EMU NL [ASX:EMU] is possibly the ASX’s newest gold explorer with the announcement it has secured several tenements with gold potential.

EMU entered a trading halt last week pending a capital raising.

But have emerged today a WA-focused precious and base metals explorer and aspiring gold producer.

Which has given the EMU share price a boost.

At time of writing, EMU’s share price is up 38.71% to trade at 4.3 cents per share, regaining its pre-COVID level.

Source: Tradingview

What’s EMU got and is it a buy?

If we go by the chart alone, then EMU could be looking promising.

The weighted moving average lines are signalling some decent looking upwards momentum.

But we can’t go by the chart alone.

So, let’s take a look at what the new EMU looks like.

Emerging from its trading halt today, EMU said it would transition into a gold explorer having made a series of project acquisitions in Western Australia.

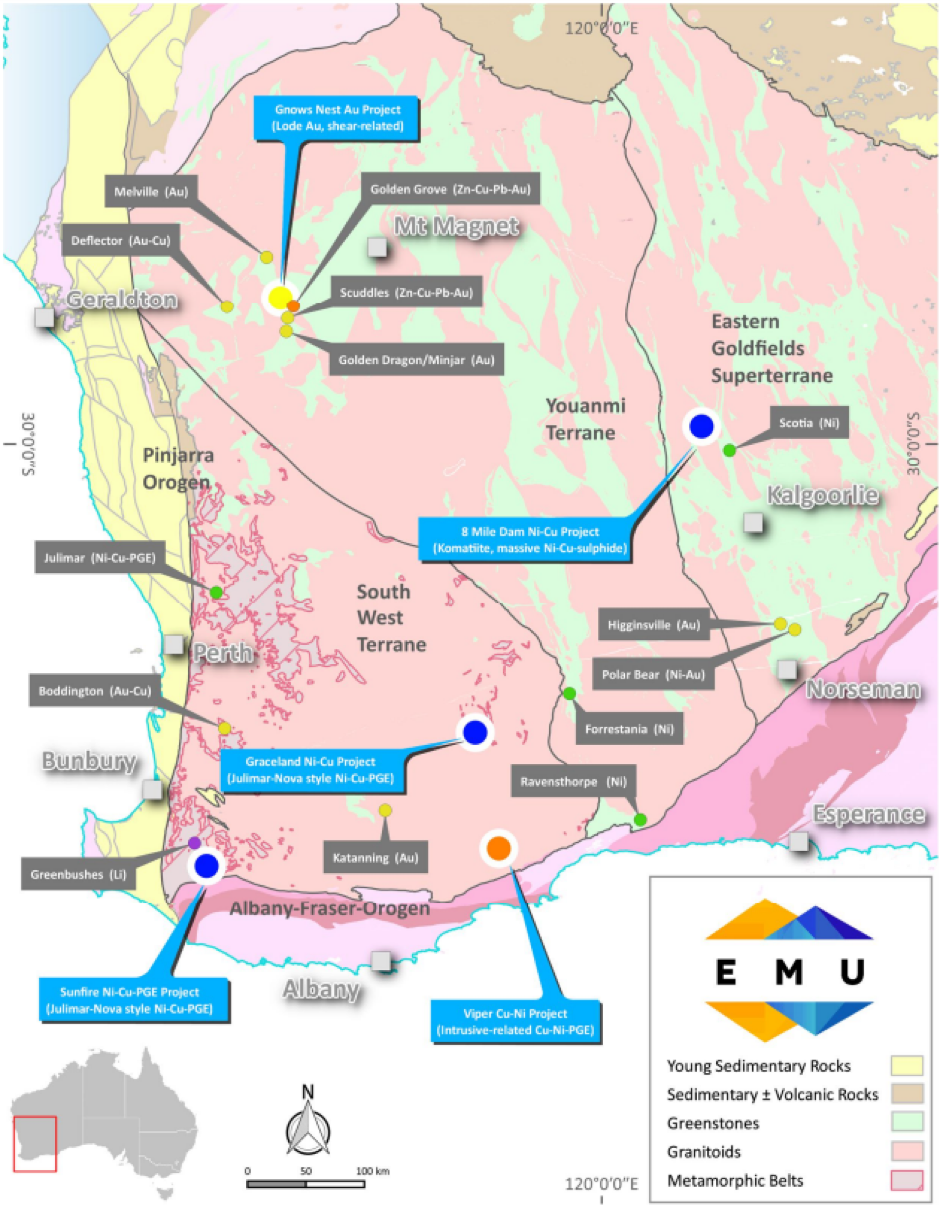

According to the company, these include:

- Gnows Nest Project: near-term production opportunity covering the historic high-grade Gnows Nest Gold Mine located near Yalgoo, which is home to Firefly Resources Ltd [ASX:FFR] and Venture Minerals Ltd [ASX:VMS].

- Sunfire Project: a prospective nickel-copper-platinum group element (Ni-Cu-PGE) play located near Bridgetown.

- Graceland Project: another Ni-Cu-PGE play located near Lake Grace.

- Viper Project: unexplored trend hosting historic copper workings located near Jerramungup.

Source: EMU NL

Gnows Nest was acquired via the purchase of Coruscant Minerals Pty Ltd.

The project hosts the historic Gnows Nest gold mine with reported production of ~27,925oz at a recovered grade of 22 grams of gold per tonne between 1923 and 1941.

Recent drilling by Coruscant has outlined shallow mineralisation that remains open at depth and along strike.

EMU said its principal focus would be to advance this resource as a near-term production opportunity via a simple shallow open cut gold operation.

The three other projects were acquired for what EMU called a ‘modest purchase consideration’.

The flagship project, Sunfire, is said to host a significant Ni-Cu anomaly in close proximity to Venture Minerals Ltd’s [ASX:VMS] and Chalice Gold Mines Ltd’s [ASX:CHN] ‘Julimar lookalike’ JV.

Buy now, pay later

If you’re thinking this is quite a significant acquisition to make for a microcap company, then I would agree with you.

It is.

EMU, as part of its announcement today, said it would also complete a share placement to institutional investors to raise about $1 million in order to fund the acquisitions.

EMU said it had agreed to place roughly 33.33 million shares at a price of 3 cents per share.

If you haven’t already read our resident gold expert Shae Russell’s latest report on why Australia is set to become the new ‘gold epicentre’, then be sure you do. The stream of new explorers like EMU are part of a big trend forming in the Aussie gold scene. Download your free copy today.

Kind regards,

Lachlann Tierney

For The Daily Reckoning

Comments