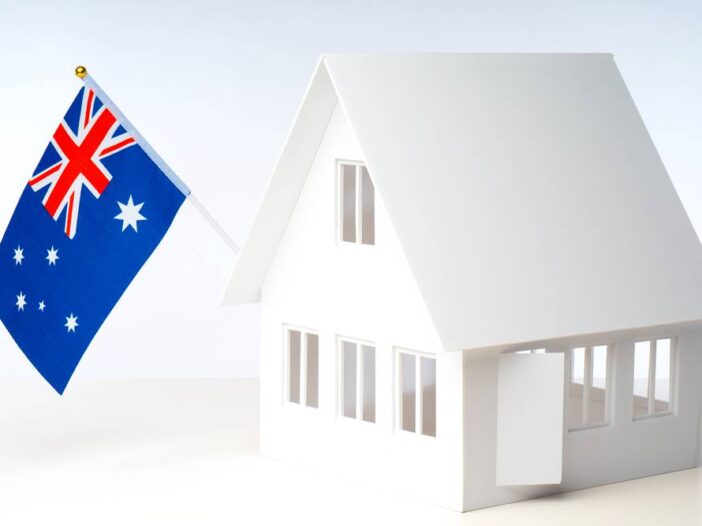

I’m taking you back to this chart today:

|

|

|

Source: Prosper Australia |

It’s the forecast we produced at Prosper Australia a few months ago.

It charts the historical increase in unimproved land prices in Australia.

We are one of the few countries that record this metric. It’s a very important one, noting that it is the locational value of land that appreciates — not the buildings on top.

The forecast (as per the orange and red lines) is based on past land price growth rates extrapolated from the national accounts (ABS 5204061).

The last decade’s increase in national land values averaged 4.9% per annum.

A similar rate of increase over the next five years would have taken Australia’s total land values from $6.2 trillion to $8.2 trillion by the end of this cycle (2026).

However, the latest figures from the national accounts have just been released, and the results have blown the above forecast out of the water.

They have revealed record land price inflation over the last 12 months.

Triple the highest ever previously recorded.

$683 billion was the past record in 2016/17.

However, over the last 12 months, the cost of land in Australia has gone up by $1.72 trillion.

97.1% of that is residential land.

We’re experiencing the biggest land boom in recorded history — just as we forecasted in Cycles, Trends & Forecasts a few years ago.

It also means that the MSM is back to screaming about unaffordability and first home buyers being priced out.

Four Corners covered it in a special report the other night. In the report, economist Saul Eslake said:

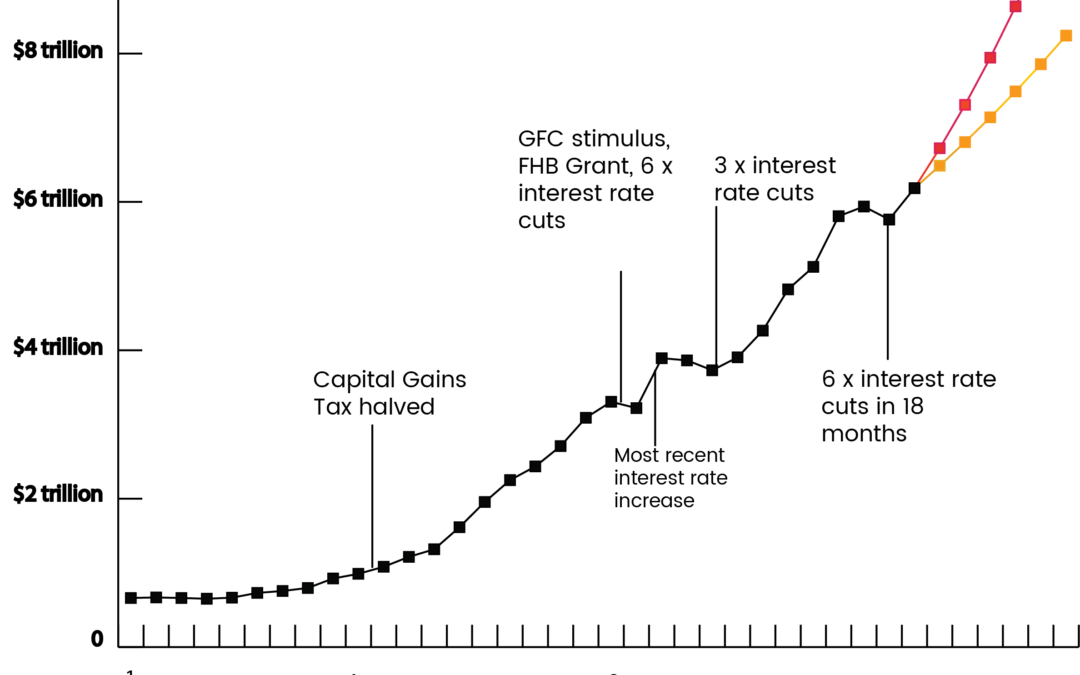

‘What’s really striking is the decline in the home ownership rate among people under the age of 45.’

In the 2016 census, the rate of home ownership among people under 45 was lower than it had been at the census of 1954:

|

|

|

Source: ABS dataset (H/T Louis Christopher) |

Bottom line, of course, is that the market is rigged to keep housing (or rather land) unaffordable.

The tax system allows land rentiers to get rich, at the expense of labourers. Allowing them to pocket large capital gains in the upward swings of the cycle.

As the economist John Stuart Mill (1806–73) quipped:

‘Landlords grow rich in their sleep without working, risking or economising.’

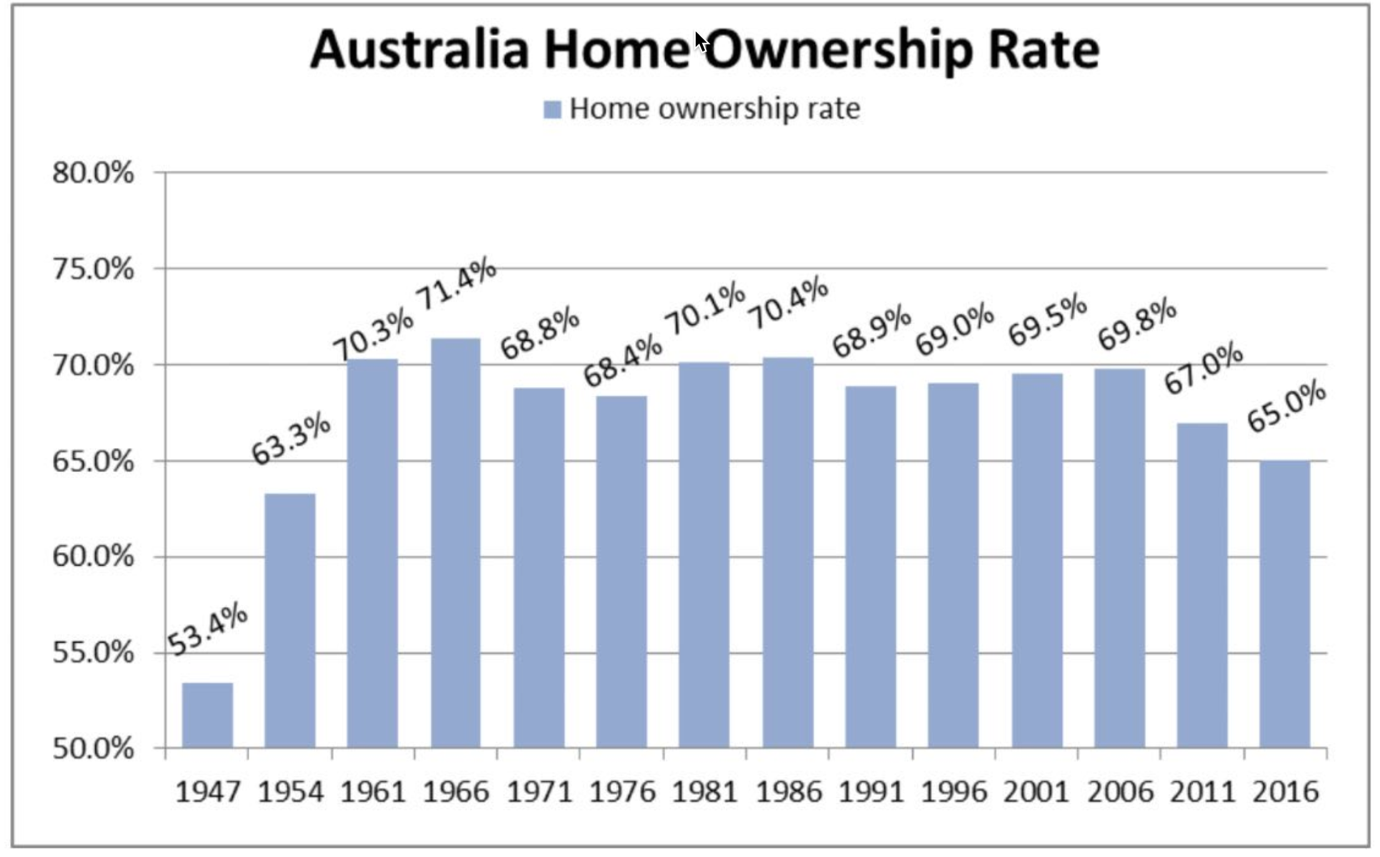

Take a look at this article featured on Four Corners — written in 1963:

|

|

|

Source: Four Corners — from the Sunday Telegraph — 11-8-1963 |

‘Tens of thousands of Australian couples, many of them with children, are desperately in need of homes. Most of the husbands have good, steady jobs and could afford to repay a housing loan.

