The Galaxy Resources Ltd [ASX:GXY] and the Orocobre Ltd [ASX:ORE] merger is set to create the fifth largest global lithium chemicals firm, worth $4 billion.

It was a big week for ASX lithium stocks last week.

As we covered, lithium stocks like Vulcan Energy Resources Ltd [ASX:VUL] and Lithium Australia NL [ASX:LIT] enjoyed strong investor support as the electric vehicle revolution gathers momentum.

But this week may be even bigger for the ASX lithium sector with today’s huge merger announcement.

At the time of writing, GXY share price is up 3.3% while ORE shares are up 4.6%.

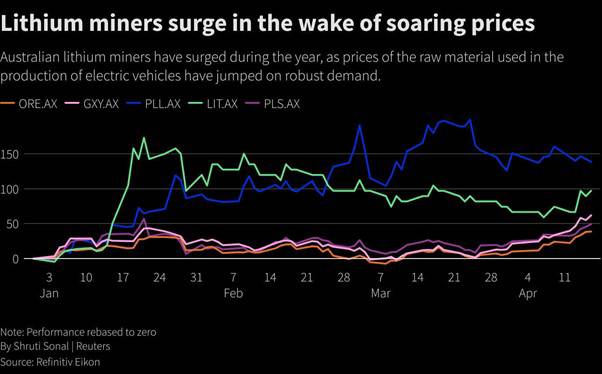

Both stocks have performed well this year.

Year-to-date, the GXY share price is up 64% while the ORE share price is up 44%.

Both are up over 190% in the last 12 months.

Orocobre and Galaxy to merge

Today, ORE and GXY announced they have entered a binding merger implementation deed (MID).

Three Ways to Invest in the Renewable Energy Boom

According to Galaxy Chairman Martin Rowley, the merger has the ‘potential to be a significant value-creating opportunity for Galazy [sic] and Orocobre shareholders.’

Under the MID, the two firms will merge via a Galaxy scheme of arrangement where Orocobre will acquire 100% of the shares in GXY.

Galaxy shareholders will receive 0.569 ORE shares for each GXY share held at the scheme record date.

Once implemented, Orocobre shareholders will own 54.2% of the fully diluted share capital of the combined entity.

GXY shareholders will own the remaining 45.8%.

Galaxy’s board unanimously recommended the scheme and each director intends to vote all the shares that they hold in Galaxy in favour of the scheme.

Likewise, Orocobre’s board endorses and supports the scheme.

The merger is subject to the standard conditions — there being no superior proposal emerging and a independent expert concluding the scheme serves the shareholders’ best interests.

The two companies did not announce a name for the new entity but reported that a name will be selected in ‘due course representing the global reach of the new entity.’

The head office will be in Buenos Aires with corporate headquarters located on the ‘Australian East Coast.’

Orocobre and Galaxy set to create $4 billion lithium giant

According to the two firms’ joint release and based on ASX market capitalisation, the new entity will be a top five global lithium chemicals company.

The merged entity is expected to be included in the ASX 200 Index, even approaching the ASX 100 Index threshold.

The entity is expected to become the leading ASX lithium company and one of the world’s largest producers of lithium chemicals with 40,000 tonnes per annum of LCE production capacity.

ORE and GXY expect the merger to result in a ‘highly complementary portfolio of assets delivering geographical and product diversification across brine, hard rock and vertical integration across the supply chain.’

The potential benefits led Orocobre Chairman Robert Hubbard to say that the ‘logic of this merger is compelling.’

Strategic rationale for merger

A key rationale for the merger was diversification of assets.

The joint release mentioned that incorporating ORE and GXY’s assets diversifies the new entity across geography, lithium source and end products, with a vertically integrated strategy for ‘all key assets.’

ORE and GXY also mentioned that the merger would enhance the new entity’s financial position and ‘potentially accelerate development with the ability and intent to capture further downstream value.’

Finally, the firms estimate the merger will strengthen the balance sheet with pro forma gross cash of US$487 million.

This cash position is expected to deliver a ‘world class project pipeline.’

Outlook for the ORE and GXY Share Price

The price of lithium fell sharply in 2018 but has rallied this year.

Prices for lithium carbonate surged by nearly 140% over the past six months.

And prices for spodumene — the hard rock lithium — while lagging the carbonate recovery, still rallied 50% since the start of March.

As the Sydney Morning Herald noted recently, electric automakers are expanding production, sales are strengthening in China and Europe, and many world governments are ‘unleashing “green” stimulus packages targeting transport electrification.’

This state of affairs is sowing great optimism in investors and analysts alike.

For instance, UBS is forecasting more price hikes for lithium products in 2021 and for electric vehicles to comprise 40% of new vehicle sales by 2030.

These projections suggest the demand for lithium will be vast.

Established or maturing companies with large production capacities will stand to benefit the most.

Likely, this partly informed the merger decision between Galaxy and Orocobre.

As GXY CEO Simon Hay commented: ‘the transaction will allow the group to materially accelerate the development of our combined growth projects.’

Galaxy indicated earlier this year it wanted to spend a total of US$397 million constructing two new lithium projects over the next five years.

It was unclear exactly how those Canadian and Argentinian projects would be funded given Galaxy’s cash reserves totalled US$215 million in December 2020.

But as the Australian Financial Review today reported, Mr Hay thinks the merger can bankroll and fast-track these plans:

‘The current project portfolio continues at current rate or accelerated rate, that is the way I would look at the pipeline.’

In turn, GXY Chairman Martin Rowley thought that the ‘merged entity’s growth opportunities in both brine and hard rock position it uniquely to take advantage of expected rising EV demand for lithium.’

Speaking with Reuters, Canaccord Genuity Analyst Reg Spencer described the proposed merger as ‘overwhelmingly positive.’

Mr Spencer thought that ‘on a high level, you have got significant synergies with both businesses having an Argentina base.’

In his view, these operational synergies and the firms’ global diversity can make the merged company a ‘major global player.’

ASX lithium stocks were already riding a strong wave of interest recently.

After today, that interest is likely to intensify.

Therefore, if you want more information on a sector enjoying a resurgence, then I recommend reading our free lithium 2021 report.

Regards,

Lachlann Tierney,

For Money Morning