Almost a month after the US put pressure on the Netherlands to join their chip war against China, Japan has now joined in on the action too. As they announced last week, Japan’s ministry of economy, trade and industry is seeking to restrict some of its chip exports.

While they didn’t explicitly point to China in this policy proposal, it’s clear what their intention is. Even going so far as to make this sly verbal jab:

‘We are fulfilling our responsibility as a technological nation to contribute to international peace and stability…’

It’s hard to imagine that comment is aimed at anything but China’s expansionary aggression because as we all know, Beijing’s aspirations to control Taiwan are hardly secretive.

More importantly, though, it’s just the latest blow to leave China behind technologically.

After all, as Ryan Dinse and I have been telling our subscribers in Exponential Stock Investor, the timing on this chip war is very deliberate. As we speak, we’re seeing the biggest transition within the microchip industry in decades…

But, of course, China was never going to just sit idly by as this happened.

No chips, no rare earths

According to reports from Nikkei overnight, China is now considering a rare earth export ban — a move that appears to be motivated by this chip war.

As the outlet reports:

‘Officials are planning amendments to a technology export restriction list, which was last updated in 2020.

‘The revisions would either ban or restrict exports of technology to process and refine rare-earth elements. There are also proposed provisions that would prohibit or limit exports of alloy tech for making high-performance magnets derived from rare earths.’

In other words, China is aiming to strangle Western tech efforts via their strong suit: rare earths…just as the US and its allies have done via limiting microprocessor technologies.

And if you’re unaware as to just how dominant China’s rare earth industry is, look at this infographic:

|

|

| Source: Statista |

As you can see, China is by far the top dog of rare earths mining. But it goes beyond that too…

When it comes to processing these minerals and producing the key magnets from them, they’re just as dominant. Up to 85% of all rare earths refining is done by China. As for making the magnets, they account for an even more astounding 92% of global output.

Suffice to say, China is by far the biggest miner, processor, and producer of rare earths products.

And now they may be about to cut the world off to strike back at this chip ban.

History repeats itself

Curiously, this isn’t the first time China has done this. As the Nikkei article notes, we saw a similar move from Beijing more than a decade ago:

‘China suspended exports of rare earths to Japan following tensions in 2010 surrounding the Japan-administered Senkaku Islands, which Beijing claims and calls the Diaoyu.

‘Japan specializes in making high-performance magnets from rare earths while the U.S. produces products that use the magnets. That episode led to a heightened sense of alarm in Japan and the U.S. on the economic security front.’

In fact, I’m sure Aussie investors may recall this event pretty well themselves.

Back in 2010 and 2011, this rare earths ban led to a huge market bubble.

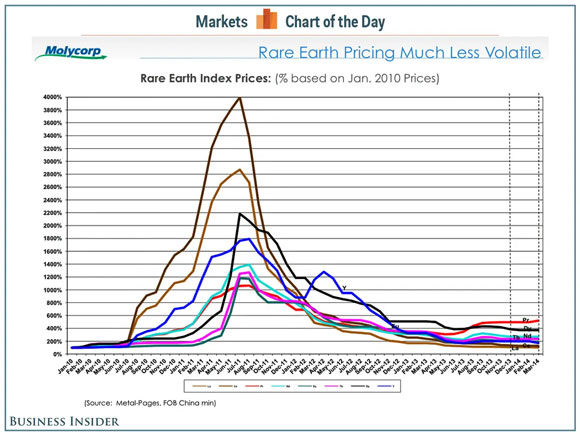

Junior mining companies across the ASX jumped on the rare earths bandwagon as prices went parabolic. Here’s an old chart showcasing just how quickly and steeply things got out of control:

|

|

| Source: Business Insider |

As a result, in the span of about a year, investors saw some huge speculative returns. But as the chart suggests, that euphoria didn’t last all that long.

Eventually, the ban was lifted without much fanfare. The fears of a massive supply shortage that fuelled the exponential pricing never actually materialised. And, like any bubble before it, the gains evaporated almost instantly.

This time around, things are similar but also different.

For starters, rare earths are far more important now than they were back in 2010. Their use in electric vehicles has made these critical minerals more sought after than ever before.

On top of that, while China still dominates global supply of rare earths, there are new alternatives. Companies like Lynas Rare Earths [ASX:LYC] — which barely survived the 2011 bubble — have become vital suppliers. And while there aren’t as many explorers or pre-production miners as there were in the last bubble, Australia has a few junior rare earth plays still floating about.

The key difference is that they’re not relying on absurd prices to become profitable projects.

So, if China really does go ahead with another rare earths ban, keep an eye on the local industry. While we probably won’t see the same absurdities as 2011, some rare earth stocks could stand to benefit…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Due to the Easter weekend, there will be a modified publishing schedule for Money Morning. We will return to our usual publishing schedule on Tuesday, 11 April.