‘In fact, often the loan repayments would be LESS than the rent they are paying now. Yet in June, 1961, there were 194,109 UNOCCUPIED dwellings in Australia. And the waiting list of couples seeking homes grows steadily longer, outstripping the growth of new houses…’

Truth is, there’s still a heap of unoccupied dwellings in Australia.

At Prosper Australia, we analyse the number of vacant properties for a 12-month period each year based on water usage data.

You can take a look at the research here.

Some years, we’ve uncovered potentially 80,000 properties sitting empty in Greater Melbourne alone. Properties not for sale and not for rent — held for speculative gain only.

Fair to say that the government (both state and federal) are not going to do anything to make housing affordable.

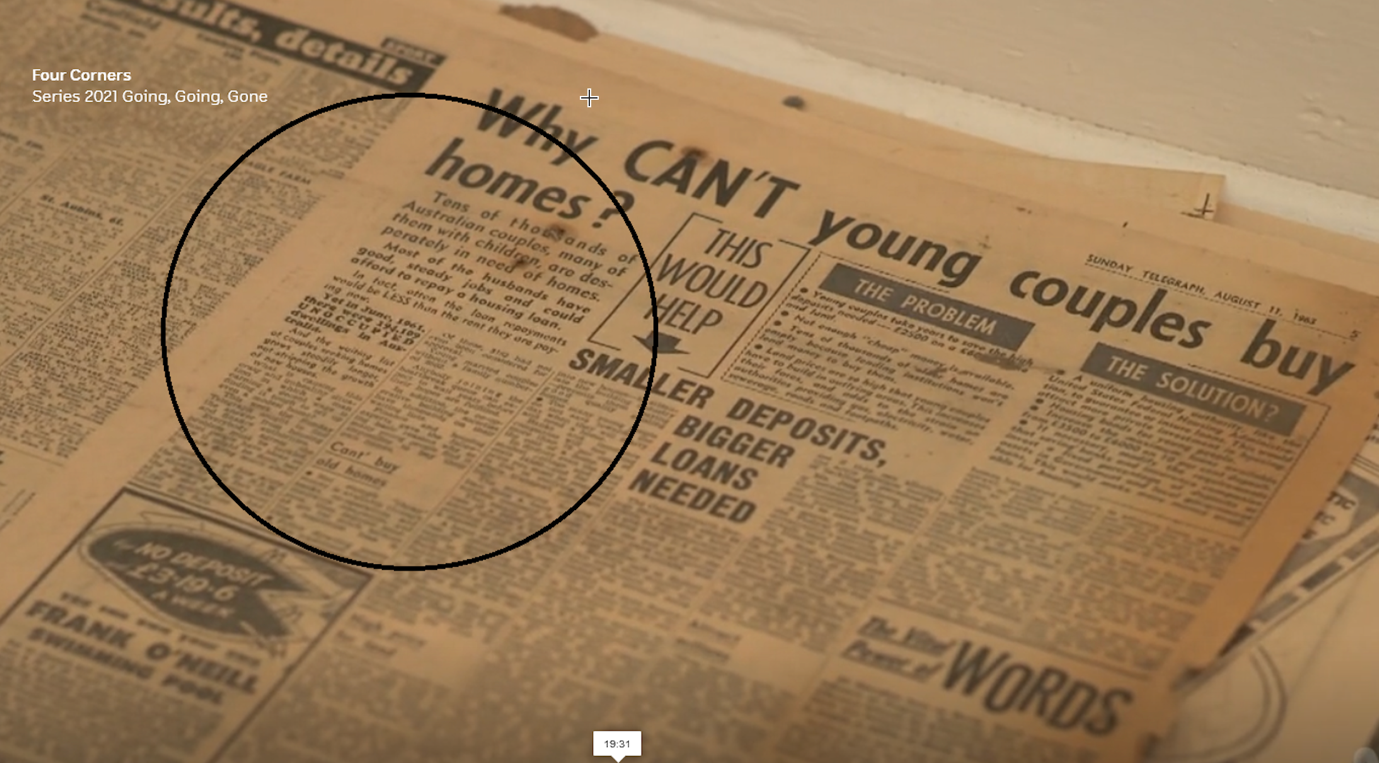

Still, when the 2021 census results are released in 2022, it’s highly likely we’ll see an uptick in homeownership.

