In today’s Money Morning…this chart shows you why BTC could soon find support…exponential growth of inflation mentions and BTC to be best-performing asset…but what happens after that?…and more…

[Editor’s note: I sit down for a chat with Chris Brophy of Hiremii, a soon to be listed ASX company that focuses on the automation of labour forces. The company is looking to disrupt the recruitment industry and it’s a fascinating chat. Have a listen via this direct download link!]

Yesterday I wrote to you about the bitcoin-Ethereum distinction and the recent bitcoin price pullback.

Today’s piece is more about what we’re seeing in the broader market and the relationships between BTC price action, inflation fears, and what’s happening with commodities.

It’s a telling sign when CoinDesk starts to become a more relevant media outlet than say the Australian Financial Review, Bloomberg, and the now paywalled Reuters.

So, I’ll be pulling some cool charts and commentary from there more often.

Let’s get straight to the first chart I want you to look at.

Bitcoin vs Gold — Which Should You Buy in 2021? Download your free report now

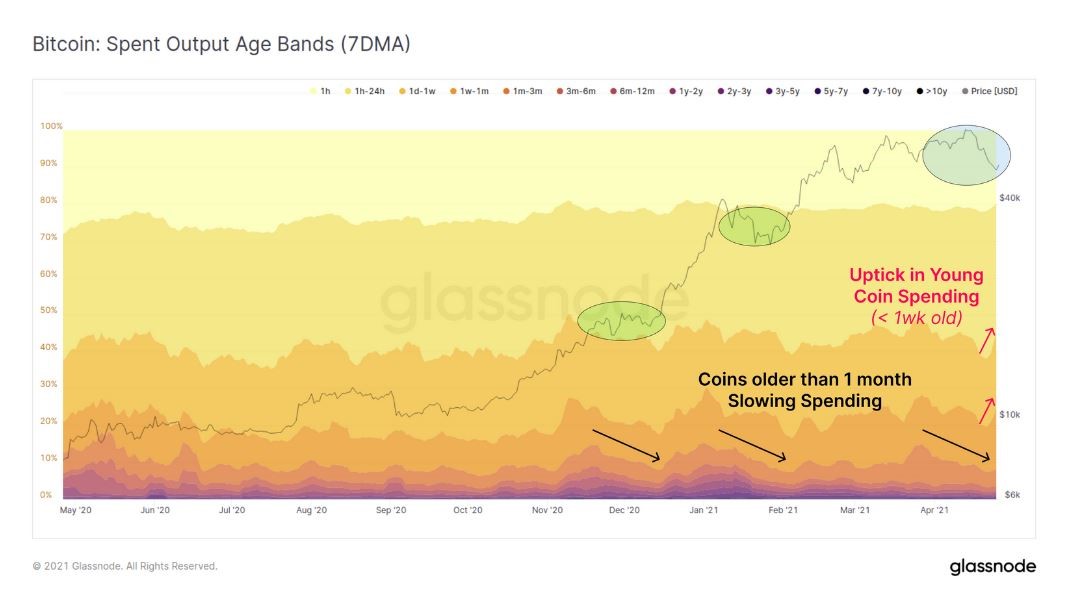

This chart shows you why BTC could soon find support

Yesterday, I labelled the BTC price action as a ‘battle between the fearful and the confident.’

Here’s a chart that backs up that claim:

|

|

|

Source: Glassnode |

Glassnode is a cryptocurrency analytics company that focuses on blockchain data.

This is what you need to know about the chart (emphasis added):

‘The Short Term Holder SOPR metric has also fallen to the lowest value seen during this bull market. This indicates that coins spent this week were at an aggregate loss relative to prices when they last moved. This metric provides further evidence that short term holders who purchased coins at higher prices have been shaken out during this correction. Deep and lengthy retraces of the SOPR metric has historically been constructive for price in a bull market, as panic sellers are exhausted and coins are transferred to stronger hands.’

New entrants to BTC panicked a bit, basically.

Think of this as old ‘whales’ versus new retail punters worried about regulatory issues.

There’s more to the story as well, and it comes back to the story that is most on TradFi (traditional finance) players’ minds.

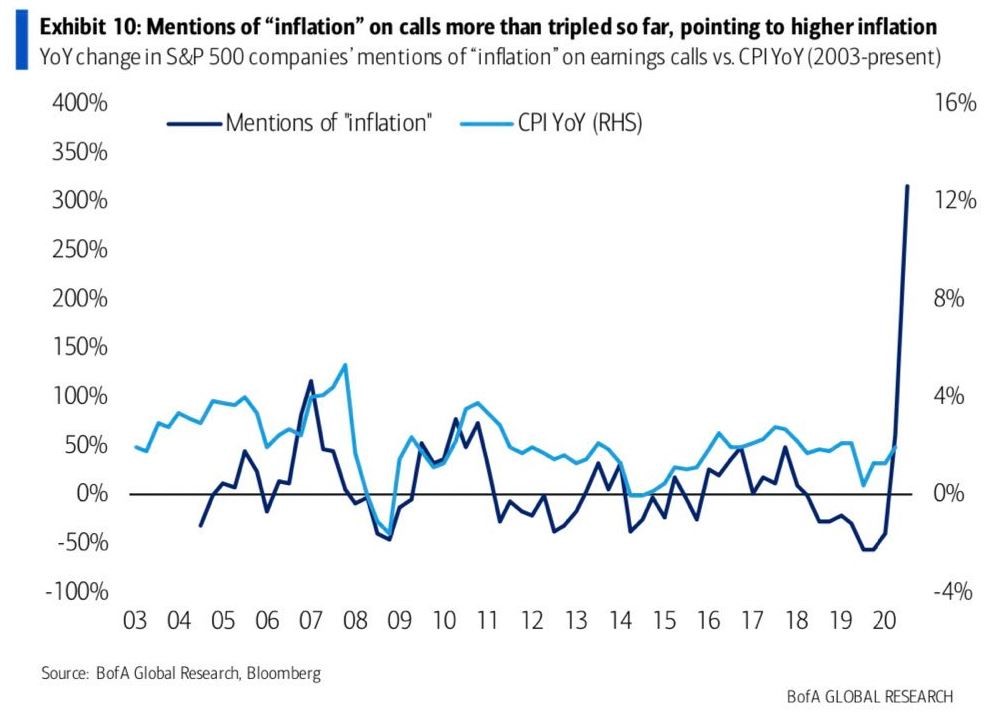

Exponential growth of inflation mentions and BTC to be best-performing asset

Check this exponential chart out:

|

|

|

Source: CoinDesk |

And here’s the context from CoinDesk:

‘Bond markets have been predicting a pickup in inflation for at least a year. Inflation expectations for the second half of the coming decade have more than doubled since the March 2020 crash to a 30-month high of 2.25%, per data from the Federal Reserve Bank of St. Louis…Bitcoin has risen roughly in tandem with inflation expectations over the past 13 months — since just after the March crash — and recently hit record highs above $64,000. Though the price has since settled back to about $55,200, the cryptocurrency is still up about 90% this year alone.’

Even if the BTC price goes sideways for the rest of the year, it would likely wind up being the best-performing asset class — something I said would happen at the start of the year.

TradFi people would’ve turned their nose up at this argument, but it was hardly a brave call at the time.

Which brings me to gold — could it be back on the menu with all this inflation fear?

What I’m seeing on the gold stock charts on the ASX is a reversal pattern/setup.

Gold is in a rut, but these are companies with solid margins and real earnings.

Would a bond yield-driven value pivot help put these stocks back into investors’ minds?

The inflation picture is pointing to yes, so check out the VanEck Vectors Gold Miners ETF [ASX:GDX] chart:

|

|

|

Source: Tradingview.com |

But there’s also a confounding variable which could mystify the gold bulls — the possibility that BTC eats gold’s safe haven/inflation hedge status.

I don’t think BTC will do this due to demographics, but it’s something to bear in mind.

Punchline — I’m bullish on gold, but only mildly.

Get ready for the monetary flamethrower treatment

What I am bullish on is commodities as a whole, of which gold is only one small part of the overall picture.

The stocks to commodities ratio isn’t levelling out just yet or even reversing because the S&P 500 is still charging ahead:

|

|

|

Source: Longtermtrends.net |

The Bloomberg Commodities Index bottomed out in early 2020 (in my view) and is pushing higher on recovery:

|

|

|

Source: Bloomberg |

Without context, this would appear to be quite the puzzle.

Imagine if the US market cools while commodities fly and the stocks to commodities ratio levels out or reverses.

I think that symbolic moment would open the floodgates for a mammoth commodities boom, something Ryan Dinse and I call the ‘Supercell’.

Gold may exit its slumber on this, and it’s possible if Biden gets his capital gains tax reform over the line, that could prove to be the catalyst.

Meanwhile, BTC goes nuts as well.

But what happens after that?

This is the big, big story you should have your eyes on right now.

Central bank-backed digital currency rollouts cascading across the world in the next two years, taking a flamethrower to the value/trust in fiat.

That’s a systemic shock that you simply must be prepared for.

Get ready.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Promising Small-Cap Stocks: Market expert Ryan Clarkson-Ledward reveals why these four undervalued stocks could potentially soar in 2021. Click here to learn more.