The ASX200 has shot up 1.59% this morning, with the market welcoming the news of the Australian Government’s new multibillion-dollar stimulus package. Though, the notion of the government having to prop up what was considered a booming market just a short time ago should be met with scepticism, not hope.

The crux of the stimulus package is to provide investment allowance businesses and a financial boost for pensioners, as well as immediate support for small- and medium-sized businesses. But it will do little to prevent the current slide of the stock market. Some economists warn that the country is at risk of falling into recession.

Investors are clearly spooked by the unknowns of the coronavirus (COVID-19). For the time being, forward earnings estimates for most companies are becoming little more than wild guesses, leaving investors hesitant.

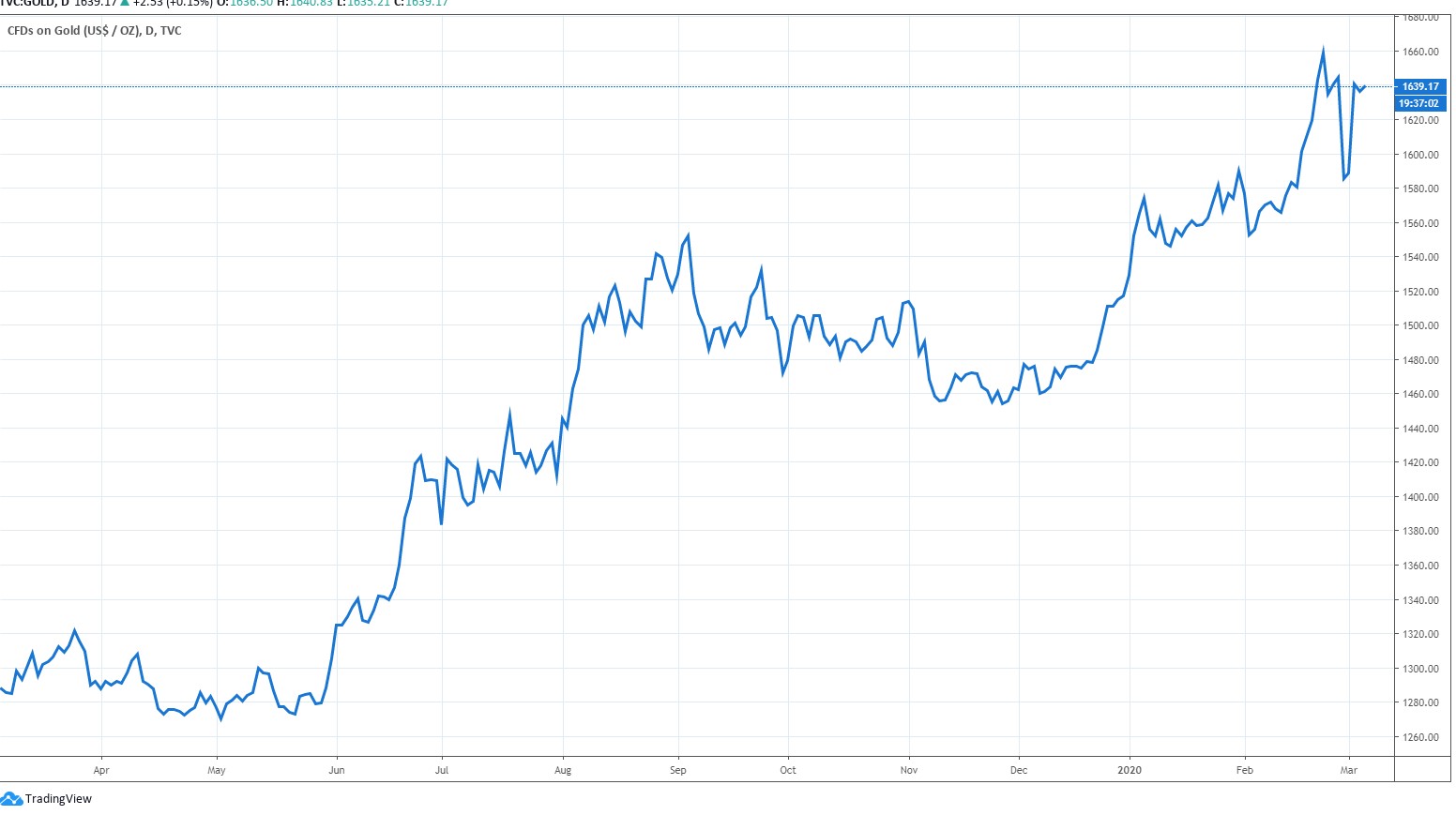

Gold is the safe haven

Source: Tradingview.com

In times of uncertainty, gold has been the go-to for investors looking to weather the storm. And there’s plenty of it, currently.

With the price of gold on the up, expecting to hit US$10,000 in the next few years, Australia’s gold miners could once again be providing sanctuary for investors.

The market took a dive yesterday on the back of the RBA cutting interest rates once again, but some gold miners were the notable exception.

Saracen Mineral Holdings Ltd [ASX:SAR] and Northern Star Resources Ltd [ASX:NST] both climbed 7% and 6.9% yesterday, respectively. The past 12 months have seen the pair’s share prices climb around 60% higher.

Both are gold producing giants, which means if the gold price continues to climb, they’re likely to be dragged up with it.

And SAR has been on the hunt for growth.

Saracen aims to increase gold production to 400,000oz per year from 2021 from its two mines in Western Australia. The company also announced last year they would acquire a 50% stake of the Super Pit gold mine — one of the country’s largest gold mines.

Gold Road Resources Ltd [ASX:GOR] and Silver Lake Resources Ltd [ASX:SLR] are also worth a look. The GOR share price has played out in much the same way as SAR and NST, increasing by a solid 60% over the past year.

GOR recently upped its production guidance for 2020 by 35,000 ounces to 285,000 ounces, at its Gruyere Joint Venture with Gold Fields Ltd [NYSE:GFI], indicating GOR has been able to covert the inferred resource into indicated resources.

SLR is a similar story. The company’s share price has rocketed up 120% over the past 12 months as FY20 sales are now expected to be between 240,000–250,000 ounces of gold equivalent, up from its previous guidance of 215,000–230,000 ounces.

Evolution Mining Ltd [ASX:EVN] also deserves an honourable mention. While the company hasn’t produced the level of gains the other four have of the past year — clocking a modest 22.81% — it has been a consistent performer.

With the company reporting a 62% increase in first half FY20 net profit from the prior corresponding period, EVN are in a solid position to continue to build on this record profit if the gold price continues its upwards push.

Of course, not all gold miners will see their share prices increase with the price of gold. It’s a notoriously risky sector.

Diversifying your gold portfolio with other commodity miners is a great way to potentially reduce some risk. In this free report, Money Morning analyst Ryan Clarkson-Ledward shows you his top five Aussie mining stock picks for 2020. Click here to claim your copy today.

Regards,

Lachlann Tierney,

For Money Morning

Comments