In today’s Money Morning…why fund managers will add bitcoin to their portfolios eventually…the signs are there…front run the funds…and more…

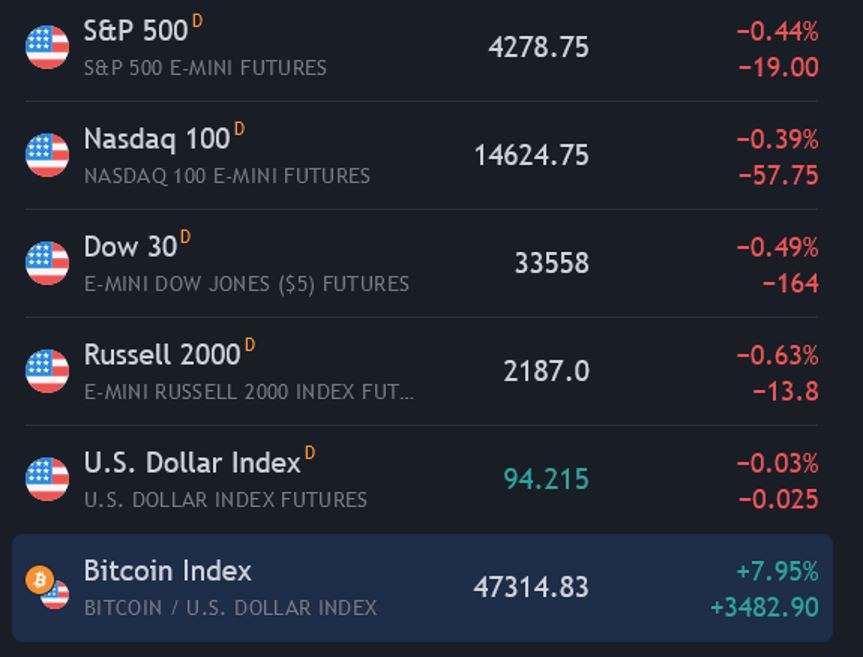

While most markets finished a bad week even weaker on Friday, one market bucked the trend.

Check it out here:

|

|

| Source: Bloomberg |

Yep, Bitcoin [BTC] positively surged on Friday, up almost 10%.

That led to a mini-resurgence in all manner of cryptocurrencies over the weekend. Some in my portfolio shot up 20% and more.

It’s early days but some in the crypto community have already christened October as ‘Uptober’!

Now, of course, one moment of ‘non-correlation’ doesn’t mean anything in itself.

But it’s certainly something to keep an eye on.

And you can bet your bottom dollar it’s something the big end of town will be looking at very closely too.

Why fund managers will add bitcoin to their portfolios eventually

Fund managers probably don’t invest how you think they do.

It’s not all about trying to make the most money for their clients. No, that’d be too simple and transparent.

Instead, they use something called modern portfolio theory (MPT).

The way MPT works is by using the power of diversification.

It was devised in the 1950s by economist Harry Markowitz and he later won a Nobel Prize for it.

The basic idea is that if you can lump in enough assets that are non-correlated — that is, assets that don’t react the same in different market conditions — then you can make better risk-adjusted returns.

Which Markowitz presumes most investors would prefer.

Something called the Sharpe ratio is used to measure relative fund performance. This ratio considers the volatility for any returns made.

Personally, I prefer the Sortino ratio, which only punishes downside volatility (not upside).

After all, why should upside volatility be bad!?

Anyway, the maths behind this is dense. And like all economic theories, probably much more useful to academics than investors.

But the point is, this is how the managers of trillions of dollars operate.

So how bitcoin behaves in a world of weaker markets will certainly be interesting.

And it could be this factor — not the decade-long history of stupidly high returns – that ultimately swings big money into bitcoin.

Talking of high returns…

The signs are there

There are a couple of near-term catalysts pointing to such professional money coming in soon.

For example, I came across an upcoming seminar in the US specifically for US-registered financial advisers.

|

|

| Source: Bitcoin for advisors |

The site explains:

‘Bitcoin for Advisors equips investment advisors with the tools to best understand how bitcoin, ethereum, and other digital assets can successfully impact their clients’ portfolios.

‘CoinDesk works with the leading investment professionals in crypto, blockchain, and traditional markets to design a series of keynotes, interactive roundtables, and priority-driven workshops that are relevant, valuable, and actionable for the advisor community.’

I had a quick scan of the speakers and sponsors and you can really see how much more professional this event seems than in times past.

The point is, this type of conference is really speaking the language of the advisor community and I’d expect such ‘industry’ events to gather steam over the next 12 months.

But the bigger catalyst for money moving into bitcoin is probably the imminent approval of an exchange-traded fund (ETF).

A registered US ETF provides a compliant way for money managers to get bitcoin exposure into client portfolios.

So it’ll be very interesting to see how a US-approved ETF goes when launched.

Here are the main ETFs awaiting approval, the likely approval date, and the odds of success, according to Bloomberg senior ETF analyst:

|

|

| Source: Bloomberg |

As you can see, October is shaping up to be a big month and that could very well explain the surge in interest in bitcoin despite the macro headwinds.

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Front run the funds

The thing I love about bitcoin and crypto is it’s literally the only asset class I can think of where you can invest in before the pros can get involved.

Such chances for the little guy to front run rarely occur.

The last big chance was probably the advent of the internet in the early ‘90s, but back then venture capital still usually got in first.

And the big difference between the internet revolution and blockchain technology, is that this time you can actually grab a stake of the underlying network itself.

As this tweet from futurist Jeff Booth put it:

|

|

| Source: Twitter |

Sure, there are still heaps of naysayers out in the advisor community.

And I’d wager if you asked your average advisor about bitcoin today, they’d tell you to run a mile.

The thing is, that fact is why the opportunity is still so big.

Because when everyone feels comfortable with bitcoin in their super, the opportunity for big returns will be long gone.

Anyway, don’t say you weren’t warned…

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.