Updated July 2024

For years, a small elite group of stocks have been the dominant force in the markets.

Some might know them as ‘Big Tech’.

But they also go by the more epic-sounding moniker: the ‘Magnificent Seven’.

They consist of the biggest, most profitable and most influential tech companies in the world — Meta, Amazon, Apple, Alphabet, Microsoft, Nvidia and Tesla.

And for more than a decade, their dominance seemed unshakeable.

But that’s changing…rapidly.

According to Mike O’Rourke, the analyst who first came up with the term ‘Mag 7’, ‘group’s dominance over the stock market is coming to a close.’

That’s because of a major shift happening in the markets.

Capital is starting to flow AWAY from Big Tech, and into AI microcap stocks.

And in today’s Fat Tail Daily, I’m going to give you some ideas on how to capitalise on this shift.

What’s happening to the

‘Magnificent Seven’ stocks?

In his recent piece titled ‘R.I.P. the Magnificent Seven Era’, Mike O’Rourke predicted the coming demise of this once-elite group.

He said, ‘This big rising tide of seven names lifting all boats in the stock market, is what I see ending. I don’t see these seven names rising together.’

Now, to be fair, he didn’t say that all stocks in the ‘Magnificent Seven’ lineup will go down.

But still, it’s surprising news.

Especially since these stocks had a fantastic 2023 overall.

That year, they saw a 107% return, doubling the Nasdaq-100’s returns and massively outperforming the S&P 500’s 24% gain.

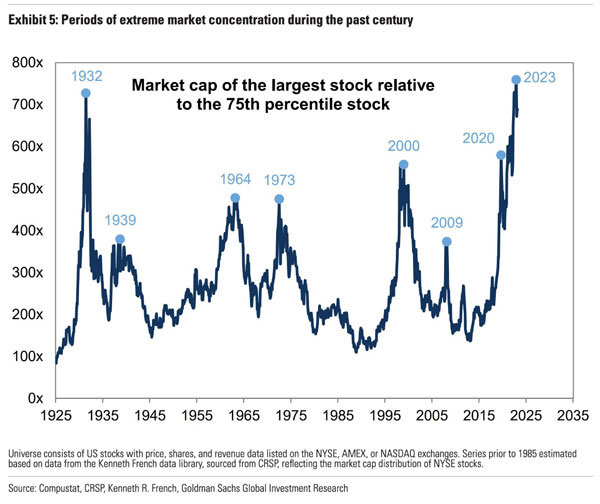

As a result, these tech titans accounted for around 30% of the S&P 500 index in 2023 — a point of historic market concentration and capitalisation.

Check out the chart below:

| |

| Source: MarketWatch |

But as earnings season approached, pockets of weakness started to emerge among this famed group of stocks.

The once Magnificent Seven are now seeing their trajectories split.

You see, through a combination of fierce competition and public missteps, three are now being left behind.

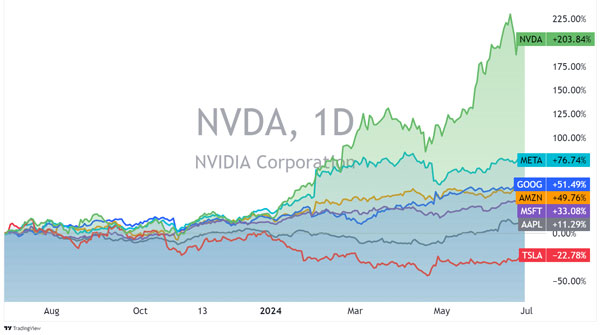

We’ve seen Tesla’s [NASDAQ:TSLA] stock fall over 20% this year so far as the EV market fights for the shrinking slice of car sales.

Alphabet [NASDAQ:GOOGL] has stepped from one AI blunder to the next in its attempt to catch up with OpenAI’s ChatGPT.

While Apple [NASDAQ:AAPL] has seen its stock languish as regulation and fierce competition squeeze earnings.

Look at their performance since the beginning of 2024:

| |

| Source: TradingView |

Just like that, the ‘Magnificent Seven’ has now been reduced to the ‘Fantastic Four’.

The question is: can the remaining players keep up?

The problem with the ‘Fantastic Four’ stocks

I believe we’re at a turning point.

The market concentration we’ve seen in the past 12 months — where the big tech stocks dominated — could begin to shift.

And that could open up opportunities among the microcap stocks in the market.

As my colleague Callum Newman says in his article, ‘All this, to me, is painting a positive outlook for stocks come 2024 and, certainly, 2025.’

Let me explain.

Markets have historically struggled to broaden beyond the top players, who in this era remain some of the most profitable companies in the world.

However, when things are stretched (as they are right now), investors will eventually shift to investments that present better value.

Today, the S&P 500’s forward P/E is 23.4, while the equity risk premium (ERP) is only 3.5%.

Historically, this is around 5%, so from a risk-adjusted view, you’re not going to get good long-term value at these prices.

Is this because the market is overheated?

It depends on your perspective.

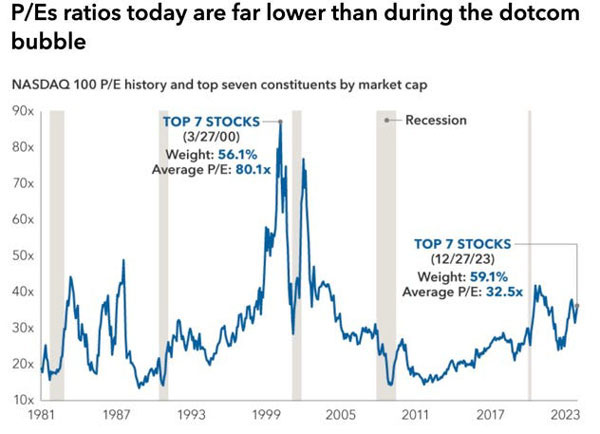

One could argue that compared to the dotcom bubble (see chart below), the top seven stocks aren’t so overvalued compared to back then.

| |

| Source: Business Insider |

But in the context of the sensational earnings growth delivered by Nvidia [NASDAQ:NVDA] and other tech giants, such a P/E ratio isn’t irrational.

The day after Nvidia’s recent earnings release, it added an astonishing US$277 billion to its market cap.

That’s the equivalent of a Bank of America or Chevron in a single session!

Who knows how sustainable this growth could turn out to be?

Goldman Sachs’ Hedge Fund Trend Monitor shows that six of the 10 largest holdings in over 700 aggregated hedge fund portfolios are these ‘Mag 7’ stocks.

Hedge funds, ETFs and passive traders are crowding around the same portfolio of stocks.

This resembles the obsession with the Nifty Fifty.

You can say that this was the ‘Mag 7’ of the 1960s and 1970s.

They were 50 of the most popular big-cap stocks on the New York Stock Exchange and considered some of the best investments of the time.

Many called them ‘one decision’ stocks because you could buy and hold them forever.

Investors went crazy over them, thinking that no price was too high for quality.

But as it turned out, their best days of growth were behind them.

The Nifty Fifty ultimately flatlined for nearly two decades.

That’s not to say the mega caps won’t perform from here. Big Tech could still register growth in the coming years (especially Nvidia).

However…

The possibility of a soft landing and interest rate cuts by late 2024 presents an opportunity for the market rally to broaden.

And that could open up more opportunities with small-caps — especially microcap AI stocks.

This, I believe, is where you should consider allocating some of your investment capital.

Here’s why:

Watch out for ‘AI disruptor’ stocks

Many of the Big Tech monopolies are now ripe for upheaval and disruption, especially from the smaller players.

Just take Google’s 90% stranglehold on search market share.

Recently, Microsoft CEO Satya Nadella admitted that his company had spent US$100 billion upgrading its search tool, Bing.

This huge multi-year spend is its latest attempt to unseat Google’s two-decade dominance over search. Why the big push?

Each percentage of Google’s search market share that Bing can siphon away is worth around US$2 billion in ad revenue per year to Microsoft.

But so far, this huge spend has done little to shift the needle away from Google.

For now, Bing’s service is too similar to Google’s.

This is where we are seeing smaller players disrupt the field.

Perplexity — the Jeff Bezos-backed start-up — has recently reached unicorn status after only being launched in August 2022.

The service is part chatbot and part search engine. If you haven’t used it yet, I recommend trying Perplexity.ai as your new search alternative.

It’s already passed the important milestone of 10 million monthly active users (MAU) and could become the next big name in search.

For now, it remains private and out of reach.

But it’s a good example of the fundamental upheaval to long-held dominance that AI could fast-track.

Soon, you’ll see these AI disruptors pop up in every market and sector, unseating the big guys when they least expect it.

An exciting future for investors

As we peer over the horizon of the tech landscape, it’s clear that the ground is shifting.

The dominance of the big players is fracturing, opening up vast expanses of investment potential.

Yet the market is still crowded at the top.

This is your ‘in’ as a smart investor.

Right now, the real opportunities lie with the agile, innovative companies ready to disrupt the status quo.

For the first time, AI has given them the tools to really turn the tables on the big boys.

And I believe these are the investments that could redefine the tech landscape and, more importantly, have the potential to generate handsome returns for those discerning enough to recognise their potential.

If you want to look for these AI disruptors, we invite you to join Alpha Tech Trader.

This is a new service where Ryan Dinse and I (Charlie Ormond) give you an insider’s look at the AI-led era of disruption…

And how to spot our best microcap AI stocks with the greatest potential.

You can get access to it here.

Regards,

|

Charlie Ormond,

For The Insider

Comments