Do you think the world is starting to feel jaded over the increasing chaos and outright absurdities playing out?

This week has seen Elon Musk rattling the Twitter board once more by demanding proof that no more than 5% of Twitter accounts are fake or controlled by bots.

This puts the board in a bind, especially because they know they’ve lied to the Securities Exchange Commission, their advertisers, and the public about their business. Not to mention they’ve been exposed as a den of mentally ill authoritarians who suppress free speech.

It gets more dystopic as President Joe Biden’s Twitter account, which has 22.3 million followers, was shown in an audit by SparkToro to comprise 50% fake accounts or bots!

But never mind that because he won with a record number of votes (81 million) in the safest and most secure election!

Speaking of elections, we have one this Saturday. I’ve written before that Australians have a wonderful choice between two unelectable major parties. The policies they present to the country promote more government spending, handing out free stuff to encourage more mooching and less freedom to individuals. Check out my colleague Catherine Cashmore for more detail on how both parties’ policies, especially on making housing affordable, are like spitting into the wind.

So much to look forward to…not!

Market chaos resumes in three, two, one…

And how about the market roller coaster?

Up one day, down the next three! On Wednesday, trading in the US saw the biggest daily drop since March 2020 amidst the virus outbreak and global lockdowns. The Dow Jones dropped more than 3.6% or 1,164 points, while the NASDAQ Index again led the way down the tubes with a 4.73% decline.

Amidst the market carnage, the Federal Reserve, and other central banks, raised interest rates long after the inflation horse bolted out of its stables. They claim it’s all a result of the global virus outbreak, Ukraine, and climate change…

They’re to blame!

And I should add ‘I told you so’.

Most of you have put two and two together that massive currency creation, record government deficit spending, rounds of stimulus cheques, and a global shutdown (which broke the supply chain) would lead to inflation.

The central bankers did not. They wanted us to believe that inflation would be a minor problem and it would go away.

That is until they literally steered the Titanic into the iceberg while cruising at record speed!

How much further can the market fall?

You hear of MarketWatch inviting experts to talk about how these people expect the markets to tumble 60% or more.

The same news platforms were telling you months ago that the market is on a path of recovery, all because inflation is under control.

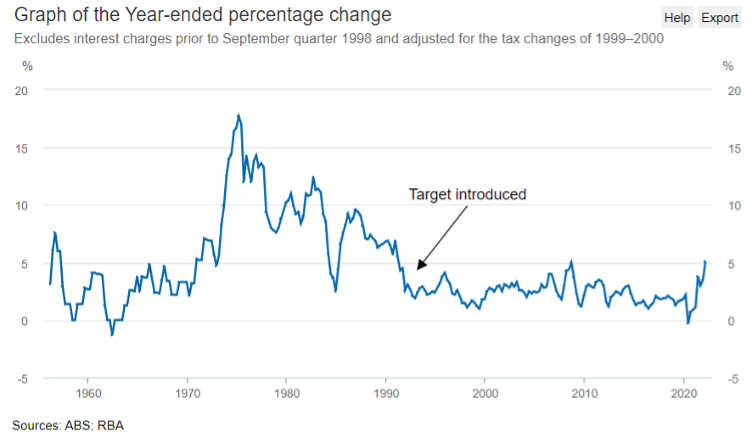

Well, official inflation levels are at record highs around the world. In Australia, even the normally comatose RBA was rudely awakened by inflation hitting levels last seen in June 2008 (see below):

|

|

|

Source: ABS, RBA |

You remember what happened the last time inflation was that high, right?

Could it happen again?

It’s entirely possible that we’re amidst a brutal bear market that could get worse.

Where to now for safety?

I am biased when it comes to this question.

It’s gold.

But you can’t accuse me of shilling my own wares.

Let’s look at the numbers since the start of the year.

S&P 500 down 17.7%…

NASDAQ down 27.0%…

Nikkei down 9.3%…

ASX 200 down 5.1%…

Bitcoin [BTC] down 36.7%…

US Dollar Index up 8.5%…

How about gold?

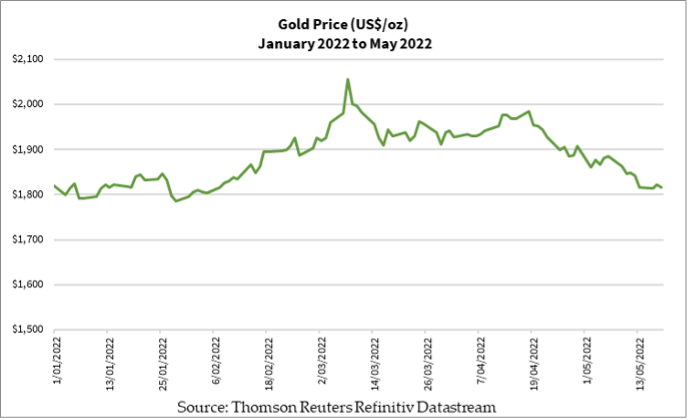

It’s trading at the same level since the start of the year. Have a look below:

|

|

|

Source: Thomson Reuters Refinitiv Datastream |

Not too bad if you ask me.

But what makes gold a strong case for dealing with the coming months — as the central banks continue vainly attempting to control inflation by raising rates — is that gold can withstand market shocks better than other assets. We saw that three months ago at the start of the Russia-Ukraine conflict.

We also saw that on Wednesday trading in the US. Gold actually closed 0.3% higher when everything tumbled in the market bloodbath.

There used to be cryptocurrencies that would steer investors away from gold because of the meteoric rise of bitcoin, Ethereum [ETH], and other altcoins. But the recent nuclear event of Terra Luna crashing down makes people think twice about taking refuge in digital currencies and tokens.

That’s not to say that there’s no future in cryptocurrencies. I see them as a logical alternative means to exchange once the world breaks off the fiat currency system yoke, while avoiding the snare of central bank digital currencies.

And central banks raising interest rates crashing the market this time could blow back massively onto themselves as the final shreds of their credibility break. It could even lead to a hyperinflation of their currencies.

That’s why even though the US dollar is up since the start of the year, I’m cautious in putting much faith in it.

Right now, gold is in a great position as it stands unchallenged as an asset to stand up to central banks and their insane plans to raise rates in a global recession.

Leverage your gains on gold’s strength with gold stocks

There’s a lot to like about gold. You can rig the price, but you can’t create gold like you can create fiat currencies. You need to dig it out of the ground, process it, and refine it.

Gold mining is a lucrative but highly risky business.

And I believe that the market will favour gold stocks going forward as investors seek safety in gold. Gold stocks — while inherently risky — can potentially deliver outsized gains.

You can choose between producers, developers (mine builders), and explorers.

In the last gold bull market during 2019–20, gold rallied 57%, and the ASX Gold Index rallied a solid 75%, but it was a group of explorers and developers that delivered 800–1,200%.

Depending on your risk appetite, you have a few options to choose from.

Those who have nerves of steel and want to take a punt on the more speculative gold stocks can join me here.

This offer lasts till next Monday, so get in quick.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia