How would you like to make 14%…in a day?

Perhaps you don’t believe me. Sound crazy? It isn’t.

Myer [ASX:MYR] shares rose this much yesterday.

Yep — the old department store warhorse outperformed the latest hot thing in AI, green metal tech or whatever market meme you care to latch on to…at least in the last 24 hours.

I’d like to think you were watching for a move like this — after all, I wrote about the potential opportunity in Myer this time last week.

I called it the ‘share market shopper’s delight’.

You didn’t even have to pay for the idea!

Did Myer come out with a barnstorming update?

No!

Management said its sales were about the same as the first half of last year.

The market loved this news.

What’s going on?

It’s all about expectations. I suggested the following in Fat Tail Daily last week…

‘A lot of the listed retailers were hammered, in terms of share price.

‘Things only need to get ‘less bad’ for them to potentially start rallying.

‘Remember that the share market is not pricing in what’s happening now…but what will be happening in 9–12 months.’

Now, put Myer’s result in recent context too. They’ve held their sales steady in a declining retail market.

That’s a good effort!

The trump card is that the stock is so cheap. It still looks that way even after the rally yesterday.

Myer has $120 million in net cash. It’s on track for about $50 million in profit for the first half.

Most of this should flow black to shareholders via a juicy dividend or even a buyback.

Tax and rate cuts will be in play next year. So will consumer confidence and the ‘wealth effect’ of rising house prices.

That’s enough for the market to keep pushing Myer shares along.

Here’s another reason Myer shares were able to kick up a lot.

It’s a small-cap stock!

For such a well-known and trusted brand, Myer only has a market cap of $650 million.

I doubt many analysts follow it anymore — or even the wider investor community. It’s a bit ‘old hat’.

But therein lies the opportunity!

The only way to rip alpha out of the market is to find information and situations most aren’t following…and therefore are not reflected in the price.

If you do what everybody else does, you’ll struggle to make a buck, and run the risk of buying at a ‘top’.

Here’s what I’ve found too.

Often, investors are preoccupied with things that seem important but are hard to turn into market profits.

The RBA meeting and rate decision is an example. The media is all over it.

Here’s the reality. The market had already priced in that the RBA wasn’t going to raise…the meeting just confirmed it.

Nothing the Governor said tells us what to buy on a Wednesday either.

I must admit, I didn’t even watch or read the RBA stuff.

I was too busy watching my Myer shares fly up on big volume.

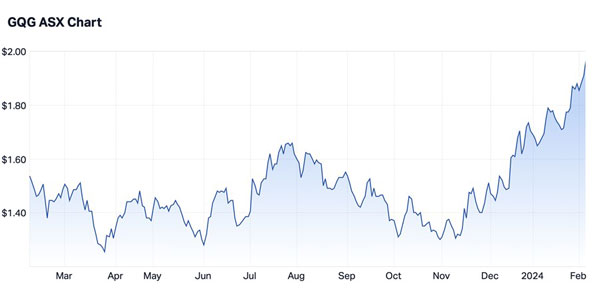

That’s not the only one. GQG Partners [ASX:GQG] is another stock I told my subscribers to buy last year.

Look how it’s going lately…

| |

| Source: Market Index |

Can you see my point? Shares are breaking out in all sorts of sectors…whatever the market commentators waffle on about.

Are you keen to start having a crack at some of these?

All I can do is urge you to read my latest report with my current top five ideas here.

It’s exciting out there…

My January recommendation is up about 40% in under a month.

It’s not that I’m so clever (unfortunately).

It’s just that the small-cap sector is so suppressed and battered after two years in the dumps.

Of course, I don’t always get it right, and the small cap space remains high risk and volatile…

…but now the outlook is improving…and they’re jumping up like my 4-year-old on a sugar high.

Grab them while you can — the bargains are going fast.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments