I rocked up at an auction the other week to bid on a property for some overseas home buyers.

It was a nice home — single-fronted Victorian, three-bedroom, two-bathroom, only 6km north of Melbourne’s CBD and surrounded by an abundance of facilities.

This includes some of Melbourne’s best schools, shopping strips, and a few hundred metres from both train and tram stops.

The agent thought he had a couple of solid bidders on the property — with an expectation around $1.45 million.

But despite a fairly large crowd at the auction — no one but myself put up a hand to bid.

It ended up passing in, to me, and through negotiation, I secured it below what the owners’ paid in 2019.

Needless to say, they weren’t too happy.

But with rates forecast to continue to rise in the shorter term, there’s understandably a lot of fear out there. It’s holding people back.

The thing is — if you’re in the market to buy — it couldn’t be a better time.

For the vendors that must sell (and the ones selling this house had committed elsewhere), the market has already bottomed!

Financially strapped owners will drop as far as they need to today to secure a sale. You just need to be savvy with negotiation and know how to identify a good opportunity.

But forget the price for a moment.

There’s a bigger lesson to glean here.

The value of productive well-located residential land is enduring.

Something Fred Harrison — arguably the world’s most accurate economic forecaster — uncovered when he penned his 2006 publication Ricardo’s Law: House Prices and the Greatest Tax Clawback Scam.

It’s important you understand this concept because the price gap between richly facilitated locations and poorly facilitated locations, quite literally, determines the length of a person’s lifespan.

Evidence shows that those who monopolise the best locations, secure the difference between a healthy long life or an early death.

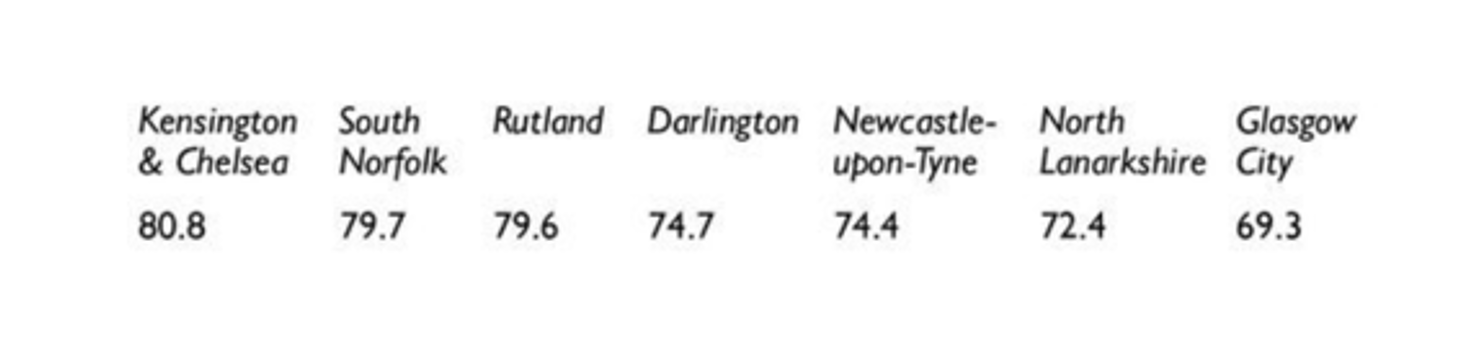

For example, if you live in London, surrounded by the best amenities, with housing equity some four times that of the UK’s northern regions, your average lifespan will be around 80 years.

But the further away from London you progress into the poorer northern regions, the worse your chances of a long, healthy life become.

Life expectancy at birth by UK local authorities:

|

|

|

Source Ricardo’s Law: House Prices and the Greatest Tax Clawback Scam, by Fred Harrison |

The same phenomenon has been evidenced by President of the World Medical Association, Michael Marmot.

In the ABC Boyer Lectures in 2016, he pointed out the following:

‘I had been studying health inequalities in Baltimore. In the poor part life expectancy for men was 63 years. In the richest part it was 83 years. A twenty-year gap in one city.

‘If you live in the richest part of Baltimore and want to see what it is like to live in a place with male life expectancy 63, you could fly to Ethiopia…Or you could travel just a few miles..

‘Life expectancy for men in the poorest part of Baltimore is the same as Ethiopia, two years shorter than the Indian average.’

What I’m trying to emphasise here is that a well-located property will always have someone willing to pay more to secure the site in the bull phases of the property market.

But when everyone is running fearful, there are some golden opportunities to be had.

The market today reminds me of the 2018 downturn.

Lending practices were under the spotlight due to the Banking Royal Commission — with serviceability rates assessed at around 7%.

However, when the market turned in the second half of 2019, it was the sharpest recovery I have ever witnessed. All that competitive advantage disappeared almost overnight.

Land has enduring appeal — time the market right — and you can make substantial wealth.

We don’t need to limit this concept to residential land either.

Warren Buffett has countered gold bugs over the years with a similar understanding of land’s enduring qualities.

In 2011, he suggested to investors that they put their wealth into the equivalent value of farmland (instead of gold):

‘A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops — and will continue to produce that valuable bounty, whatever the currency may be.

‘Exxon Mobil (XOM) will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons).

‘The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond — (2011 annual letter for Berkshire Hathaway shareholders).’

That alone should give you some idea as to why Bill Gates has quietly snatched up more than 242,000 acres of farmland spanning 18 states. (As well as a stake in 25,000 acres of transitional land on the west of Phoenix, Arizona, which will be turned into a new suburb, I might add.)

Just a few weeks ago, he was additionally cleared to purchase 2,100 acres of rural North Dakota farmland.

Gates now has the title of the US’s biggest private-farmland owner.

And there are many pots in Gates’ investment portfolio.

Including attempts to re-engineer the climate by spraying dust into the atmosphere to block the Sun. (It’s called ‘Sun dimming technology’. You can read about it here.)

And, of course, his desire to wean the population off depending on animals for food with the creation of fake meat and dairy products from plants (soy). (See ‘better than meat’, ‘Impossible Foods’ and ‘lab cultured breast milk’.)

You can come to your own conclusions regarding the agenda behind it.

But the timeless truth remains…

All of his investments depend on the location and resources of quality land!

The lesson?

Monopolise land and its natural resourses — and absent of significant land taxation (as promoted by the economist Henry George) — you monopolise and control the wealth it generates and the people it shelters and feeds.

Sincerely,

|

Catherine Cashmore,

Editor, Land Cycle Investor