The share price of Golden State Mining Ltd [ASX:GSM] has been in steady decline since hitting its all-time high in July.

With first assays released today from its Yule Project near Port Headland in WA, the GSM share price has continued its slump.

Source: Tradingview

Despite Yule originally injecting enthusiasm into the GSM share price, ongoing works at the project have seemingly failed to live up to expectations – contrary to GSM’s sentiments.

At the time of writing the GSM share price has lost a further 4.44% to trade at 21.5 cents per share.

What’s wrong with Yule?

The explorer has today released the first assays from its two reconnaissance air-core drill programs having completed ~15,125m for 196 holes.

GSM say they are pleased with the results and have generated several targets it believes warrants a targeted drilling campaign, which will begin in Q1 next year.

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

Managing director Michael Moore commented:

‘These highly encouraging first results from our second reconnaissance air-core program at Yule further underline the potential of the GSM tenure in this very prospective region.

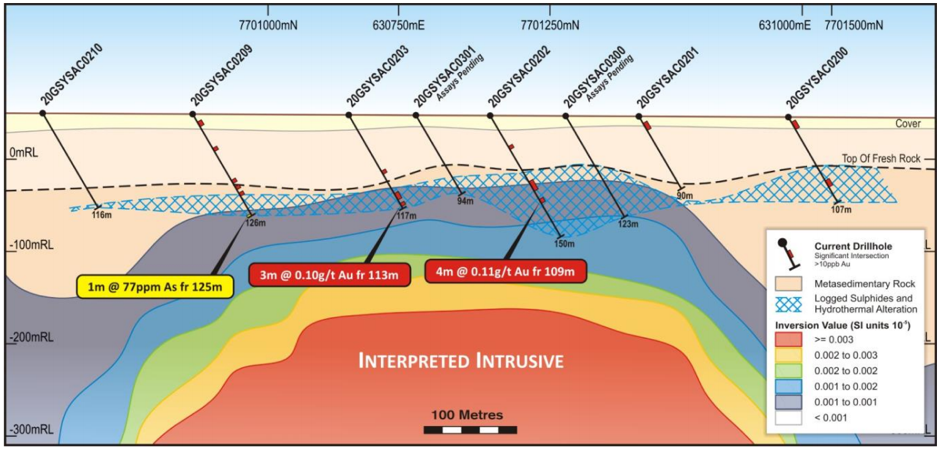

To intersect highly anomalous gold grades (see below) at Target 1 West above an interpreted intrusive in this geological setting demonstrates the robustness of our targeting strategy and provides strong vectoring information for follow-up drilling in early 2021.’

Source: Golden State Mining

To be clear, GSM’s recent drilling was not aimed at defining a resource specifically.

Rather, their aim was to generate targets on their tenements that have good potential to host significant gold mineralisation.

Which they have achieved.

As you can see in the figure above, GSM did hit some gold mineralisation, albeit very low in grade.

Perhaps investors were hoping for a more defined, high-grade mineralisation, which could be the cause for the continued dip in share price today.

Outlook for Yule

Often times when investing in speculative gold stocks you should consider its recent share price actions independently from its actual prospects.

By that I mean try to give some context to why people are speculating on this stock.

In GSM’s case, its share price peaked at the same time we saw the first big run up in the De Grey Mining Ltd [ASX:DEG] share price.

Why?

Because Yule is situated on Mallina Shear Zone – same as DEG’s +2.2 million ounce Millina Gold Project.

In fact, GSM’s tenements are located just west of DEG.

So, we can hazard a guess to what might have cause the excitement around the share price.

As for Yule’s geological potential, I believe there is potential for a decent gold discovery.

What might be hurting the share price currently is the speculative nature of their results.

They are not clear cut.

Though we could see a bump early next year should the next round of drilling turn up something more tangible.

Our resident gold expert Shae Russell is tipping Australia to become the new gold epicentre. If Australia knocks China off the top spot, we could see more attention given to Aussie gold stocks like GSM. In her free report, Shae details why this could mean big spikes for Aussie gold stocks and what to look out for. If you’re interested, get your free copy here.

Kind regards,

Lachlann Tierney

For The Daily Reckoning Australia