I know that it’s been almost a week since the election. No doubt you’re getting news fatigue as the headlines pump out commentary about it on every angle possible.

I want you to indulge me on an alternative angle, looking at the implications for our country. And, more importantly, how you can avoid becoming a victim of the upcoming economic storm.

More of the same

As much as the media wants us to believe this new government is a breath of fresh air, I beg to differ.

Not because I’m sour over the Coalition not retaining government given my conservative values.

Not at all. In fact, I wasn’t keen on them retaining government.

This party abandoned many of its traditional values of free markets and small government. It betrayed its constituents through massive stimulus spending, not standing up enough for small businesses during the lockdowns and pushing mandates that have turned out to be ineffective, even proving destructive to the economy.

The Liberal Party, in particular, was very much the man in Aesop’s Fables who sought to please everyone. It pleased no one and ended up losing the donkey (governing power) as it crossed the river.

The incoming Australian Labor Party may try to flatter themselves with the aid of the fawning media that they have the mandate to govern. The truth is that they came into power with even fewer votes than in the last election. They’re put into power thanks to preferences from the Greens and the climate change activists funded by businessman Simon Holmes a Court.

And this ALP-Greens-Climate 200 alliance could be a real circus if the past is any indicator. Australia’s seen this before, back in 2010 with the Gillard minority government.

This time will be harder given that Australia, and the world at large, stand in an economically precarious position.

Spoiler alert: Get your own house in order or else face the storm unprepared!

Under the burden of government deficits and debt

Politicians make a career out of promising big to win government and then spending their term in power working out how to take from Peter to pay Paul.

It’s a very hard balancing act. Easier to cut corners instead.

Rob both Peter AND Paul now, and stick it to their children too as the debt pile grows.

Everyone knows about paying taxes. They want to pay less.

But ask the typical voter what they think of the government paying out some benefits or granting subsidies, especially on causes they support, and you’ll hear them enthusiastically agree to it. These voters cast their support at the election, not realising they’ve signed up everyone to pay for it.

Most of us are unsuspecting suckers to the government. We’re giving them permission to take what belongs to us to distribute it around in the vain attempt to make us feel like we’ve done something good.

To keep us in this illusion, politicians talk about balancing the budget in terms of budget surpluses and deficits.

Regardless of who’s in power, both sides play this game of pursuing a budget surplus. They promise they’ll achieve a surplus next year while pushing it to the year after and then in five years’ time. By that time, it’s likely the other party’s problem.

It’s a scam.

Do you celebrate when you are able to spend less than you earn in a given year?

I suggest you aim higher if you do.

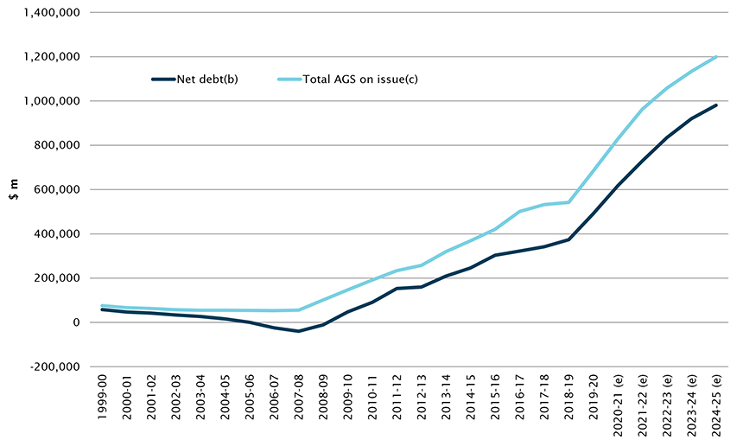

Let me show you the record of our federal government’s debt levels since the turn of the millennium:

|

|

|

Source: Australian Federal Government Budget Strategy and Outlook 2021–22 |

The dark blue line shows the amount the government owes its creditors. It’s now standing at around $700 billion. Projections show that it could reach $1 trillion in three years’ time.

To put it into perspective, each Australian citizen is currently liable for $28,000 of government debt. Throw into the lot our own debt — personal credit, housing, and business loans, and you’re talking an eyewatering amount.

Talking about balancing the budget each year is a diversion from the mounting debt crisis that Australia is facing! Look here, don’t look there.

Don’t fall for it!

The only time in the last 20 years we managed to see our debt decrease was during the Howard government from 1996–2007.

After the subprime crisis and the massive stimulus spending under the first term of the Rudd government, the deficits grew and our government net debt climbed.

It didn’t matter much which party was in power — they both spent more than they received. The debt ballooned as the government and the people became addicted to it. See why I consider both parties to be one and the same?

Don’t expect government to help reduce inflation. Not when it benefits most from inflation!

In short, there’s a reason why politicians and the media steer away from talking about national debt. The whole business of more government would lose its appeal. Keeping people ignorant and distracted helps the media herd people to play the blame game.

No way out of the game, so play it better than other participants

You can’t really sit out of this game. As long as you live on Earth, you’re going to have to pay taxes and follow their rules.

The way forward is to play the game better.

I’m not advocating dodging taxes.

But I believe you can stay ahead of the vicious debt-inflation cycle.

Weeks ago, you could take the crypto rocket, but that did a Challenger 1986 earlier this month. It could be a good buying opportunity now, but the ride is rough.

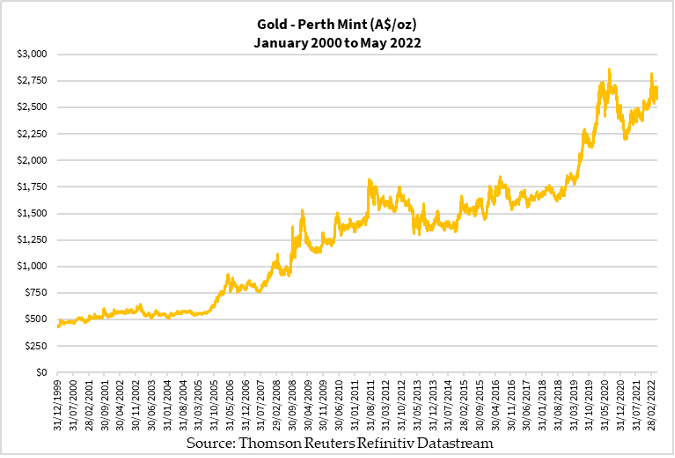

Gold is sitting quietly, retaining its purchasing power all through this time.

Let’s have a look how it’s fared since the turn of the millennium:

|

|

|

Source: Thomson Reuters Refinitiv Datastream |

Notice how it’s been rising in a similar pattern as government debt?

Expect this incoming government to need to hold its hand out for more funds from us, whether in taxes or debt.

You can find out more about how to harness the power of gold with my Niche Gold Strategy. Check it out here.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia