Most of you who’ve been following the mining sector may feel that it’s been underwhelming. The near-term prospects of many companies haven’t been too encouraging.

However, this could set the foundation for a much stronger medium-term potential.

I wrote two articles last month that were stark contrasts of each other. In one, I wrote about why I believe the commodities boom has been more talk than reality based on recent price movements. The other, which I wrote a week after, talked about how the falling US Dollar Index [DXY] and the price of crude oil — remaining at the US$65–70 a barrel range — might act as a tailwind to drive mining companies to deliver better profits.

What followed was the US Federal Reserve raising the Federal Funds Rate by 0.25% in the last week of the month, taking it up to 5.25–5.5%. This quickly pushed the US Dollar Index back above 100, as you can see below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

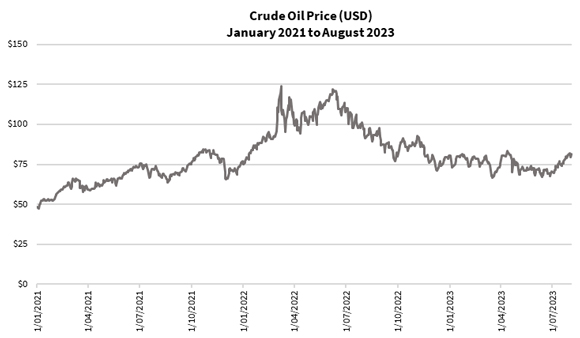

At the same time, the effects of the production cut for crude oil by OPEC in June started gaining traction. This saw the price of crude oil lift to over US$80 a barrel, as shown below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

It seems like the current trends and conditions have tipped the scales to favour the views espoused in the first article. This means mining investors will need to temper their positive expectations in the short term and be prepared for a rough market.

But don’t let that pour cold water on your hopes with your mining investments. Because I believe the medium to long-term potential for this sector has just gotten better.

Let me explore the dichotomy in the sector, starting with the half-empty case.

The ‘glass-half-empty’ mining sector

The 2023 June quarter reporting season showed some improvement in operating conditions for the established miners across different commodities.

However, investors were asking for more, especially with the coming year’s production forecast. After all, there’s been so much hype about how the coming clean energy revolution should lead to a resurgence in the mining sector. Therefore, they were expecting companies to unveil major upgrades to production and exciting developments.

That hasn’t emerged yet.

Thus far, the challenging operating conditions in the past three years with inflation, a higher oil price and labour shortages have caused bottlenecks in production. On top of that, the latest spanner in the works included land heritage titles that could cause delays in permitting or development. Even though WA has recently scrapped a law relating to this, the debate over ‘The Voice’ could mean this issue will linger for some time.

Several producers sold down after their results announcement. Even the larger operators weren’t spared. Northern Star Resources [ASX:NST] and Fortescue Metals Group [ASX:FMG] fell by around 10% over a two-day period.

Some mid-tier companies took bigger hits because of their disappointing production guidance. For example, Aeris Resources [ASX:AIS], Regis Resources [ASX:RRL] and Silver Lake Resources [ASX:SLR] tumbled by more than 20%. Westgold Resources [ASX:WGX] rallied when it released a solid operating performance, but gave back its gains a few days later when management released the 2024 guidance that fell below expectations.

My guess is that a reason behind these sharp drops comes as economic conditions move against the mining sector, exacerbating the overreaction by market investors on even a hint of negative news.

This might be for the short term, though.

There’re signs that central banks around the world may likely bring forward rate cuts even as their official narrative suggest otherwise. For one, the US debt downgrade at the start of this month has brought an abrupt change in market sentiment, making them more bearish. This momentum could build and cause a selloff, forcing central banks to backpedal.

The case for a ‘glass-half-full’ mining sector

Now I don’t want to use the prospect of a market downturn and central banks cutting rates to argue a favourable case for the mining sector going forward.

Clearly, the mining sector can do better than that!

One can’t deny the share prices across the mining sector look quite dismal, lithium stocks being the exception. However, the activity on the ground for most mining companies is suggesting things are looking positive. This is especially the case for the smaller explorers.

I’ve written earlier this year about the corporate activity in this sector. Most notably major international gold producer Newmont Corporation [NYSE:NEM] taking over Australia’s largest gold producer Newcrest Mining [ASX:NCM], the proposed merger between lithium producers Allkem [ASX:AKE] and Livent Corporation [NYSE:LTHM], up-and-coming gold producer Genesis Minerals [ASX:GMD] purchasing the Leonora operations from mid-tier producer St Barbara [ASX:SBM], and the takeover of nickel producer Mincor Resources [ASX:MCR] by Andrew Forrest’s privately owned Wyloo Metals have shown that the boards of the larger mining companies are looking at snapping up smaller competitors to add to their portfolio.

And there’s been several cases of smaller explorers merging with their neighbours. These include gold explorers Brightstar Resources [ASX:BTR], Rox Resources [ASX:RXL] and uranium developer Deep Yellow [ASX:DYL].

The more astute executives are now making their move when the sector is cheap. You can expect many will follow suit as everything heats up. Of course, they’ll end up paying more by then. In some cases, such purchases will cost shareholders dearly and some executives will end up falling on their sword for destroying value.

While investors are looking at prices and fretting about their portfolio whipsawing every day, these companies’ management and their teams are busy on the ground drilling, building and moving lots of dirt. I’ve noticed several explorers haven’t cut their exploration budget but even increased it in recent months.

They know that the big players are on the prowl and the best way to avoid being the next takeover target is to create value, and fast!

A mining newsletter to suit your appetite!

There are a lot of mining investors out there who’re feeling restless.

They might’ve made a nice profit with their lithium stocks and bought into other commodities thinking they’d take off. After all, the clean energy revolution is supposed to be in motion and that’s meant to supercharge the commodities boom.

However, the reality isn’t as rosy for many producers that faced a tough few years. The quarterly reports always brought sky-high expectations back down to the hard rocky surface.

If you’re looking for big gains in the coming years, this is the time to accumulate. You might need to take a few more bumps and tumbles along the way as central banks desperately keep their system from crashing. Treat that as a temporary roadblock as you travel to your desired destination.

Investing in the mining sector is high risk so consider signing up with James Cooper’s Diggers and Drillers to find out which mining companies are best positioned to run in the coming years. Or join me at The Australian Gold Report if you want to build a precious metals and gold stocks portfolio.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments