There’s quite a heated debate going on in the renewable energy industry at the moment.

That is, when it comes to the energy transition, how big of a role will hydrogen play?

Hydrogen is an energy carrier that can transport or store large amounts of energy when, for example, solar and wind produce too much energy.

Green hydrogen — hydrogen made from renewables — has lots of potential to help reduce emissions in industries where electrification is difficult such as in steel, cement, and aviation.

Hydrogen can also be used with fuel cells to power things like cars, trucks, or buses.

And there are many fans out there for the technology.

Japan, in particular, is quite focused on developing hydrogen.

And you’ve likely heard Andrew Forrest is a big proponent too, with big plans through Fortescue Future Industries.

And while most car manufacturers have focused on manufacturing battery electric vehicles, a handful of car manufacturers (Honda, Hyundai, and Toyota) are making fuel cell hydrogen vehicles.

But the technology also has its detractors.

Engineer and author Saul Griffith, for example, recently placed doubt on hydrogen’s big future at a parliamentary inquiry in Australia, saying:

‘The idea that hydrogen will play a large role in the energy future does not make economic or thermodynamic sense. It will play a small role, but attempting to carve out a large role for it represents a wasteful way to achieve clean energy goals.

‘When I look at the…graphs — and I do it diligently and I do it from first principle physics, I struggle to believe that hydrogen will be the contributor that is being lobbied for in this country.’

One of the big issues with hydrogen has been price. It’s still expensive. Therefore, Griffith is quite keen on electrification and using cheap solar.

Whether hydrogen ends up being a big part of our energy mix or not (I’m a fan for certain uses), I think the electrification trend will be big…

…and there’s going to be at least one big winner emerging from this trend.

Our needs for electricity are only going to grow

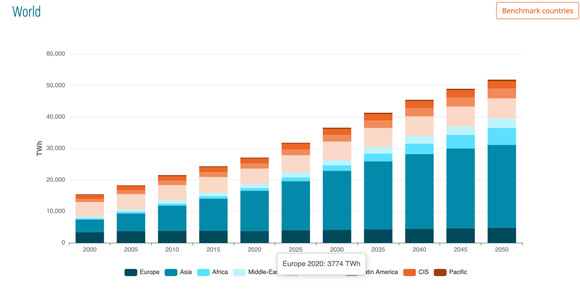

Enerdata expects that global electricity generation will increase 91% between 2020 and 2050.

Plenty of that increase in demand for electricity will come as we move through the energy transition…

But, as you can see below, much of the demand will come from developing countries like India, Vietnam, and Brazil as they continue to industrialise and require more electricity.

|

|

|

Source: Enerdata |

This global increase in electricity demand means we’re going to need more copper.

Copper is a fundamental metal in electrification and for the energy transition, since solar panels, wind turbines, electric vehicles, etc. all use more copper.

S&P Global expects that copper demand could double from 25 million metric tonnes today to 50 million metric tonnes by 2035.

Supply may struggle to keep up with this increase in demand though, after years of underinvestment in the sector.

Goldman, in particular, is quite bullish on copper. It expects that we could be hit with a long-term supply gap of 8.2 million tonnes by 2030 and that prices for the metal could hit US$15,000 a tonne as early as 2025 (prices are around US$9,000 a tonne at the moment).

So we could be heading for a shortage as supply struggles to keep up.

Copper prices continue to climb

What’s interesting is that for all the talk of recession out there, copper is doing very well at the moment, with the price having been recovering since last October.

Things have also been getting quite hot in the copper mining space.

As you may already know, BHP is trying to snap up Oz Minerals, and Rio Tinto recently increased its Oyu Tolgoi share of ownership to 66% after buying up Canadian Turquoise Hill Mining. Oyu Tolgoi is one of the largest gold and copper deposits in the world.

And in 2022 overall, copper was one of the favourites when it came to mergers and acquisitions making up 97% of the base metals deals value.

As S&P Global noted (emphasis added), it’s not a short-term thing:

‘At a nine-year high in 2022, copper exploration budgets were mostly directed toward minesite exploration and away from generative programs, led by major companies as they seek to extend the life and capacity of their producing mines. With 10 of the 18 copper-focused deals targeting assets in the reserves-development stage, many buyers’ acquisitions reflect long-term strategies rather than immediate boosts to production.’

So copper is looking pretty exciting indeed!

Best,

|

Selva Freigedo,

For Money Morning