In today’s Money Morning…the Fed’s virtual Jackson Hole and the physical/paper gold investing problem…what about ASX gold junior explorers and developers?…the hunt is on for the next Aussie gold company like this…and more…

For a lot of Aussie gold investors out there, 2021 was a frustrating year in terms of returns on ASX gold stocks.

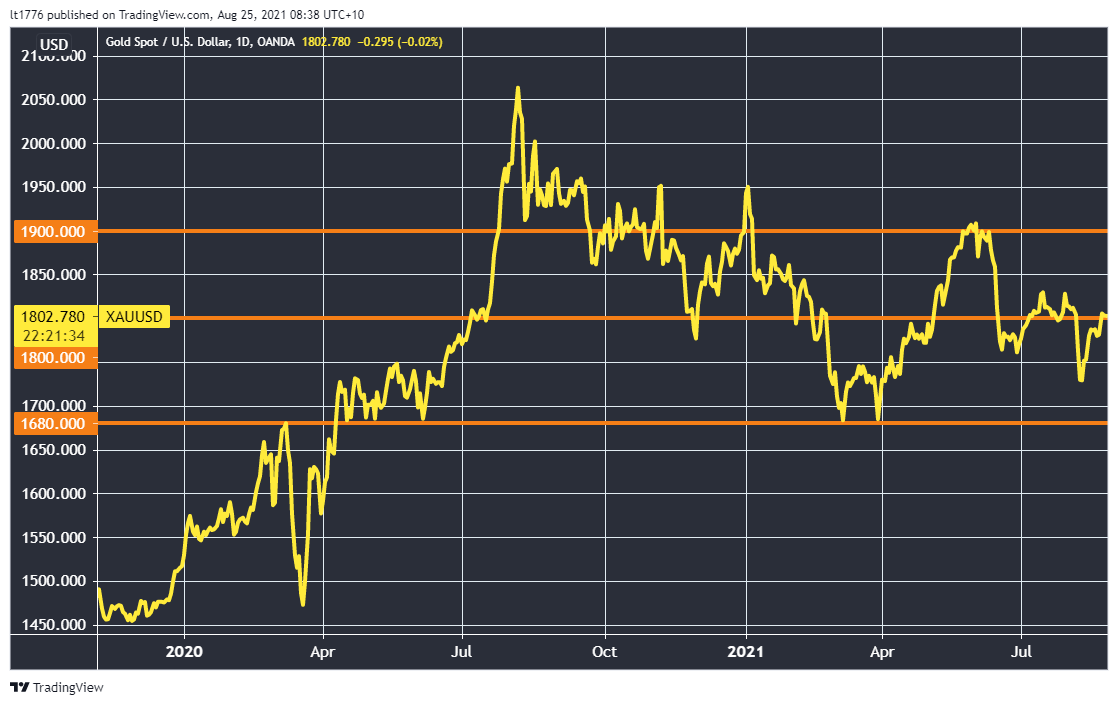

Companies with great cash balances and margins were beaten down as the price of gold in USD slipped from a high in July 2020 of US$2,060 or so, to where it is today at around the US$1,800 mark:

|

|

|

Source: Tradingview.com |

That US$1,800 line is psychologically significant, I reckon, and the longer it stays above that, the more likely another serious move higher is on.

That’s the short-term story anyway — long term, I’m bullish on gold’s prospects.

So over the coming weeks, you’ll hear a lot from us on the potential buying opportunity that exists for switched-on investors looking for ASX gold stocks in 2021.

Here’s what’s going on in the gold market at the moment and what you can do to invest in ASX gold stocks going forward.

The Fed’s virtual Jackson Hole and the physical/paper gold investing problem

Jackson Hole is an annual meeting of the various US Fed officials, and this year due to you-know-what, it’ll be held virtually.

There’s so much to consider for the most powerful institution in the world — and perversely, the spread of you-know-what may sway Jerome Powell (the Chair) towards more cheap money for longer.

