In today’s Money Morning…international inflation levels…when fiat goes in the bin, best hold onto something tangible…unbanked benefit from the Western fiat sceptics and the favour is returned…and more…

[Editor’s note: In the latest episode of The Money Morning Podcast, I catch up with Chris Brophy after the Hiremii Ltd [ASX:HMI] IPO to see how the company is tracking and get the specifics of how their algorithm could disrupt the recruitment industry.]

What do you do when your fiat is rubbish?

It’s a legitimate question.

Do you cling on in the hope that the IMF and World Bank will continue to fund your government?

I don’t profess to be an expert on development issues, but what I do know is that many countries are suffering from a crisis of confidence in their currencies.

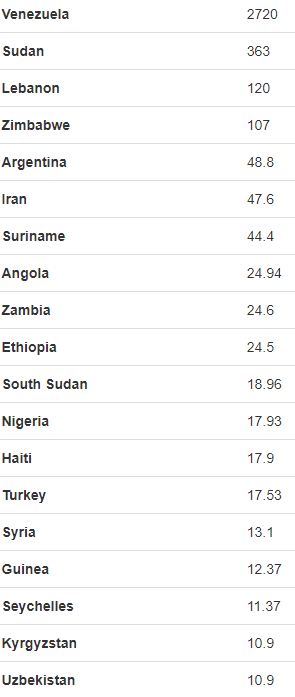

Check out the list of international inflation levels below:

|

|

|

Source: Tradingeconomics.com |

These countries are certainly in currency pain, that much is true.

I’m also aware that the various political, economic, and social maladies that this selection exposes cannot be fully addressed here.

What I am certain of, however, is that there is one powerful ‘nuclear’ option on the table for these countries.

And that’s crypto.

That’s what El Salvador opted for anyway.

Here’s why this last resort option could be worth the effort.

When fiat goes in the bin, best hold onto something tangible

When this happens, it’s common for the USD fallback to solidify.

Supposedly its trusted, eternal, and backed by a superpower.

It makes sense from a variety of angles.

The problem is getting your hands on enough USD to operate your business, pay for your family, and do anything really.

That’s Argentina’s problem, that’s Lebanon’s problem.

I can’t ever fully grapple with this kind of torment — where your home currency is essentially useless.

But what if you could swap your local currency for something where at least you know the rules governing its distribution?

That would be a very enticing proposition, indeed.

Say it loses 50% of its value in the space of months — not the best, but perhaps you could at least conduct basic transactions with it, as opposed to not at all.

This is what a whole host of younger Nigerians are discovering — that the most basic of transactions can actually be settled on a P2P basis.

No intermediaries, no IMF/World Bank, no governments — just you and your peer.

Bitcoin [BTC] is tangible in that sense.

Perhaps it’s concerning for the naysayers, but it’s also deeply liberating after watching your fiat’s value dwindle for decades.

Here’s how the whole crypto ecosystem can coexist in the coming years…

Unbanked benefit from the Western fiat sceptics and the favour is returned

It’s a bit of a monetary mess.

But there’s a whole host of developing countries casting longing looks towards bitcoin and crypto more generally.

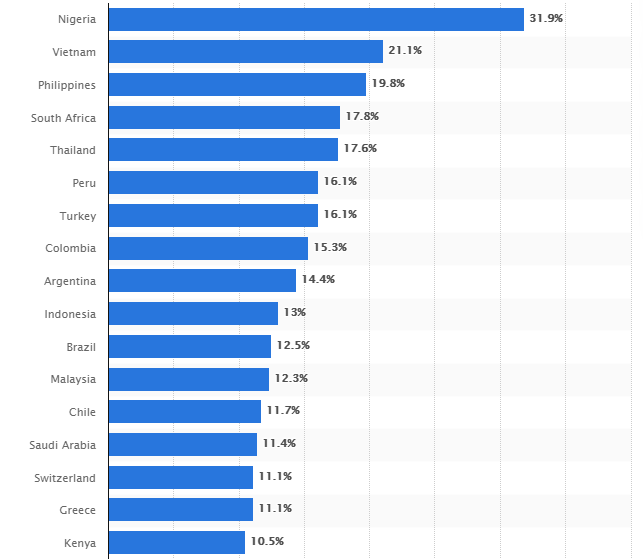

You can see this in the percentage of ownership/use of cryptocurrency below:

|

|

|

Source: Statista |

These are generally countries with fragile fiat systems.

The fragility leads to greater uptake, which interestingly, is at least partly sustained by Western fiat sceptics.

Here’s what I mean by that.

BTC is a competitive ecosystem — ‘Everyone wants a piece of it’ — so in many ways cashed-up Western HODLers put a floor under the price.

