In today’s Money Morning…warehouses full of uranium?…cornering the market…play it wisely…and more…

I’m not sure how much uranium it takes to power a nuclear-powered submarine, but it just got more expensive.

Check out the chart:

|

|

| Source: Business Insider |

The price of the radioactive fuel surged to five-year highs last week.

So what gives?

No, it had nothing to do with Australia’s decision to snub the French on a $90 billion submarine deal, and instead looked to source nuclear-powered subs from the US and UK.

Though, I suppose you could make the argument that some eyebrows were raised on how this deal might affect nuclear non-proliferation agreements.

It certainly plays into US-China tensions and a potential new arms race.

But that’s a bit of a long bow to explain short-term uranium price moves.

Here’s the real culprit…

Warehouses full of uranium?

Canadian fund manager Sprott Inc is responsible for this radioactive buying spree.

They increased their stockpile of uranium by a massive 45% over the past month, through the Sprott Physical Uranium Trust.

This extra source of buying has put pressure on actual end users like power stations.

Hence the rise in price…

Now, I’ve heard of hedge funds doing this with tankers of oil, or warehouses full of silver, but never with a highly-dangerous radioactive substance.

Which made me wonder: where do they actually store the ‘yellowcake’?

So I did a bit of digging…

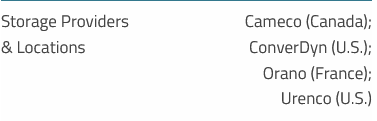

According to their website, there are four storage locations:

|

|

| Source: Sprott |

Cameco is a Canadian uranium mining giant, ConverDyn owns a Uranium processing facility in the US, Orano is a French nuclear fuel company, and Urenco is a German enrichment facility.

KPMG is employed as auditor to ensure any Trust-owned uranium is accounted for.

In other words, Sprott is basically paying these nuclear companies to not sell their uranium to power plants.

It reminds me a bit of how gold is sold to different parties without ever leaving the vault. It’s simply shuffled from one side to the other.

Anyway, specifics aside, what’s Sprott up to with this move?

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Cornering the market

It would seem like this is a classic attempt to corner the market.

Cornering the market — that is, buying up all available supply so real buyers have to pay you whatever you want — has been a Wall Street favourite since the early 20th century.

Indeed, it was so popular back in the day, that there’s a 1909 silent move called ‘A Corner in Wheat’!

That film tells the story of a greedy tycoon who buys up a bunch of wheat futures making the price of bread rise — in turn destroying the lives of those who can’t afford it.

The classic principles of cornering a market remain the same:

- Find something that’s in scarce supply

- A bunch of buyers can’t live without it

- Buy up the supply just before buyers need it

- Sell to the highest bidder

In uranium, the ‘desperate buyers’ are the owners of nuclear power plants.

Ultimately, they need supplies of uranium-enriched fuel to operate.

Though, unlike say, a coal-powered plant, the cost of fuel is actually quite low as a percentage of their overall expenses.

Which means they can actually wear some pretty steep uranium price rises.

The bet Sprott and their investors are making is that demand for uranium is about to rise at a time supply is falling.

Uranium miners have been cutting back for years and many have resorted to buying uranium in the spot market to fulfill contractual obligations, rather than mining new uranium.

So there’s certainly a potential shortfall looming. This supply shortfall can’t be easily fixed in the short term.

Uranium mining is a complex and dangerous operation and mining companies have to jump through many hurdles to get up and running.

Which means high prices could remain for years before new supply comes online.

On the demand side, things are looking more optimistic for uranium miners than they have for a while.

As reported in Yahoo Finance:

‘The robust investment demand is built on a growing realization that nuclear power is becoming more accepted by policymakers worldwide as a way to limit greenhouse-gas emissions, Ciampaglia said Wednesday in an interview.

‘“That’s something that’s just recent, and you’re seeing this from the Biden administration acknowledging and providing support for nuclear,” he said. “And the European Union clearly identifies nuclear as part of the taxonomy.”

‘Uranium is also getting a boost from generalist investors who are seeking investments that meet environmental, social and governance criteria or support the energy shift away from fossil fuels, he said.’

The ingredients certainly seem to be there for a supply squeeze.

The only question that remains is the timing…

Play it wisely

At the end of the day, this bet ultimately relies on power companies paying up eventually.

And that might not happen overnight.

As reported in Bloomberg:

‘As far as utilities are concerned, Kazatomprom doesn’t expect a rush for more deliveries in the next couple of years. While Sprott may “buy, buy, buy,” it’s “highly unlikely” that utilities will sign new contracts soon, with discussions more likely focused on supplies in 2024 and 2025, according to Batyrbayev.

‘“Utilities have good enough uranium stocks for the next three years,” the executive said. “We don’t expect big requests from energy companies to buy uranium in 2022 to 2023; that determined our decision on 2023 production.”’

The uranium market may be getting ahead of itself right now. And if so, then expect a price pullback as miners look to sell into the hype.

However, if the price doesn’t pullback, we could be looking at a classic cornering. And if that happens, this could be the start of a multiyear move in uranium stocks.

Will be a very interesting space to watch…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.