Green hydrogen energy group Frontier Energy [ASX:FHE] said it has signed a collaboration agreement with major gas pipeline company AGIG.

The idea is to fast-track green hydrogen projects in the Dampier to Bunbury Natural Gas Pipeline (DBNGP), a new hydrogen injection point for Western Australia, with capability of injecting up to 9% hydrogen.

Shares for FHE were rising more than 2% in mid-morning trade, at 46 cents per share. Metrics are also looking good in the longer term, with an 84% gain in the last 12 months, and an 82% advantage on the S&P 200:

www.TradingView.com

Frontier signs with AGIG for hydrogen-gas injection deal

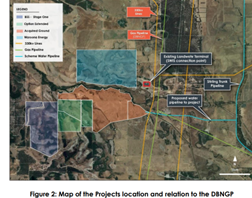

The green hydrogen energy explorer broadcast the freshly signed collaboration agreement with AGIG today, in an effort to accelerate green hydrogen projects in the Mainline South section of the DBNGP.

This would give Frontier a whole region to inject hydrogen supply via an existing gas network, and is expected to open up access to energy markets in the southwest WA.

Initial studies already conducted by AGIG in 2022 have found the project has the capability of injecting up to 9% hydrogen without any need for major modifications.

Stage One of the project should only account for less than 1% hydrogen to the DBNGP, based on an average minimum daily flow.

As a result, Frontier and AGIG have agreed to work together for the injection of the agreed percentage of hydrogen into the section and will be making joint submissions to the relevant WA government departments in relation to this venture.

Managing Director Sam Lee Mohan commented:

‘We have been working with AGIG in relation to the injection of hydrogen from our Bristol Springs Project into the DBNGP. Formalising our relationship is an important step in the process of developing the hydrogen economy in WA. Given our proximity to DBNGP, it is a win-win for all stakeholders and ensures we are a step closer to contributing to the State’s goal of delivering up to 10% hydrogen in the gas networks by 2030.

‘The WA Government has been supportive of the green hydrogen industry however the current state of legislative frameworks and intended amendments requires acceleration. To have a tangible project located on a section of the DBNGP that is immediately available for hydrogen injection and working with Government on legislative amendments will streamline and deliver the necessary change required to stimulate the green hydrogen industry.’

Source: FHE

Key milestones afoot for FHE

Today’s announcement provides tangible evidence the group is making some headway with securing offtake agreements to fund Stage One of the project.

Frontier also noted that in October 2022, energy ministers agreed to bring hydrogen blends, biomethane, and other renewable gases under the national gas regulatory framework.

The WA government has set a goal of up to 10% hydrogen being blended with natural gas across the state’s gas network.

The company’s Bristol Springs Project in WA is on track to produce green hydrogen by late 2025, and its DFS has already demonstrated the project may become Australia’s lowest-cost green hydrogen producer.

Next steps for the collaboration partners are to commence a FEED Study on the hydrogen injection facility and blending station, which is set to kick off in the near future.

Should you be looking at copper in 2023?

Hydrogen projects are certainly worth learning more about as the world chases renewable energy and low-carbon emission energy alternatives, but did you know there are some multibillion-dollar copper producers just waiting to be unearthed?

On that note, there are certain copper stocks you should be watching in 2023.

If you subscribe to Fat Tail Commodities, you can instantly download our resident geologist and commodities expert James Cooper’s most recent copper stock report — all for free.

Learn about the copper supply crisis and how you can position yourself to take advantage of changes that are already happening.

Interested in jumping at a potentially lucrative opportunity reserved for the shrewdest of investors?

Then you should click here today.

Regards,

Fat Tail Commodities

Comments