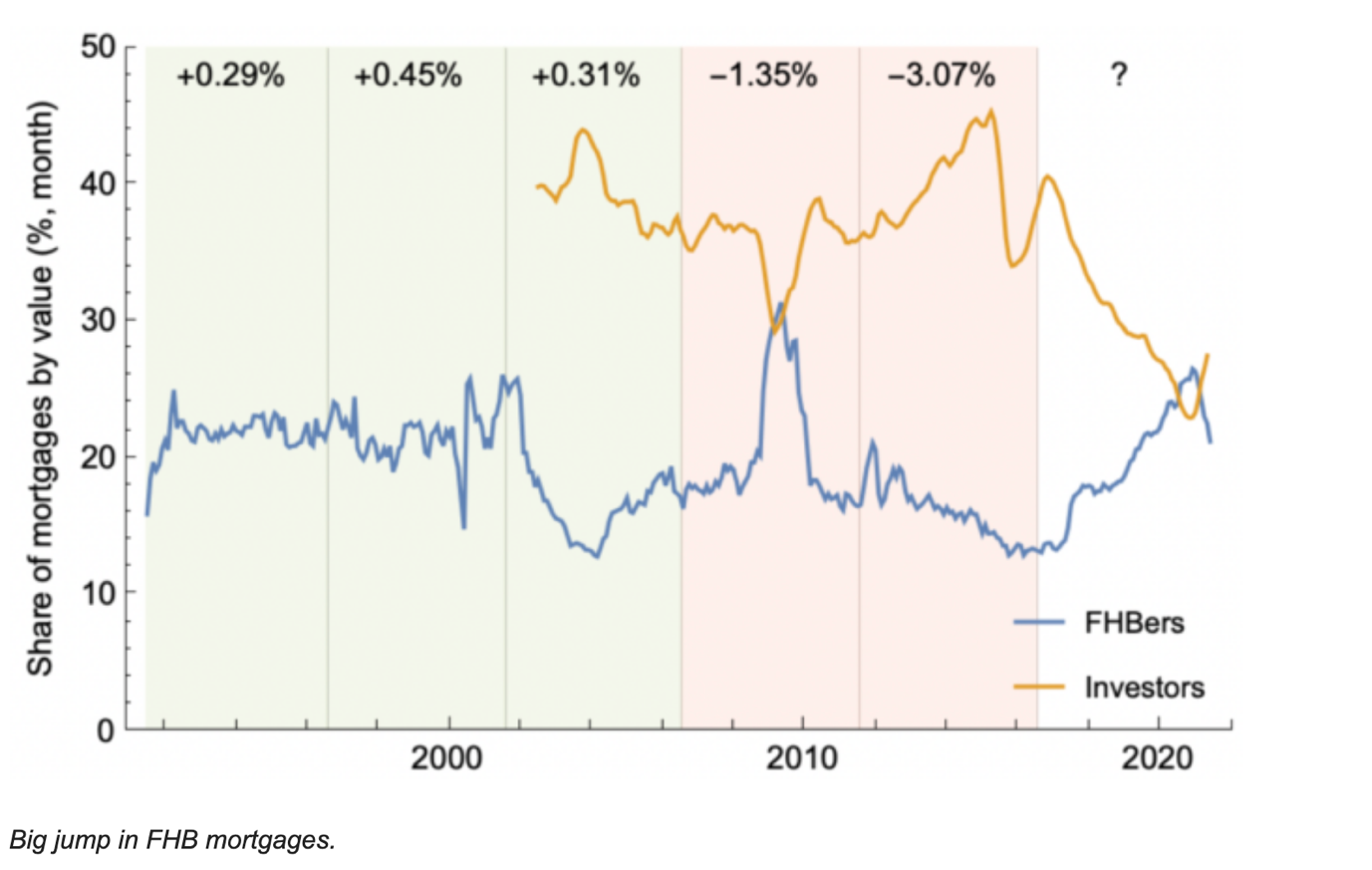

The graph below shows the trend.

The green shading shows the census periods with rising homeownership. The red shading is falling homeownership, with the percentage point change in homeownership marked.

|

|

|

Source: MacroBusiness |

Since the last census in 2016, first home buyers have been a large proportion of all new mortgage lending.

Government incentives have been driving the trend in recent times.

Many of those buyers are part of the Great COVID Migration — targeting regional suburbs and cities previously considered too small or too remote to live.

If I were an investor — I’d be following the money and doing the same.

It’s rare to experience conditions that allow buyers to get into the market at comparatively affordable prices in the regions — yet potentially take double-digit gains previously limited to capital city suburbs due to demand.

Best wishes,

|

Catherine Cashmore,

Editor, The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.