confused by what the business shift will mean for them in the long run.

But these turbulent times are hardly unique.

Veteran equities strategist, Jim Rickards, has seen many a moment like this.

Jim knows how to turn an uncertain situation into a roadmap for navigating hidden advantages most don’t see.

If you’d like to hear about how he does it, watch him here in ‘What Would Jim Rickards Be Buying Right Now?’.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia