Shares of utility retailer Genesis Energy [ASX:GNE] rose on Friday (14/10/2022) after favourable conditions in Q1 FY23 led to an upgrade to FY23 EBITDAF (earnings before interest and tax according to fuel type).

GNE’s new guidance is for FY23 EBITDAF guidance to be around $500 million, up from $455 million.

GNE shares were up 3% in late afternoon trade.

Year to date, GNE shares are down 13%:

Source: Tradingview.com

Genesis Q1 FY23 update: ‘favourable trading conditions’

Genesis Energy — one of New Zealand’s largest energy retailers — said it experienced favourable trading conditions in the first quarter of the 2023 financial year.

GNE attributed this to higher hydro inflows and thermal generation flexibility.

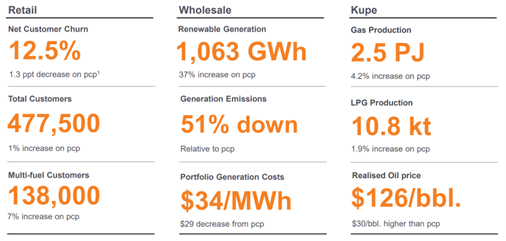

Favourable weather conditions also saw Genesis improve its renewable generation capacity by 37% to 1,063GWh.

As a result, the utility’s EBITDAF performance in the first quarter came in higher than expected.

Genesis revised its FY23 EBITDAF guidance from $455 million to $500 million.

However, Genesis cautioned that the revised estimate depends on hydrological conditions, gas availability, and any unforeseeable adverse circumstances like unpredictable weather events.

A closer look at GNE performance

What else did Genesis have to say about its operations?

Genesis said that its Huntly Power Station had slowed its generation, running in periods of lower costs, reducing running time altogether.

Gas availability has been favourable, and Rankine generation flexibility has improved, assisting in a decline in average portfolio costs.

Some areas of the business seesawed: customer numbers increased, though churn remained low, and retail gas netback grew with SME (small businesses) and C&I (commercial and industrial) sectors, yet wholesale gas sales decreased with trade volume and ending contracts.

LPG delivery costs were also noted as having risen, which the company surmises to be due to rising fuel and transport costs.

The energy provider also provided the highlights of overall group operations. The unaudited results included:

Source: Genesis

GNE was also pleased with a reduction in customer churn, announcing:

‘In terms of our operational achievements, we were pleased to see customer churn fall during what was a difficult year for many. The churn rate of 12.8% was down on the 15.9% in FY21 and is down further for the first quarter of this year. This, together with our record interaction Net Promoter Score mentioned by Barbara earlier, is a reflection of the dedication of our customer care teams our strong brand and the increasingly innovative ways we are engaging our customers.’

The great EV battery tech race heats up

EV sales are rising.

Automakers like Ford are ramping up their EV production.

And governments are pushing for decarbonisation the world over.

Yet the speed at which automakers and governments are pivoting to EVs is leading to a supply crunch.

As automakers worldwide overhaul their fleets to electric, they must secure more battery tech materials.

Prices for key materials like lithium, graphite, copper, nickel, and cobalt are rising rapidly.

Our energy expert Selva Freigedo thinks the industry is set for a supply crunch, leaving the prices for battery tech materials elevated in the medium term.

Selva has recently profiled the three key metals at the forefront of the EV revolution.

You can read about it here.

Regards,

Kiryll Prakapenka,

For Money Morning