|

In today’s Money Morning…where does this money come from?…these two energy experts are looking here…oil supply set to fall…but is that an opportunity?…and more…

Last week President Joe Biden announced US$6 trillion of stimulus spending.

Where does this money come from?

Truth is, Wall Street doesn’t care! They just want the cash.

That’s for later generations to work out…

The question you need to ask yourself today is: Where is this money going?

Work that out and you can front run it now…

The biggest disruption will be here

The Biden cash splash is focused on the usual Democrat pet projects.

So, funding Medicare, Medicaid, and Social Security takes a huge share.

Beyond that, they’ve also requested US$1.5 trillion in discretionary funds with half of that slated for defence spending.

The rest of it is earmarked for infrastructure spending and ‘green’ technology over the next 10 years.

And it’s the huge push to renewable energy that I see as the biggest opportunity for big gains.

It’s the kind of disruption you see once a decade, and it results in big winners and even bigger losers.

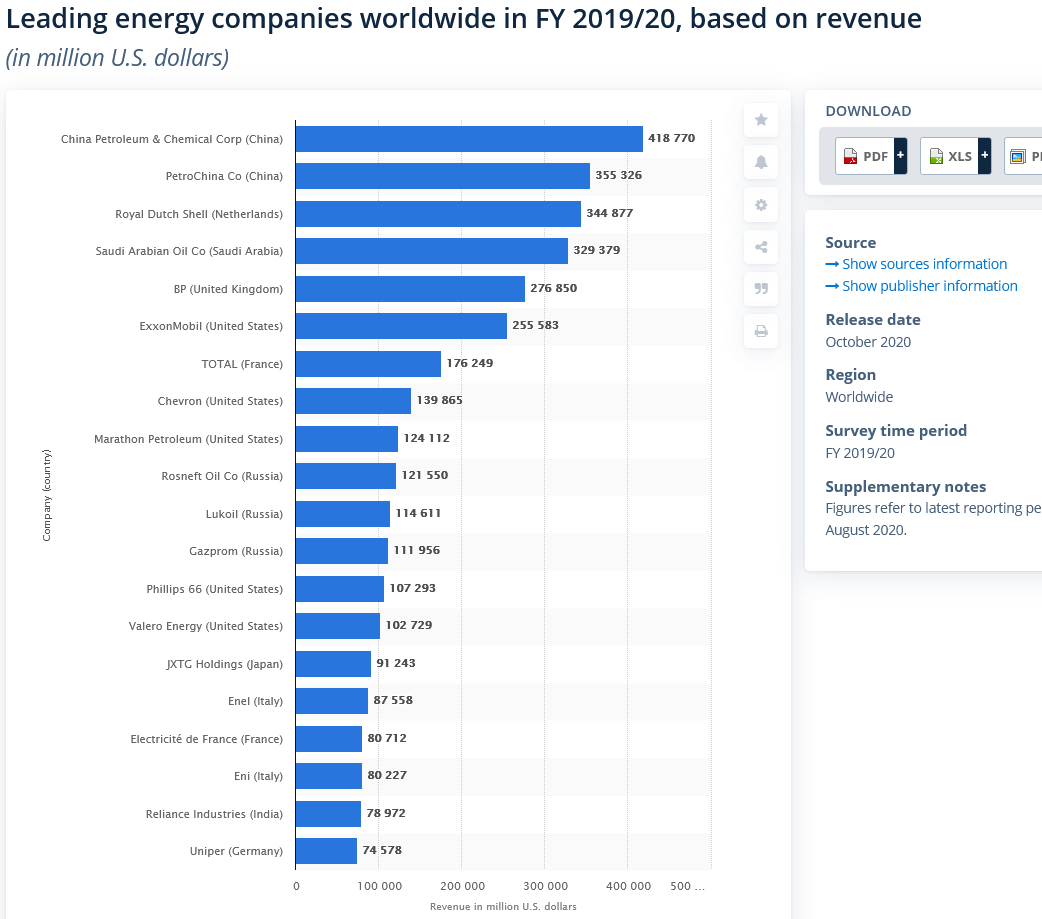

To put into context what’s up for grabs, check out the annual revenues from the biggest energy companies in the world:

|

|

| Source: Allied Market Research |

That’s some huge money ripe for the taking.

But like any industry-wide disruption, the key is working out where the winners will be before the crowd does.

So, with all that in mind, I asked two of our in-house experts who have been following this space very closely, where they’re looking.

Here’s what they told me…

These two energy experts are looking here

Selva Freigedo helps run our premium energy advisory, New Energy Investor. Its sole focus is on working out how to play this renewables boom.

You can read more about it here.

Anyway, she told me:

‘I would say some of the best places to get exposure to renewable energy are miners exposed to battery materials like lithium, cobalt, nickel, graphite, etc. And also, hydrogen. Australia has quite a chance to become a leader in hydrogen production for our region.

‘The renewables industry is now an inevitability, however, one thing to keep in mind is that this is a long-term trend.

‘We’re looking at investing timelines that expand for decades.

‘In saying that, though, I look at this stuff every day and things are already changing very fast, faster than what I thought. And things will need to move even faster to hit the “net zero targets” countries are setting for 2050.

‘The IEA recently released a sort of roadmap on how to get to net zero by 2050, and they mention some ambitious milestones we need to hit for this to happen by 2030, like EVs should be 60% of new car sales or coal demand to half from today’s demand.

‘So, while targets are set to what seems a long way away, 29 years from today, that’s not really too much time to turn the entire world’s energy system green.’

That’s a good point.

It can be easy to ignore trends that are decades off fully playing out, but the reality is the market starts to move well in advance of any actual change.

And if Selva is right, we’re definitely past the point of no return.

Lachy Tierney over at Exponential Stock Investor was equally as bullish.

The Californian-born analyst has been keeping a close eye stateside for opportunities to ride the ‘green’ money trail.

He noted on the recent news:

‘Here’s the way I see the state of play at the moment…

‘Biden is pushing for around US$15 billion extra in funding for electric vehicle (EV) chargers. Meanwhile the Department of Transport have already got around US$35 billion earmarked for that already. Charging is the number one concern holding EV uptake back.

‘Doesn’t matter is the GOP (Republicans) cut the extra funding or not. EVs will happen regardless.

‘Combine that with a focus on domestically located supply chain investment and you have all the ingredients for a battery tech and battery minerals explosion.’

He added:

‘In fact, we just tipped an US-based ASX-listed stock with two Tesla alumni running the show in Exponential Stock Investor. The company is trying to crack the mythical “million-mile” mark for EV batteries — you should definitely check out that report.’

It certainly seems there are a few places to look in the fast-changing energy market.

But what about the other side of the coin?

Oil supply set to fall…but is that an opportunity?

There’s no doubt the oil majors are under pressure right now. Just last week there was a number of news items that suggested we’re at a turning point.

As reported in Oil and Energy Insider:

‘Shell loses in court. Royal Dutch Shell (NYSE: RDS.A) lost a landmark legal case in a Dutch court, which, if it stands, will require 45% cuts in GHG emissions by 2030. The case is seen as a warning sign for the rest of the oil industry, signaling legal exposure to Scope 3 emissions (those burned by end-users). More litigation related to emissions is likely.

‘Court ruling could shrink Shell. The court ruling ordering Shell to speed up its plans to cut greenhouse gas emissions could lead to a 12% decline in the company’s energy output, including a sharp drop in oil and gas sales, according to Reuters.

‘Exxon must cut production, Engine No. 1 says. Engine No. 1 said that ExxonMobil (NYSE: XOM) must cut oil production. “They need to position themselves for success,” Charlie Penner, of Engine No. 1, told the FT. “You would certainly believe that would mean less oil and gas production going forward.” The hedge fund’s founder, Chris James, added: “Watching that meeting yesterday was such a perfect example of how they don’t realize the world has changed. It was all on display.”’

It appears that oil exploration and supply is set to drop in coming years as environmental rulings speed up the transition.

But that raises an interesting trading opportunity.

If supply drops too quickly — before renewables are ready to take over — then we could see one last oil price surge as demand for oil outpaces supply.

It might also mean the oil majors turn into cash cows over the next decade as they milk their existing oil reserves for all they’ve got.

It’s certainly an interesting idea for nimble traders to have on their radar.

Though the future appears to be in renewables, the key as always will be timing and stock selection.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: How to Find Promising Energy Stocks — Discover why the energy market is ripe for massive disruption and how to identify innovative energy stocks. Click here to learn more.