Bloomberg notes that:

‘As policy makers prepare for another Jackson Hole conference — the second straight one Powell will address virtually rather than traveling to Wyoming — the economic picture looks much different. Thanks in no small part to a $1.9 trillion, front-loaded budget boost from President Joe Biden that caught Fed officials flatfooted, the economy has roared ahead, with employers complaining they can’t find enough workers. And inflation has taken off, as the unleashing of pent-up demand combined with disruptions to production and shipment schedules to push up the Fed’s favorite price gauge by 4%.’

It’s as if the Fed is boxing itself in here — they created an inflation beast but are trying to soothe the market with assurances they won’t taper for a while.

Meanwhile, as per Forbes:

‘The average U.S. rate for a 30-year fixed mortgage reached an all-time low of 2.65% in January’s first week, according to Freddie Mac data that goes back to 1971. Last week, the rate was 2.86%, the mortgage securitizer said.

‘Investors in fixed assets may take the Fed’s decision to nix the in-person gathering as an acknowledgement the U.S. isn’t out of the pandemic yet, and a sign it won’t be rushing to extricate itself from a monthly commitment to buy $80 billion of Treasuries and $40 billion of mortgage-backed securities.’

All of this bodes well for gold in the long run as it ramps up pressure in the ‘exit fiat’ side of the market.

But do you rush out and buy every physical bit of gold you can find?

I’m not so sure. Maybe consider some a portfolio stabiliser and back-pocket/rainy-day hedge.

What really interests me in this environment is paper gold or gold stocks in particular, and ETFs to a lesser degree.

You see, based on what I’ve seen around the market, a lot of the small- to mid-sized producers in Australia have comfortable cash positions to spend on exploration, and killer margins as the Aussie dollar wanes and the AISC metrics remain low.

These beaten-down stocks would likely be beaten down further in a serious market correction as all equities tend to fall at once in these circumstances.

That being said, I don’t think we’re anywhere close to an ‘all stocks down at once’ moment — part of the reason we’ve been alerting you to small-caps via the Australian Small-Cap Investigator service.

What about ASX gold junior explorers and developers?

Well, there may be a speculative renaissance around the corner after a significant dormant period.

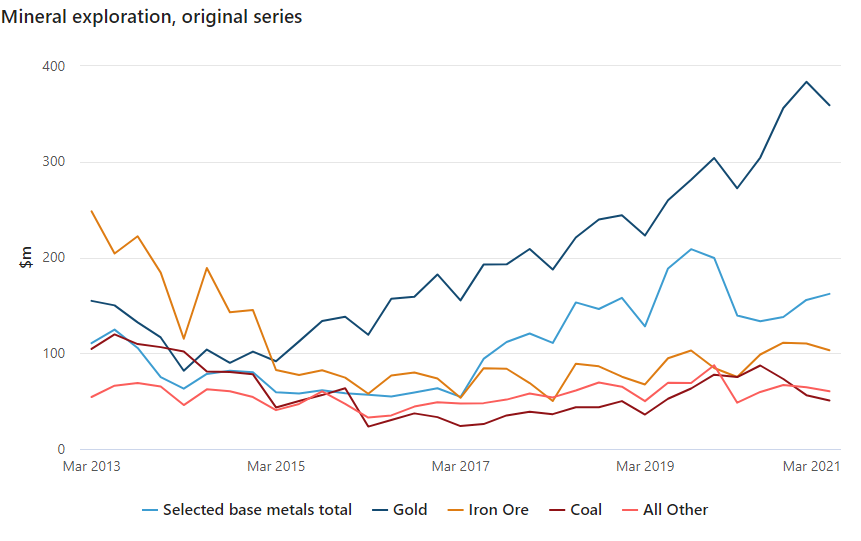

Check out the ABS data on exploration spend on gold compared to other metals too:

|

|

|

Source: ABS |

Gold is outstripping the other commodities by a country mile.

Throw into the mix a narrowing gap between Aussie gold production and China, well, you can see the jigsaw starting to fall into place.

For me, that means ASX gold stocks may have some serious surprises up their sleeve if you know where to look.

The hunt is on for the next Aussie gold company like this

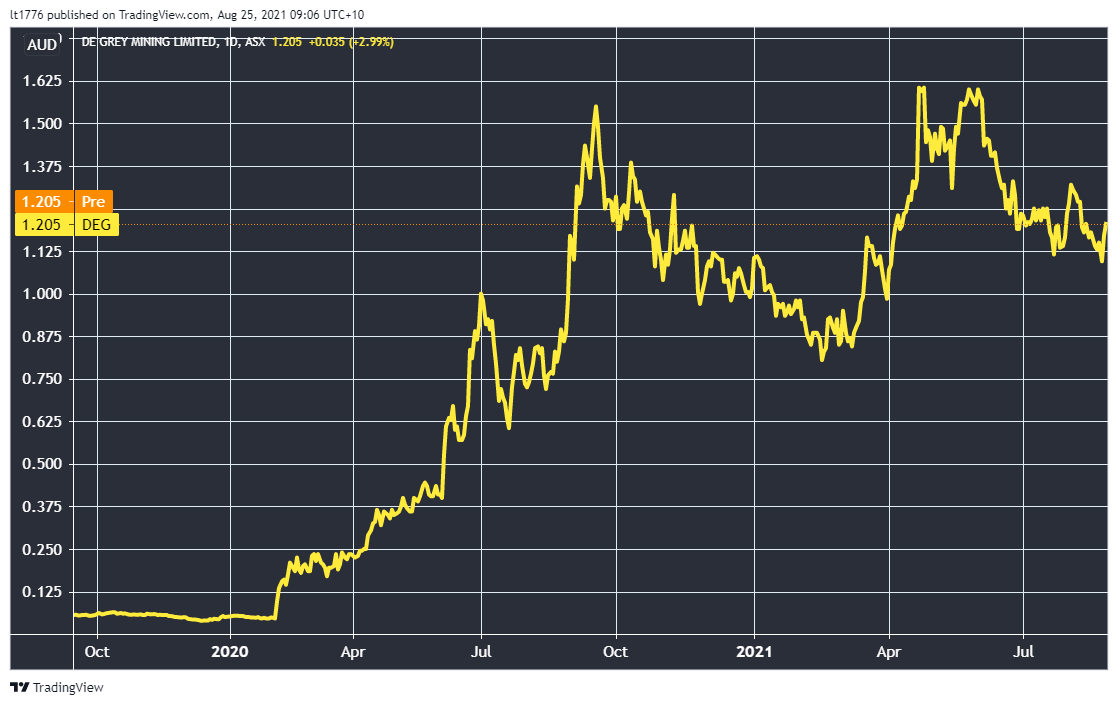

For an example of what’s possible, take a look at the almighty run that De Grey Mining Ltd [ASX:DEG] went on:

|

|

|

Source: Tradingview.com |

A huge run if I’ve ever seen one.

Of course, not all gold stocks will go up like this. It’s a speculative space of the market.

DEG started as an extremely speculative company and eventually turned into an ASX gold heavyweight.

A rare feat indeed.

But all up, I think there’s a number of legitimate reasons to be excited about gold’s potential.

If you want to learn more about ASX gold stocks, then look no further.

The latest addition to our editorial team, Brain Chu, has put together a presentation on gold which you can get access to right here.

Brian is an absolute gold nut, and I’d highly recommend you see what he has to say.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: On the theme of gold, this week I interviewed a familiar face, Shae Russell of Pallion. We talk about a range of important factors for the gold price and Aussie gold stocks.

Click here or press play below to watch.

Subscribe to our YouTube Channel here.