The most difficult aspect of forecasting is not extrapolating from existing trends, but rather identifying completely new trends that are not on the radar screen now, but will emerge seemingly out of nowhere to affect investor portfolios.

That said, what are the main determinants of economic growth and market sentiment that will be of most direct concern to investors this year? I’ve identified six determining factors: Federal Reserve policy, trade wars, social unrest, the US 2020 election, gold as a monetary asset, and ‘black swans’.

Here’s a brief outline on how three of these factors will impact stock, bond, commodity, and other markets in 2020. I’ll discuss the remaining three in Tuesday’s edition of The Daily Reckoning Australia.

Determining factor #1: What the Fed does next

Fed monetary policy works with a lag of 12 to 18 months. The overtightening in 2017 and 2018 was what caused the near recession at the end of 2018. We are still feeling the effects of that today.

Annualised GDP growth in the US has continued to slow. That trend is not your friend.

Monetary easing should also work with a lag to help growth by mid-2020.

That’s good news for Trump’s re-election chances, but it indicates the Fed has more work to do between now and then.

13 June 2020 are likely dates for rate cuts.

Even more cuts in March and May 2020 cannot be ruled out.

Collectively, those cuts would push short-term rates close to zero. At that point, the Fed would be back where it was in December 2016.

Mission not accomplished.

The only silver lining is that this rate cut path is bullish for stocks.

Determining factor #2: Trade wars will continue for years, even decades

The US–China trade war is not just a trade war, but really part of a much broader confrontation between the two countries that more closely resembles a new Cold War.

This big picture analysis has been outlined in several speeches given by Vice President Mike Pence. Secretary of State Mike Pompeo has also chimed in, warning that China is a long-term threat to the US and that business as usual will no longer protect US national security.

The trade battle is escalating, but no critical issues have been resolved and none will be in the near future.

The US cannot accept Chinese assurances without verification that intrudes on Chinese sovereignty. China cannot agree to US demands without impeding its theft of US intellectual property. This theft is essential to escape the middle-income trap that afflicts developing economies.

The US will win the trade wars despite costs. China will lose the trade wars while maintaining advantages in intellectual property theft.

Trade wars will continue for years, even decades, until China abandons communism or the US concedes the high ground in global hegemony. Neither is likely soon.

Determining factor #3: Social unrest on a global scale

There can be no doubt that Venezuela represents an extreme case of social unrest.

In fact, it represents the complete collapse of a country that was once the richest economy in South America and remains the holder of the world’s largest proven oil reserves.

But social disorder does not stop there. It will spread around the world. And that’s exactly what’s happening.

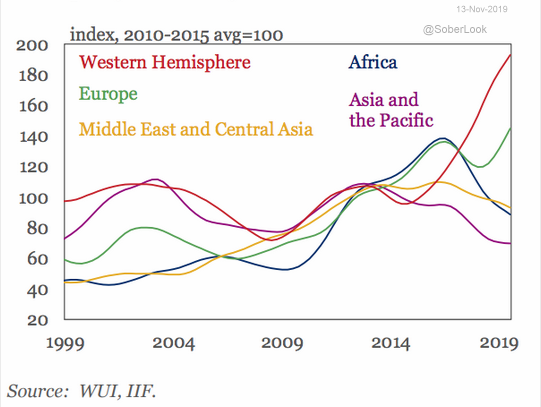

This chart shows a 10-year index of social unrest broken down by region.

What is striking is that traditionally unstable areas in Africa (blue line) and the Middle East (yellow line) are showing reduced unrest over the past five years, while more stable areas such as the Western Hemisphere (red line) and Europe (green line) are showing dramatic increases in social unrest, especially in the past two years.

Index of social unrest 1999–2019

|

|

|

Source: Pinterest.com |

Of course, the data in this chart is not highly granular and the geographic divisions are quite large (North and South America are lumped together as ‘Western Hemisphere’).

Nevertheless, the trends are distinct and the recent upsurge in areas that include most of the developed economies is disturbing.

The question is: Why? Allowing for the fact that there is always some instability somewhere, are we witnessing a trend that has a common thread (such as workers versus elites) and an element of contagion due to social media and internet-based news coverage?

The evidence suggests that may be the case. If globalisation is the problem (because it overrides indigenous concerns and displaces jobs), then it follows that a global reaction is forming.

Investors should expect the trend towards social unrest, including in developed economies, to continue.

Residents of Hong Kong certainly never expected such an unstable situation as recently as a year ago.

Cities in the United States and Australia are not immune. While local outbreaks of unrest are difficult to predict, the trend is clear and more unrest should be expected.

That’s enough for today. Stayed tuned for Tuesday’s edition of The Daily Reckoning Australia, where I’ll outline the other ‘big six’ factors that will affect markets in 2020.

|

Until then, |

|

|

Jim Rickards, PS: Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. Download your FREE report by clicking here. |