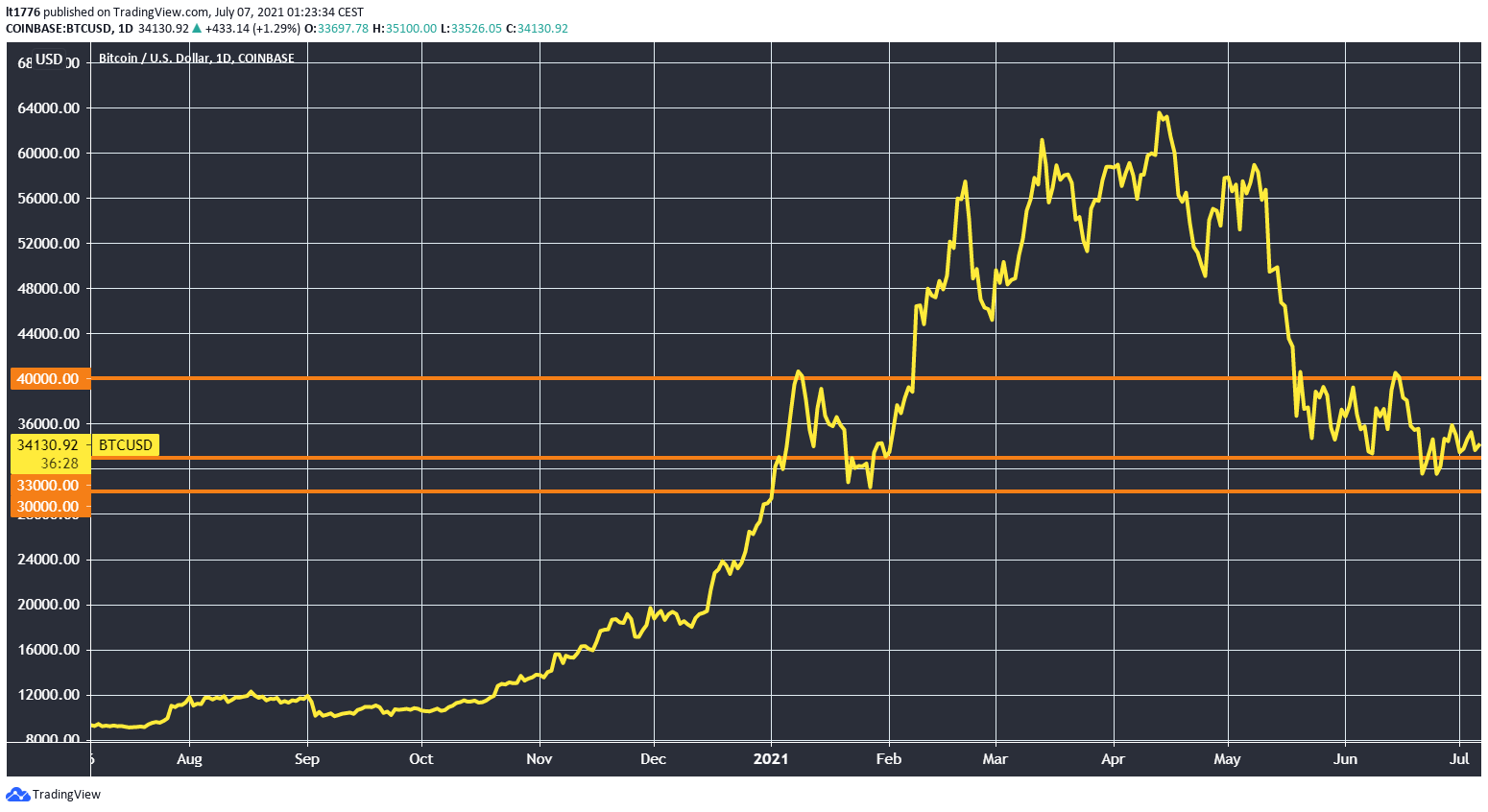

That support could be anywhere between US$30,000 and US$40,000, as BTC is tracking right now:

|

|

|

Source: Tradingview.com |

The longer the BTC price stays in that range, or pushes upwards, the more enticing crypto is to fragile economies and citizens beholden to the vagaries of USD ownership.

And in that sense, widespread crypto ownership in developing countries is predicated on Western HODLers’ mistrust of their own fiat.

Self-fulfilling prophecy, feedback loop, doesn’t matter.

Point is, Western crypto HODLers are banking on the unbanked in developing countries jumping in, and the favour is returned.

And it will reshape finance in both spheres, with DeFi looming as the key factor for these big moves.

There are opportunities here for transparent, auditable loans that otherwise would never exist.

This is evidenced in comments carried by CoinDesk from Keith Mali Chung of a Nigerian blockchain firm:

‘A lot of people are taking advantage of the [decentralized finance] industry right now, it’s giving equal financial opportunities for all, irrespective of nationality or whatsoever…A lot of people are jumping into different yield farming programs, I know quite a number of people who got DeFi loans to run their businesses.’

These are loan recipients that would never get a chance in the IMF/World Bank/government/fiat system that currently runs the show.

This is unequivocally a good thing.

It holds out the promise of more efficiently and directly financing development in a way the IMF/World bank could never do.

Does the US seize upon this moment, capture the developing world DeFi movement and win ‘hearts and minds’?

Or does it attempt to keep the old order in place via ham-fisted Digital Dollar initiatives and draconian measures?

It’s impossible to tell what the Fed is cooking up behind the scenes, but maybe, just maybe, they make the right decision here.

Crypto is the developing world’s ‘nuclear’ option, but at the same time, it’s a useful experiment.

Maybe the best experiment ever undertaken, for both the West and developing countries.

Let’s see how it plays out.

Regards,

|

Lachlann Tierney,

Analyst, Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.