People like aphorisms.

So how about this one.

We are what we pay attention to. And the landscape of our thought is bounded by our focus.

There is so much information out there. Data, facts, titbits.

But there is only so much attention. Information is boundless, attention is not.

So, what you attend to separates you from the rest. The crucial question is what deserves your attention and what doesn’t.

If you’re a stock picker, does the Reserve Bank deserve your attention? Or the latest inflation forecasts?

Unlikely.

I agree with colleague Callum Newman, who recently said:

‘The only way to rip alpha out of the market is to find information and situations most aren’t following…and therefore are not reflected in the price.

‘Often, investors are preoccupied with things that seem important but are hard to turn into market profits.’

So on this week’s episode of What’s Not Priced In, we get back to the basics.

Talking stocks, valuations, and businesses.

Because, in essence, that’s what investing is. The appraisal of businesses and their outlook. Topics Greg Canavan (yes, he’s back again!) and I discussed:

- Market is currently rewarding earnings growth, valuation be damned

- Were we wrong about Nvidia?

- Is Nvidia priced to perfection, or can it run higher still?

- Why Domino’s is a great example of expectations outpacing business performance

- Cettire’s capital light balance sheet a big reason for recent surge

- Do results from Myer and Nick Scali suggest retailers have bottomed?

- Carsales and Commonwealth Bank trading at steep premiums…but for how long?

Looking back on our Nvidia call

In our inaugural episode, in late May 2023, Greg and I talked about Nvidia.

Nvidia was then becoming a household name. We mused this meant the valuation has likely plateaued. If it’s in the news, it’s in the price.

But since that episode, Nvidia is up nearly 80%. It is now a US$1.7 trillion company.

In the last six months alone, the chipmaker added US$700 billion to its market cap. That’s bigger than some iconic US names like Coca-Cola and PepsiCo combined.

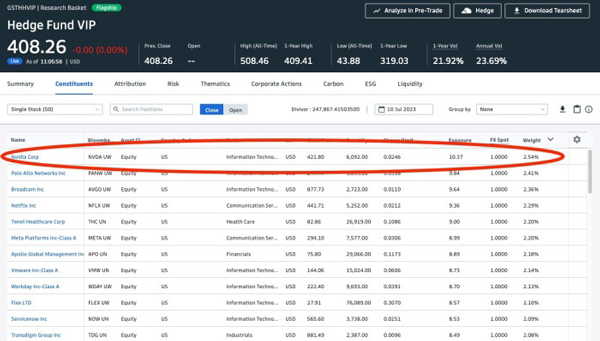

Nvidia is now also the top constituent of Goldman Sachs’ Hedge Fund VIP basket. It’s an index of the biggest positions held by 740 hedge funds. In total, these funds have US$2.2 trillion of gross assets.

| |

| Source: Financial Times |

It’s not hyperbole to say Nvidia is the most talked about stock. And hundreds of hedge funds have backed the talk with cash.

So were we wrong?

Was the market wrong?

Or have the facts changed in the interim to render our initial thoughts obsolete? Has, perchance, Nvidia’s growth outlook improved in the intervening months?

Greg didn’t beat around the bush.

Clearly, we were wrong.

But can Nvidia keep rising from here? Can it hit US$2 trillion? US$3 trillion? That’s some crazy numbers!

A stock’s price is not a reward for past performance. It is a bet on the future. Pick up any corporate finance textbook and you’ll find the message repeated.

Here’s Martin Fridson, in his popular text: ‘A company’s equity value lies wholly in its future performance.’

Nvidia had an exceptional 2023. But its feverish rally is not about last year’s big profits. It’s about 2024, 2025, 2026…

How much future growth is already baked into Nvidia’s current price?

Yes, AI is transformative. But investing isn’t as easy as simply knowing what technology is the next big thing.

As Warren Buffett once said:

‘The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors.’

Nvidia’s valuation is provoking some dissent on Wall Street.

Last week, Barclays’ Sandeep Gupta exited the echo chamber to voice concerns about Nvidia’s outlook. Supta thinks competition is coming along with demand headwinds:

‘AI chip demand will eventually normalize once the initial training build has been completed. The inference phase of AI is going to require less computing power than the training phase. High-powered PCs and phones could be capable enough to run inferences locally, reducing the need for growing GPU plants. [...] We think the cost of building Large Language Models (LLMs) and limited monetization opportunities could eventually force the exit of smaller (but still meaningful) customers of Nvidia from the AI market, helping to ease GPU supply constraints.’

