Australian lithium miner IGO is one of the worst performers on the ASX today after releasing its September quarterly update.

IGO’s report centred around two big pain points for the company: softer spodumene prices and production woes within its nickel mining.

Both have sent investors running, with the share price down by 7.9% to $9.81 per share today.

IGO shares are down -37% for the past 12 months, reflecting the volatile lithium markets and their Chinese supply chains, which have been described as ‘opaque’ by insiders.

In recent months, Australian mining executives have been advocating for changes in a market that they claim is putting them at a disadvantage. Are these just immature markets at play? and what does the future hold for IGO?

Source: TradingView

IGO misses the mark

In its quarterly report, IGO blamed ‘difficult operating conditions‘ for a 25% drop in nickel production at its Nova mine and Forrestania Project.

A seismic event at one site and issues with paste-fill efforts in another meant that mine stability was a core issue for IGO.

The knock-on effect was that lowered milled tonnes and feed grades were seen across the company, dropping production to 7,131 tonnes and raising net costs of operations by 33%.

Offsetting this poor result, its Lithium side saw record production for the quarter. Spodumene totals came to 414,000 tones, a 5% increase from the prior period, thanks to improved grade feeds at its Greenbushes mine in WA.

However, these stellar production numbers failed to materialise into gains for IGO, as sales fell 9% for the quarter, while spodumene revenues dropped 36%.

Greenbushes is the world’s largest hard rock lithium mine and is operated by Talison Lithium, a joint venture between IGO and American chemicals giant Albermarle.

The colossal mine feeds into four refineries, one of which is the Kwinana lithium hydroxide refinery, with which IGO also shares a joint venture with Chinese giant Tianqi Lithium.

While this refinery saw production improvement, it failed to meet guidance targets, with 607,000 tonnes of lithium hydroxide produced during the quarter.

The final result of this quarter’s activities meant that total sales revenue was up 3% QoQ to $248 million, while underlying profits fell 42% to $362 million.

Commenting on the results, acting CEO Matt Dusci said:

‘Looking ahead, we note the recent volatility in the lithium market and the impact this is having on participants across the supply chain, a dynamic which is not unexpected for a market which is growing rapidly.’

‘Greenbushes shareholders are working on mechanisms to manage surplus volumes to minimise any impact to operations, however IGO notes that December quarter spodumene sales from Greenbushes are likely to be lower than production due to deferral of some product shipments during the current quarter.’

Mr Dusci has been interim CEO since the unexpected death of long-time CEO Peter Bradford in October last year.

Outlook for IGO and the lithium market

While the company failed to meet guidance across multiple domains in the business, IGO stands at a healthy capital position, with an underlying free cash flow of $530 million.

This should allow the company to invest in resolving ongoing issues and continue its exploration activities with little concern.

The company has identified exciting opportunities within its Copper Wold Project in Arizona and West Kimberly Project, but both are far from production.

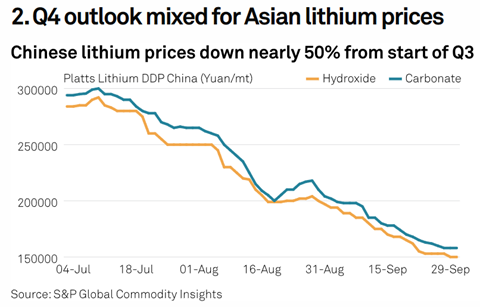

The biggest concern for IGO and the industry recently has been the volatility of lithium prices, largely thanks to EV makers in China who account for over half of the world’s production.

September data pointed to an 11% annual slump in new EV purchases in China as macroeconomic headwinds continue and households cut back spending.

This problem was worsened by an excess inventory of battery materials held by manufacturers in the region.

For many, what is usually a restocking period in the third quarter has turned out to be a quiet period where Chinese manufacturers deferred lithium purchases.

Source: S&P Global Commodity Insights

Compounding on this problem is an investigation by the EU into Chinese automakers, who they accuse of ‘flooding’ the market with cheaper cars thanks to subsidies.

The investigation will consider the application of a 10% tariff on the cars, which has put Automakers in a defensive posture.

For Australian lithium miners and refiners, there is an ongoing struggle to operate in this environment. A recent survey found that 55% of respondents within the sector see ‘very low to low levels of price transparency in critical minerals markets’.

Without a centralised market and limited spot price visibility, many producers struggle to get their products’ full value.

For now, lower lithium prices will likely continue into 2024, and markets will continue to be at the whim of murky off-take agreements.

This means a slow start to 1HFY24 for IGO and more pain ahead for the share price.

If you’re looking for another critical mineral that is needed for our future but isn’t dominated by China, then look no further than copper.

Why copper is ready for its ‘lithium moment’

‘The global copper market is entering an age of extremely large deficits‘, read a headline in a major mining publication earlier this year.

According to McKinsey, demand is set to outstrip supply this decade…by a wide margin.

To learn more about how critical copper will be for our future and how you can invest in copper, look no further than our resources expert, James Cooper.

In this video, James will give you a wealth of ideas and veteran insights for the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the coming red drought and click here today.

Regards,

Charlie Ormond

For Fat Tail Commodities