- Make sure you keep an eye on BHP today. Australia’s biggest company released their quarterly production figures this morning.

What we want to see is how the market reacts to the latest news.

Here’s why I say that…BHP, the stock, has looked mighty strong trading into this announcement.

Here’s a chart via Twitter poster Stan than shows what I mean….

|

|

|

Source: Twitter |

What I can also tell you is that BHP’s momentum is coming through loud and clear via my algorithm.

The quarterly update released today is a reality check versus the expectations building into the price before we got to now.

Does the stock rise, fall or stay steady? We’ll find out!

Think about this more broadly too.

For all the terrible news we keep getting battered with, BHP is a play on growth via the commodity sector.

A strong BHP is another indication the market is not as bearish as most presuppose.

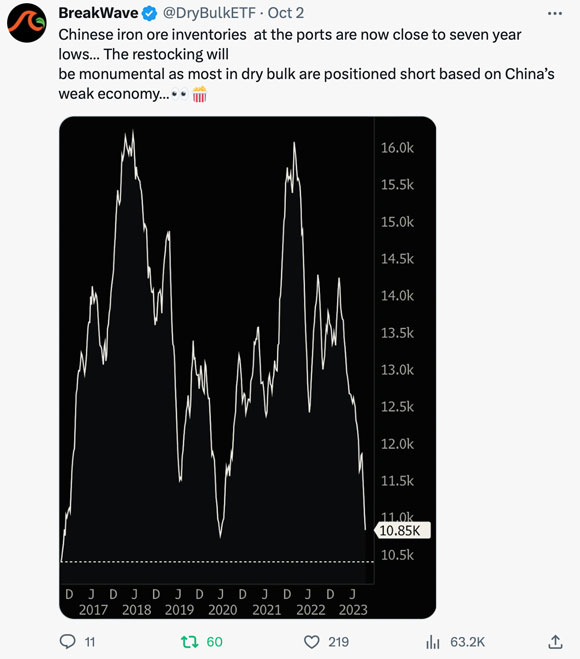

Over the last few weeks, I’ve made the case that iron ore could keep defying expectations.

It’s also possible it rises.

Here’s a recent chart of Chinese port inventories for iron ore too…

|

|

|

Source: X |

Now, BHP is a nice sturdy play on commodities over the next five years. I like accumulating it on dips.

For trading however, I like the potential for bigger, faster moves.

The best way I know how to do that is via the small-cap sector.

I’m watching the iron ore juniors very closely. Any sniff of a rise in iron ore — against all expectations — could put a firecracker under them.

I also like some of the iron ore juniors for the money they’re printing while the price stays above US$110.

Go here for more on my favourite iron ore junior.

It’s due to release its latest quarterly this month, and I’d be surprised if it doesn’t get a lift on the day — they should have minted cash in the preceding three months.

- For further evidence of the robustness, take a look at America.

What can I say?

Goodness gracious me, the United States economy just keeps surprising to the upside.

The Wall Street Journal reports that the American consumer is still spending happily, with retail data beating expectations.

What about the recession that is supposedly always around the corner?

The fear factors keep pointing to high mortgage rates, high oil prices and big debts across the economy.

Reality is more mixed, as always!

While oil prices are elevated, petrol in the US (‘gas’) is not.

In fact, as a percentage of income, it’s nowhere near its former high.

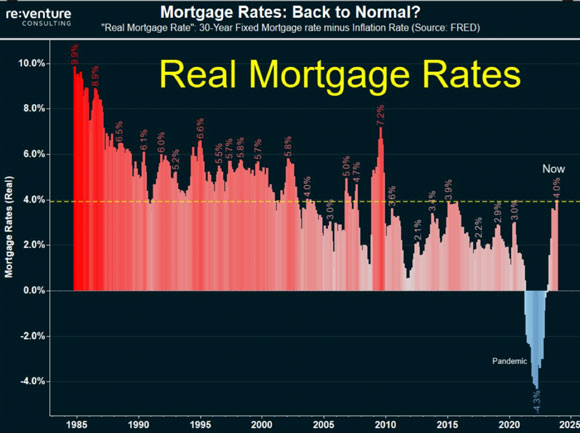

Another big one for the US is mortgage rates.

They are, nominally anyway, at or very near 8%.

However, as always with rates, there’s the ‘nominal’ figure and the ‘real’ figure (after inflation).

I found this chart very compelling…

|

|

|

Source: X |

You can see the ‘real’ mortgage rate is much higher than the mad period around COVID. But historically, it’s about average.

This is important because housing is so vital to the middle class American.

And, let me tell you, Americans are sitting on a gargantuan level of housing equity. The US housing market is up 40% since 2019.

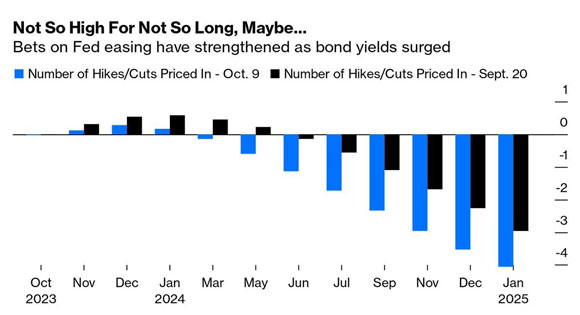

Also of interest is that the market appears to be pricing in more cuts over 2024 and 2025 than earlier.

See that here…

|

|

|

Source: Bloomberg |

All this, to me, is painting a positive outlook for stocks come 2024 and, certainly, 2025.

The wild card is, of course, the deterioration in geopolitics around the world right now, especially in the Middle East.

Where this goes, nobody — least of all me — knows.

As yet, we don’t have a clear guide from the markets. They are clearly not panicking.

However, it’s a dynamic situation. All we can do is monitor it.

Best wishes,

|

Callum Newman,

Editor, Money Morning