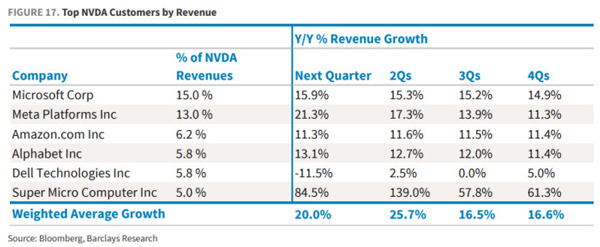

There’s also the fact that 46% of Nvidia’s revenue last quarter came from just five customers.

And these five customers have enough cash and incentive to invest in their own chip-making capabilities.

How?

The customers are Microsoft, Meta Platforms, Amazon, Alphabet, and Dell.

| |

| Source: Financial Times |

As Supta summed up, Nvidia could lose revenue share ‘if its tech customers develop self-sufficient chip manufacturing capacity’.

So let’s see how the next 12 months pan out.

Cettire shows Domino’s what a good balance sheet is

We didn’t spend the whole episode talking about Nvidia, however.

Most of the time was spent analysing local ASX companies.

Including pizza merchant Domino’s and luxury retailer Cettire.

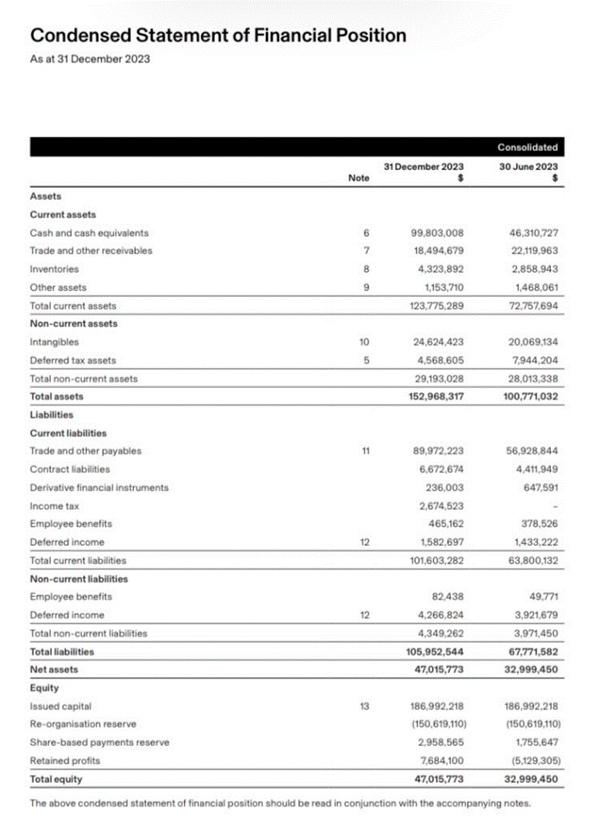

Greg admitted he wasn’t much of a luxury retail guy, but he was impressed by Cettire’s balance sheet.

It’s light on capital and debt. Unlike Domino’s.

| |

| Source: Cettire |

We then went through how to analyse a company’s balance sheet, leverage, and financial position.

And it’s not a What’s Not Priced In episode without some estimates of intrinsic value.

I won’t give it away here, so watch the full episode.

Greg didn’t just run the numbers on Domino’s and Cettire.

He also appraised Nick Scali, Carsales, and that venerable Aussie institution Commonwealth Bank.

‘Now it’s about free cash flow’

Finally, an observation.

In May 2022, CNBC obtained an email Uber CEO Dara Khosrowshani sent to staff. Khosrowshani wanted Uber to focus less on growth and more on profit.

He wrote:

‘In times of uncertainty, investors look for safety. They recognize that we are the scaled leader in our categories, but they don’t know how much that’s worth. Channelling Jerry Maguire, we need to show them the money. We have made a ton of progress in terms of profitability, setting a target for $5 billion in Adjusted EBITDA in 2024, but the goalposts have changed. Now it’s about free cash flow. We can (and should) get there fast.’

The goal posts did change. Rising cost of capital has a habit of doing that.

But Uber adjusted well.

Earlier this week, it hit new highs after reporting its first annual operating profit.

The stock is up ~95% in the last 12 months. And up ~190% since Khosrowshani’s email.

We have two local examples, too.

Online retailer Kogan and buy now, pay later fintech Zip.

Both suffered in recent years after prioritising growth at the expense of cash. Zip was by far the worst.

But the pair tightened the belt. Zip has been touting its ‘path to profitability’ for many a quarter now.

And Kogan, despite weak sales growth, is restoring its margins…and earnings.

Both have rallied in the last 6–12 months.

Kogan is up 70% since April 2023.

Zip is up 230% since October 2023. (Albeit still down 90% from its peak, with a long way to go to be self-sustaining).

In the end, cash is king.

Investors can be patient. But at some stage, you have to show them the money.

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In, where he and a new guest figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments