Some years go by without much drama. Then there are years where an entire decade of events come one after another.

2022 is the latter category.

Barely a week goes by without an Earth-shaking event (or two).

Let me go through two noteworthy events recently taking up much airtime — the FTX collapse and that stray missile that hit Poland two days ago.

These two events don’t seem linked.

But let me show you how they may be…

Deep in the global information war

I mentioned in a piece in July that we are living in a global information war.

Each day, media outlets release stories to not only inform you of what’s happening, but they seek to shape how you perceive things. They may stir you emotionally and persuade you to adopt a particular view through their narrative. As a result, it’s possible for two people to perceive the same event differently — from different sources — and end up in disagreement. This can lead to societal division, isolation, and discord.

In recent weeks, this war has escalated further, with Elon Musk taking charge of Twitter. Instead of having a prevailing narrative on an event that comes from purportedly ‘trusted sources’, you end up having competing perspectives. Each side declares the other as spouting ‘fake news’ and ‘debunked theories’.

Literally, everything you read (including this article) may potentially spring a trap, leaving you a casualty to false information and narrative confusion.

How do you traverse through this psychological minefield?

I’d say follow the money trail and identify the ulterior motive — sometimes, that motive is out there in plain sight.

And the FTX saga is an intriguing case in point…

FTX collapses — a dirty money trail of corruption, deceit,

and something darker

Critics of crypto have enjoyed another week of ‘I told you so’ with the collapse of the second-largest crypto exchange, FTX.

This time last year, crypto investors were on top of the world.

Bitcoin [BTC] traded at an all-time high of US$68,000, and it seemed like it would send gold to an ignominious retirement.

Things turned around with the outbreak of the Russia-Ukraine conflict in late February, with Russian crypto investors facing expulsion from many exchanges in early March.

Token prices across the board plummeted. This accelerated with the demise of Terra Luna in May and Celsius in June.

With each high-profile demise of crypto tokens or trading platforms, the usual suspects come out to talk about regulating the crypto market and shilling their central bank digital currencies (CBDCs). The demise of FTX last week served to spark further calls for regulation on crypto trading and ownership.

What’s interesting is that FTX was a front for dark activities, which the liquidator is revealing for all to see. One that could end up implicating some of the globalist elites who are hell-bent on pushing people into CBDCs.

For example, the disgraced founder of FTX, Sam Bankman-Fried, is linked to influence-peddling using corporate donations to Democrat members of the US Congress. Furthermore, he was the second-biggest donor to the Biden campaign in 2020 and bankrolled heavily for the Democrats in the recent midterm elections (more about this here).

Those who ran FTX and its associated trading firm, Alameda Research, were a tight-knit group of young men and women from high society. They engaged in front-running the market, earning massive profits while shafting their customers.

Even the World Economic Forum regarded FTX highly. It earned a prominent ESG (environmental, social, and governance) ranking from the group and became an exemplar for other corporations to follow.

But since its demise, the organisation has removed references to FTX from its website.

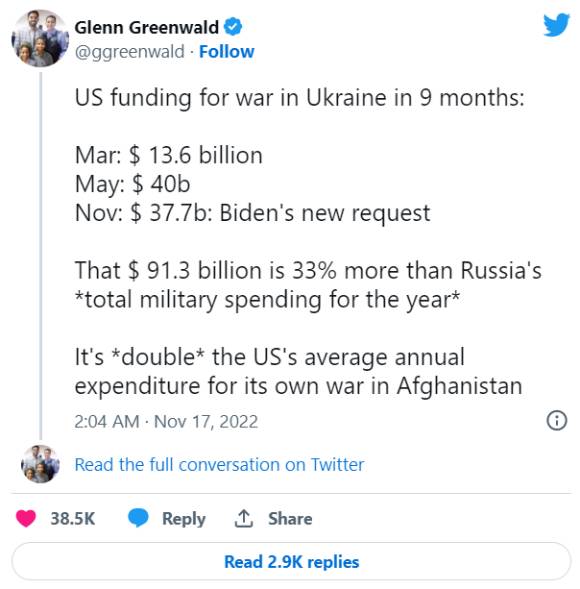

Then there’s foreign aid to Ukraine, paid through taxpayer funds. So far, the US Government has sent more than US$50 billion to Ukraine:

|

|

| Source: Twitter |

FTX was a preferred platform for such transactions.

