Plague, pestilence, war…

No, not The Book of Revelations.

Just January 2020…

It’s been one hell of a start to the year…

And I wouldn’t be too surprised if a seven-headed beast appeared out of nowhere soon as well.

But end times or not, life and investing go on.

As you know by now, I’m a little bit more optimistic about the current situation.

I think it’s more likely we’re just dealing with the usual two-headed market monster — the twin emotions of fear and greed.

Markets can shift quickly between the two. As they are right now. It can make it hard to make rational investing decisions.

So how can you cut past the noise and make good decisions through it?

Here’s an idea I turn to in times like this…

ETFs provide investment clues

There’s a theory that the Book of Revelations in the Bible was actually a thinly veiled swipe at the Roman Empire, rather than a literal prophecy.

According to Princeton University religious professor Elaine Pagels:

‘The great scarlet beast with seven heads and seven crowns, for example, may represent the emperors from the dynasty of Julius Caesar. And the name of the beast — which is not named but is represented by the numbers 666 — may refer to Emperor Nero.’

The number ‘666’ was apparently some kind of early Christian code. Meaning rather than some mystical Armageddon vision, Revelations might’ve just been an old-fashioned political hatchet job on the early Christians’ oppressors.

The point is, truth is always in the eye of the beholder. And that’s never truer than in the markets.

Your eternal mission as an investor is to try and see the underlying truth first.

The real situation you’re dealing with is very different from the narrative in the mainstream. It often lies buried deep beneath the imagery of market commentary.

I find following the money flow of investor funds can help you here…

One way you can do this is by studying movements in the ETF (exchange traded funds) space.

ETFs are specially designed vehicles for investing in certain categories of stock ‘in one go’.

An ETF invests in a broad basket of stocks related to a certain subject, with adjustments made to decide what percentage of each stock is held within it.

The price of an ETF goes up and down to reflect the combined performance of all the investments it holds.

And you can buy an ETF in almost anything.

There are ETFs in shipping, blockchain stocks, gold…there’s even an ETF that invests in space-related stocks. Ticker code: UFO!

ETFs are a lazy way of exposing your portfolio to a particular theme. But they can be a smart way to invest too.

For example, don’t fancy investing in the Tesla circus, but are still very keen on the electric car space? How about investing in the Global X Lithium & Battery Tech ETF [LIT] instead?

You get the benefits of investing in the electric car trend without having to dig in deep to the stocks within it. It’s the time-honoured investment technique of diversification at work.

But even if you’re more of a ‘stock picker’ like me, studying ETFs can provide you with some investment clues too…

[conversion type=”in_post”]

ETF trends so far in 2020 and what they tell you

ETFs provide a level of detail that’s more granular than looking at a simple index.

For example, the Russell 2,000 index will tell you how small-caps (the top 2,000 of them) in general are going. But the S&P Software and Services ETF [XSW] will tell you how the specific segment of small-cap software stocks is going.

Think about this potential scenario for example…

Small-caps in general could be falling, but small software stocks could be rising. That could give you some ideas to investigate further.

And get you asking some questions like:

What’s the reason?

Are there further opportunities for you?

What does this tell you about the economy?

In short, it helps you work out the true state of things. Which as we said at the start, is your task as an investor.

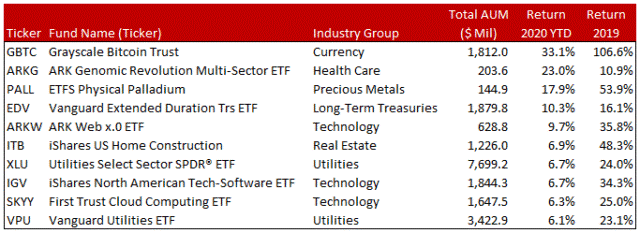

This graphic shows the ETFs that are doing well in 2020 so far:

|

|

| Source: Seeking Alpha |

You can see bitcoin is doing remarkably well so far (more on this tomorrow). As is healthcare, home construction, web stocks, and palladium.

You can also see that a lot of these winners are continuing on from good 2019 years. This is classic bull market behaviour and should give you cause for optimism.

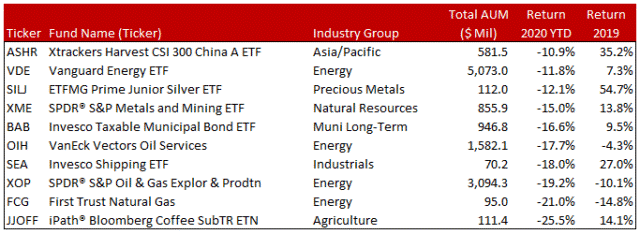

On the other hand, this graphic shows the ETFs that are doing badly so far in 2020:

|

|

| Source: Seeking Alpha |

What’s interesting here is the turnaround in the Invesco Shipping ETF [SEA].

It was doing great in 2019, but has had a shocking start to 2020, and as I discussed last Monday, is perhaps an early warning sign that global trade is slowing down.

You can also see that by the fact that a lot of energy and oil ETFs are down too.

ETFs are not just a lazy way to invest. They’re also a great source of further information.

And working out trends and divergences is ultimately how you can look for good stock opportunities.

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments