Well, as you know, markets have experienced spectacular moves this week.

Japan’s Nikkei is leading on that front…down 12% on Monday but up 11% on Tuesday!

Incredible whipsaw action. That’s not what you want to see when you have a large chunk of your life savings tied up in equities.

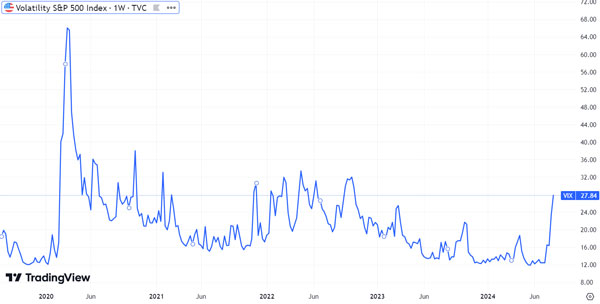

As measured by the VIX below, volatility has declined over the last 12 months… But it spiked dramatically this week, returning to levels not seen since 2022.

| |

| Source: TradingView |

A financial crisis looms?

This week marks the tragic 79th anniversary of the bombing of Hiroshima and Nagasaki; it’s perhaps weirdly fitting that Japan’s Nikkei experienced one of the most tumultuous weeks in its history.

Monday’s collapse followed a rise in the Japanese Yen as the BOJ (Bank of Japan) announced its intention to raise rates for the first time in over a decade.

The announcement followed weak job data in the US and escalations in the Middle East over the weekend.

In other words, Monday morning was a perfect storm of bad news events.

And the market reacted accordingly.

While I’m not a macroeconomic expert, I sense déjà vu in this latest market action… We’ve been here several times before.

In early 2023, global markets sat on the brink after the failure of Silicon Valley Bank.

As commentators reminisced about the 2008 Lehman Brothers collapse, investors waited fearfully for contagion to take hold and a broad US banking failure.

Of course, that never took place.

Those same anxious feelings culminated in June 2022, when inflation spiked as high as 9.1 percent in the US, raising fears that interest rates could reach double figures.

Again, that never happened; rates simply adjusted to their long-term mean.

This latest market shock feels reminiscent of these prior events, which hit suddenly and from a point of low volatility.

I don’t believe this will be the ‘global recession maker’ some make it out to be.

The BOJ is caving in already

In response to Monday’s wild market moves, the BOJ announced yesterday that it would hold off on hiking rates.

But don’t get carried away with this dovish pivot…August is traditionally a volatile month in global markets — traders delight, investors fright.

I suspect we will see further whipsaw action over August and perhaps into September as the recovery falters and other unseen risks emerge.

But looking beyond these potentially volatile weeks, a strong set-up could be in play as we approach 2025.

‘Real’ rate cuts will finally materialise in the US…this could deliver sustained relief for markets that have misinterpreted the Fed’s cutting intentions over the last 18 months.

By November, a new US President will have been elected…markets hate uncertainty; right now, there is no clarity on who will win this year’s election.

But this great unknown will finally have settled before the year is out.

Both events could usher in a rosy period for markets moving into 2025 and beyond.

So, what sectors should you target?

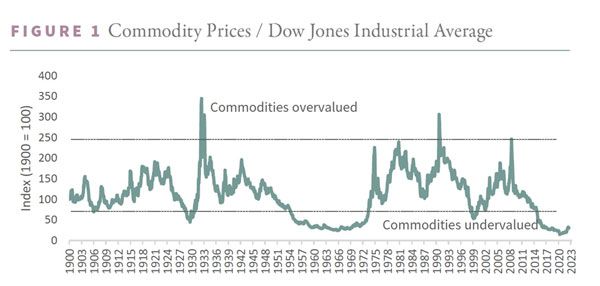

Here’s a graph I like to dig up for my paid readers every time the market slips into a deeply pessimistic phase:

| |

| Source: Bloomberg & GR Models |

It demonstrates the deep value offered by commodities relative to US equities.

The chart, from the Wall Street investment firm Goehring & Rozencwajg, compares the relationship between the Dow Jones Industrial Average and various commodity indexes over the past century.

The commodity index includes energy, grains, precious and base metals.

Some commodities, including gold, already trade at all-time highs, so they may not represent the value demonstrated here. The same could be said for copper and silver, trading around elevated levels.

But others, including food, industrial and critical minerals, oil and gas, hover around multi-year lows.

This index encapsulates the full spectrum of the commodity market…and right now, the resource market is considered extremely cheap.

Periods below 75 on the chart typically represent bear markets for commodities. The chart shows that 1929, the 1960s, 1999, and the early 2020s were the most undervalued years for commodities.

As you can see, we began to exit a deep trough in 2023.

All roads lead to commodities in 2025

Despite the long-term set-up and strong value, global volatility will undoubtedly affect commodity markets.

We witnessed this on Monday’s dramatic worldwide sell-off, with silver futures falling especially hard by more than 4%.

Yet other commodities performed relatively well; copper futures closed flat for the day, and gold fell a modest 1 percent. Meanwhile, iron ore was up more than 1 percent!

This may signal relative strength against the broader market… Fundamentally, much of that strength exists in their deep value.

Take the tech giant NVIDIA, which trades on a Price-to-Earnings multiple of 62. Meanwhile, Australia’s iron ore giant, Fortescue Metals [ASX:FMG], trades on a multiple below 10!

Monday’s events demonstrate that large institutional investors could start to unwind their massive holdings away from richly valued mega-tech firms into value plays like commodities.

A recent regulatory filing showed Warren Buffett offloaded over 50% of his Berkshire stake in the US$3.2 trillion tech giant Apple since the start of the year.

Most of those proceeds are going into Berkshire’s enormous cash hoard.

However, oil stocks are among the few items on Buffett’s buy list… His 30 percent purchase of Occidental Petroleum in June confirms where the ‘Oracle’ sees value in the market.

As an investor, you should be paying attention.

The oil and gas sector represents exceptional value, especially within the junior sector…with a pullback underway, now could be a great time to investigate this poorly understood market as part of a long-term strategy.

To get you started, I’ve put together a detailed report on the junior oil and gas market. You can access that here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments