Incannex Healthcare Ltd [ASX:IHL] shares are up after announcing a pre-IND meeting with the US FDA.

At 2:30pm today, the IHL share price was up 5%.

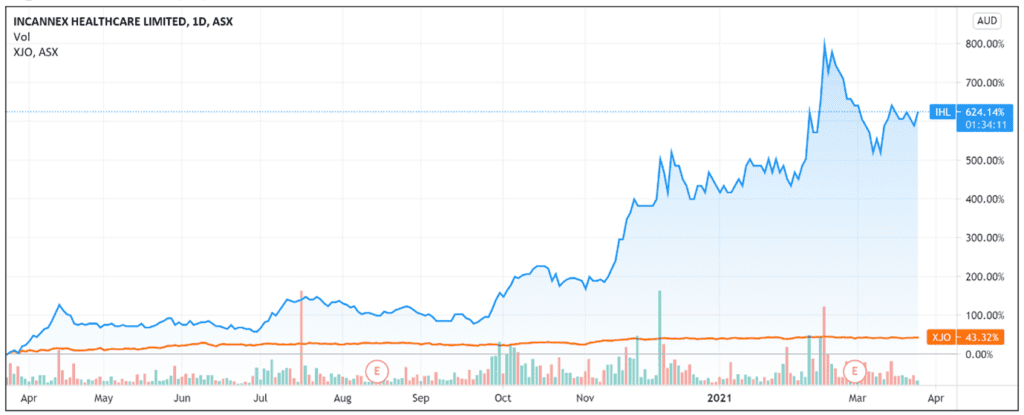

The pharmaceutical development company — specialising in medicinal cannabis pharmaceutical products and psychedelic therapies — continues its strong run this year, with Incannex shares up 35% YTD and up 570% over the last 12 months.

Source: Tradingview.com

Source: Tradingview.com

Incannex to meet with the FDA

Incannex announced today that it was granted a pre-IND (investigation new drug) meeting with the US Food and Drug Administration (FDA).

The meeting comes after the company submitted an information package about IHL-675A and the product’s proposed use in preventing acute respiratory distress syndrome (ARDS) caused by trauma and sepsis associated acute respiratory distress syndrome (SAARDS) caused by infection.

FDA informed Incannex it plans to comment on their development proposal by 21 April 2021.

FDA members from multiple divisions will offer feedback on the company’s entire development program.

Incannex explained that the purpose of the announced meeting is obtaining ‘regulatory guidance and agreement on the most efficient clinical development plan’ before submitting its IND application for IHL-675A.

Why is Incannex submitting the IND application?

Incannex stated in the release that patients diagnosed with ARDS currently suffer poor treatment outcomes.

Oxygen ventilators are used to treat symptoms but according to Incannex, not the ‘underlying inflammation “feedback loop” that causes the fluid leakage.’

IHL believes that its IHL-675A directly targets the lung inflammation.

IHL share price outlook

Today’s announcement didn’t state that IHL is entering FDA’s second stage, only that the FDA is willing to meet Incannex and guide it in preparation for the company’s IND application.

According to the FDA, the IND application is the second stage in a 12-stage drug approval process.

Should the pre-IND meeting go well and should IHL pass the second stage, it will have to conduct human-trial studies that will first involve 20–80 people, then a few dozen to 300 people, and finally several hundred to about 3,000 people, according to the FDA.

This will likely take some time and will surely involve some bumps along the road.

Investors with long-time horizons will likely find it easier to hold IHL shares all through Incannex’s FDA approval journey.

That said, securing FDA approval will be a big boost to the company as it seeks to carve out market share in an emerging market.

IHL is surely aware of the journey ahead but believes it can ‘harness increasing regulatory enthusiasm for promising medicinal cannabinoid and psychedelic therapies.’

ASX pot stocks are catching the eyes of investors seeking growth markets. If you are interested in pot stocks and wish to research the growing CBD healthcare industry and what investing opportunities are out there, then this free report is highly recommended.

Well worth a read!

Regards,

Lachlann Tierney,

For Money Morning