Much of the funds seemed to have disappeared after they were sent or are untraceable. The Office of Inspector General earlier this month launched a task force responsible for auditing and tracing it.

I find the timing of setting up this task force and the demise of FTX, with exposure to its corrupt and nefarious activities, to be quite interesting.

But let’s say it’s just a coincidence (for now). One thing is for certain, ‘stakeholder capitalism’ and socially responsible investing have clearly taken a king-hit.

Peace talks, stray missile, and an embarrassing mass-retraction

of ‘fake news’

In the past week, Ukrainian forces managed to reclaim parts of Kherson after Russian forces vacated the city. While some perceived this to be a decisive defeat of Russia, even the mainstream media, with its pro-Ukrainian leaning, cautiously hinted that this may be a strategic move by Russia as winter approaches.

Things became more interesting as Ukrainian President Volodymyr Zelenskyy said he was ready for peace talks. This contrasted with his hard stance last month, where he declared this impossible.

At this point, one would hope that the poor citizens of Ukraine can go back home and rebuild just as winter approaches.

Except we woke up yesterday morning to news that a missile hit Poland, killing two civilians.

There was much speculation as to who launched the missile, with many fingers pointing to (you guessed it) Russia. Not long after, a chorus of Ukrainian officials (including President Zelenskyy himself), foreign leaders, and media outlets (here, here, and here) claimed that Russia wanted to provoke war by firing the missile.

There was heightened tension for several hours until the Polish President Andrzej Duda and the Biden Administration announced that the missile may have been fired by Ukraine as a defence measure against Russian strikes.

The Associated Press, along with several media outlets, was forced to retract its fake news reports, one that could’ve brought the world close to an international hot war.

In the meantime, Ukraine received another pledge from the US of US$37.7 billion in taxpayer-funded aid.

As tensions remain high, let history guide your investing decisions

The world appears to have dodged a global hot war for now, but it’s clear things are far from cooling down.

Regardless of your leanings and views, what you should realise is this:

Someone wants to escalate the situation in Russia and Ukraine. There’s big money behind it, and even more if the conflict spirals out of control.

Take what the officials, media outlets, and online influencers say with a grain of salt. The first casualty of war is the truth.

Regardless, it’s critical to safeguard yourself in such times of chaos and confusion.

The collapse of FTX has gutted the crypto market once again. But I assure you that it’ll rise from the ashes. Right now, it’s dangerous territory best left to the most gung-ho of investors.

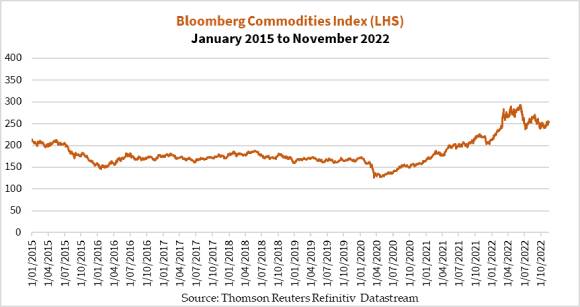

On the other hand, the global supply chain remains in bad shape. But a rising demand for commodities will continue as many countries seek to return to some form of normality.

The Bloomberg Commodities Index is showing signs that the worst is behind it:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

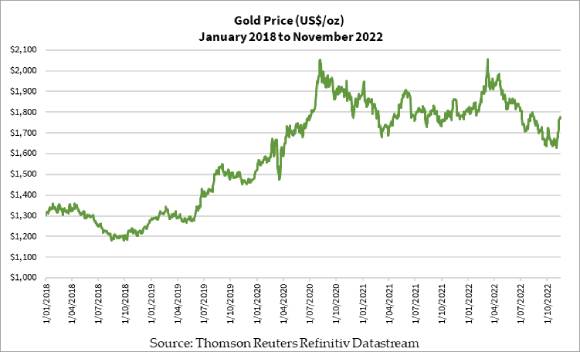

What about gold? It’s bounced nicely in US dollar terms in the past two weeks:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

The Federal Reserve might still raise rates to combat inflation going forward. But it’s hitting the critical point where it could topple the markets.

Where do I place my cash in such troubling times? Gold and commodity stocks. History has shown commodity prices will do well.

Fat Tail’s newest service, Diggers and Drillers, as well as Jim Rickards’ Strategic Intelligence Australia — of which I am a part of — could help you navigate through the upcoming storm.

Click the above links to find out more about how you can take part in this opportunity!

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia