At time of writing, the EMVision Medical Devices Ltd [ASX:EMV] share price is up more than 13%, trading at $2.75.

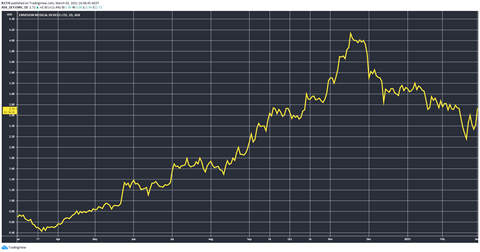

After moving up the chart and going higher than $4 in November, the EMV share price fell away but is now pushing higher again today:

We look at the latest announcement, which details a significant bid win. We then turn to the outlook for the EMV share price.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Highlights from MRFF bid win announcement

Here they are:

‘• The Australian Stroke Alliance (“ASA”) has been successful in its competitive Medical Research Future Fund (“MRFF”) bid to transform pre-hospital stroke care, of which EMVision is a key commercial collaborator.

‘• The ASA has advised EMVision that it will receive $8 million in non-dilutive cash funding anticipated to be weighted to the earlier years of the 5-year program. The funding will support EMVision’s development and clinical validation of its planned first responder model for air and road ambulances as well as confirmation of EMV’s portable brain scanner’s diagnostic capabilities in the hospital environment.

‘• The ASA provides EMVision with invaluable global clinical connectivity, expertise, and advocacy, including support from the leading minds in stroke care, paramedic services across Australia as well as the Royal Flying Doctor Service.

‘• EMVision will retain sole IP rights over the course of the program and in recognition of funding and the clinical expertise will negotiate with the ASA an appropriate revenue stream with respect to Australian road and air ambulance sales on standard commercial terms.’

So all positives today, including retention of intellectual property and an $8 million injection of funds.

The EMVision device is designed to be portable and carried by first responders, which could be particularly helpful in treating remote cases.

The announcement notes that:

‘The Company’s 1st generation device for commercialisation is currently under development and is targeted for use in ICUs, stroke, neurology wards and emergency departments.’

Outlook for EMVision share price

I’m broadly bullish on ASX-listed medtech companies.

In contrast to say a biotech or pharmaceutical company, which faces many regulatory hurdles and can fall down in the clinical trial stage, medtech products are a bit easier for investors to wrap their head around.

Simply put, if it can prove it does the job better, cheaper or faster, then the opportunity is more obvious.

As such, if EMV’s product is commercialised there should be a significant addressable market for it to enter.

Their most recent half yearly details a loss of $3.2 million cash of $13.2 million — so a sizeable runway to advance the product is there.

Regards,

Lachlann Tierney

For Money Morning

P.S: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.