I don’t usually read mainstream media property reports.

However, I was sent an article from the Herald Sun a couple of days ago by an investor with a headline screaming ‘Big Results Rock Melbourne…’

You can read it here (paywall).

It gives rolling coverage of the weekend auctions in Melbourne.

This is street theatre at its best — especially in hot real estate markets!

Big crowds fight it out with auctioneers screaming at the crowd to run the bidders up against each other.

The report is littered with examples of auctions that sold ‘hundreds of thousands’ above reserve.

A house in the bayside suburb of Beaumaris came in over $300K above reserve.

Another in the same area, went on the market at $2.65 million but ended up selling for $3.23 million.

However, the one that stole the headlines, is a property in Coburg North.

36 De Chene Parade.

A knock down on a big block of land — large enough for development.

Take a look:

|

|

|

Source: Realestate.com.au |

It sits in an excellent location.

Bang opposite one of the best (and biggest) parks in Melbourne — Coburg Lake Reserve.

This is an area where it can feel as if you live in the country — yet it sits on the border of the city.

The property was quoted at $900–990K.

The auction was packed with a mix of first home buyers and investors.

The reserve — $990K.

However, it sold under the hammer for $1.511 million.

Whoa…!

Selling more than $500K above reserve! Now that makes a great headline!

You can hear the screams of ‘underquoting!’ now.

Except it wasn’t.

The reserve was in the advertised range — $990K.

What’s going on?

Had the purchasers really paid too much?

Not in the current market.

I was bidding for a buyer on this property.

Fair to say I’d done a fair amount of research in advance.

I knew from the onset that properties within 1km — in lesser positions — were transacting for more than $1.4 million.

This property was ALWAYS going to sell for over $1.4 million.

Simply — the vendor expectation and reserve had been kept unreasonably low.

A trick every sales agent uses to bag what looks like a great result.

‘Quote it low, watch it go.’

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

Headlines like this are great advertisements for the agency.

But realistically, it sold close to where it was always expected to sell in this market.

It may sound like a lot — but by the end of the year, it will likely be valued at an even higher price than this.

In a country where the government backs real estate with buyer grants and tax cuts, you know from a quick glance at recent history that we’re in for a boom in real estate values that’s not about to peak out yet.

Sales tricks like this play into it.

Buyers miss out on a few auctions and up their budget to try and avoid riding the roller coaster of emotion week in week out.

Without experience, a lot of time can be wasted chasing stock that will always exceed their budget.

We’ve been warning investors since 2019 over at Cycles, Trends & Forecasts, that in this part of the cycle we would witness the biggest real estate boom in Australia’s history.

And so far, everything we have written has played out as forecast.

(Including, warning of the 2020 downturn prior to the event I may add.)

Simply — this is the real estate cycle in action.

It does have an ‘end by’ date.

But that’s not now.

If you have the knowhow to take advantage of it, you can make a lot of wealth.

This is the knowledge I share over at Cashmore’s Real Estate Wealth.

Let me give you an example.

Many real estate moguls will tell you it’s ‘time in the market’ that matters.

Not ‘timing the market’.

However, they couldn’t be more wrong.

If you know exactly (according to the property cycle) when, where, and what to purchase, you can double the gains you make over a boom period.

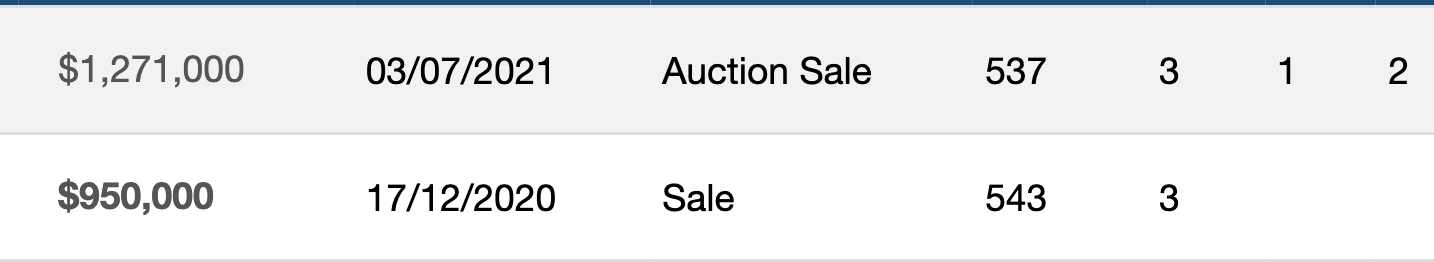

Using this knowledge — in December last year, I assisted a reader to purchase a suburban house on a block of land in Aspendale for $950K.

The market was not as hot as it is now.

There wasn’t a lot of competition. However, I knew that would change.

Indicators were showing me this was a great suburb to invest in.

Low vacancy rates and the ‘work from home’ demographic moving outbound along the coast.

Scoot on seven months, and a similar conditioned property (3 bedrooms, 1 bathroom, similar sized block of land) sold a few doors down on the same street for $1.271 million.

|

|

|

Source: REIV Property Data |

Not a bad ‘unearned’ gain in a few months.

As I said above — we have a few booming years ahead before the next downturn will rattle the property market.

There are numerous ways you can take advantage of it — as a stock market investor or a property investor.

You can learn all about it in Cycles, Trends & Forecasts and Cashmore’s Real Estate Wealth.

Don’t miss out.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.