In today’s Money Morning…it’s all about risk…traders must be wary of FOMO…the Magnetic Trader Workshop part 3…and more…

I usually provide a video on Wednesday, but instead I want to give the microphone to Murray Dawes again.

You see, this week we are running the ‘Magnetic Trader Workshop’.

It’s a great way to get up to speed on how to trade, or even if you are an experienced hand, learn some new tricks.

Today’s third essay in the workshop is all about risk.

Now risk sounds boring to some people but it’s actually one of the most important things you need to wrap your head around as a trader.

Take this little story of mine, for example.

Back in July I released a video on YouTube about risk management and stop-losses in the BNPL frenzy.

The hype was reaching peak levels and I suspect a lot of retail punters were jumping on stocks they knew little about purely because of a fear of missing out (FOMO).

This is not a viable strategy and I was pushing back against investors that thought these companies would go up forever.

[conversion type=”in_post”]

One particularly enthusiastic cheerleader commented on my video:

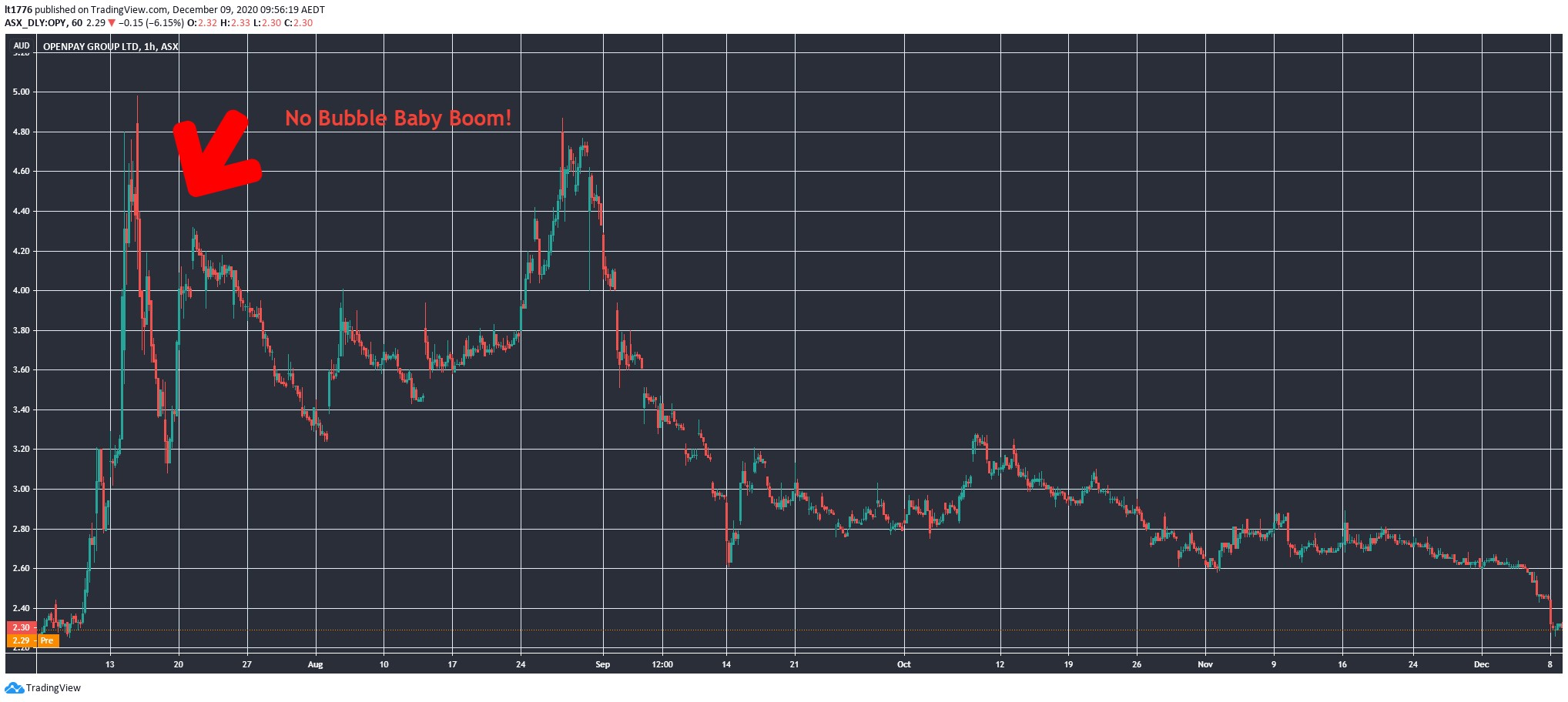

‘I bought 10,000 openpay today no bubble baby booom.’

Now, ‘baby’ and ‘boom’ aside let’s take a look at what’s happened to the Openpay Group Ltd [ASX:OPY] share price since then:

|

|

|

Source: Tradingview.com |

You can see OPY shares lost about half of their value since the ‘no bubble baby boom’ comment.

Maybe he was an astute trader who set a stop-loss.

But I suspect not.

This is why you simply must learn about how Murray Dawes manages risk in his trades.

It’s a unique system that is designed to reduce risk and leave you with more profitable trades.

And it counter-intuitively actually sets a wider stop-loss after the initial take profit level is hit.

Just listen to one particular subscriber of Murray’s service (named Fordham) explain it:

‘I have taken 5 trades, all are in the money and none closed out with an average gain of 25%. Murray provides good entry points where there is value (buyers) coupled with a fundamental analysis. I also like his staged exits, taking profits along the way as a way to take away stress by reducing risk. I very much appreciate Murray explaining his methodology. It imparts confidence and I enjoy learning technical analysis from a professional.’

Knowing risk lets you sleep better at night, and ultimately makes you a better trader.

So, once again I cede the floor to Murray Dawes to tell you how his system works. Click here to read on.

Regards,

|

Lachlann Tierney,

For Money Morning