In a recent article we covered the fall of Flight Centre Travel Group Ltd [ASX:FLT] amid the COVID-19 outbreak, culminating in a trading halt for the company, with the FLT share price closing at $9.65 at the time.

With notice of the halt taking place on 19 March, a lot has happened since then.

Source: Optuma

Flight Centre announced on 6 April that an equity capital raising of $700 million had been completed and this was made public, with an operational update outlining some of the current issues and key strengths.

If you are looking to shift away from volatile shares such as Flight Centre’s, check out our ‘Coronavirus Portfolio’, it takes an in-depth look at the kind of companies and assets that could weather the storm. It’s a free download.

Flight Centre share price and what’s happening right now

Drastic actions were taken with the outbreak of the COVID-19 pandemic. Some 6,000 staff had to be stood down or made retrenched, along with an immediate pause in sales and marketing spend, combined with cancelation of an interim dividend.

‘We are dealing with unprecedented restrictions and extraordinary circumstances that are having a significant impact on our customers, people, suppliers and all other stakeholders’, noted Managing Director, Graham Turner.

From the outside, Flight Centre appear to have moved swiftly and effectively to put the company into a position to be able to survive the COVID-19 global pandemic.

The road ahead for Flight Centre

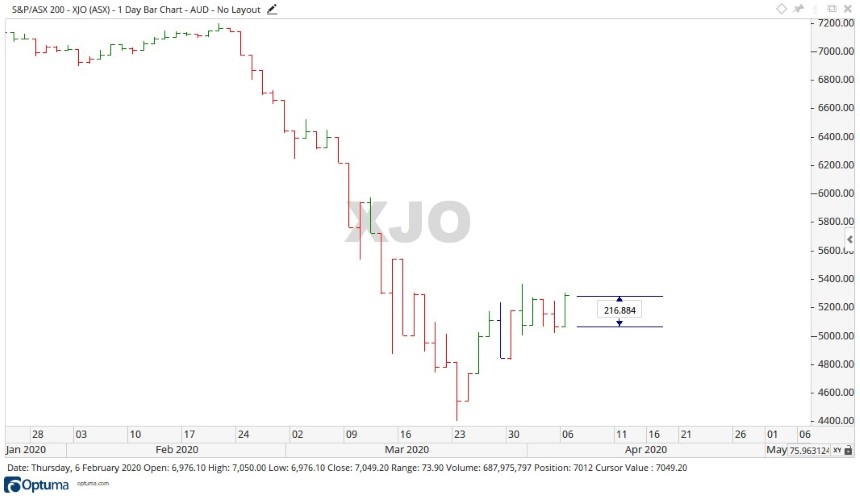

The world is still in the grips of a health pandemic and the financial disaster that is unfolding along with it. Here in Australia the [XJO] looks to have found some support from the fall, but is still experiencing days of large volatility with the most recent day recording a movement of over 200 points.

Source: Optuma

Flight Centre is a top 100 stock and will move along with the market to a degree.

Today notice was given that Flight Centre is reinstated to trade on the ASX and at the time of writing, the Flight Centre share price was down 2.23% to $9.68.

The XJO and Flight Centre are facing uncertain times with the lockdown of Australia now in place, and globally we are yet to see a point where life can resume to normal.

As noted in our previous article, Flight Centre has historical support levels around $16.20. If the price keeps falling this level will remain relevant.

Source: Optuma

From my perspective, Flight Centre looks to have done all it can to protect itself. When life returns to normal, people will start to travel once again, and Flight Centre will reap the benefits. With this in mind, the price levels of around $30 and $37 may come into play as a move up occurs.

Regards,

Carl Wittkopp,

For Money Morning

Comments