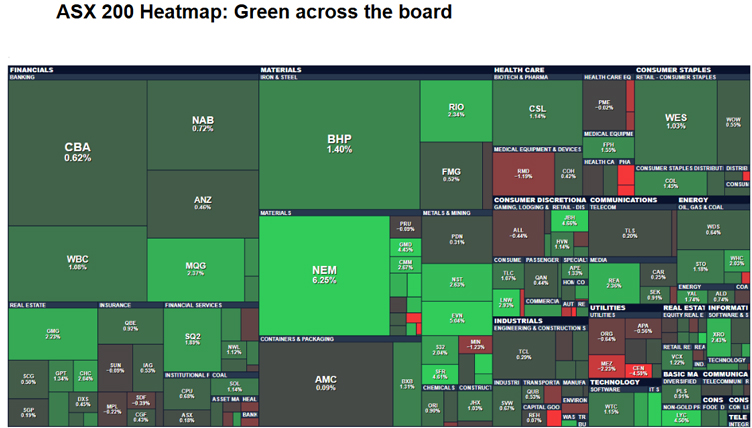

The ASX 200 heatmap looks verdant today:

Source: Trading Economics

[Click to open in a new window]

Meanwhile two major US market announcements this week signal something profound: the commodity-tech nexus is no longer a thesis.

It’s reality.

Elon Musk just combined SpaceX and xAI into a $1.25 trillion entity ahead of what could be the largest IPO in history.

Later this year, retail investors will get their chance to buy into a company planning to launch AI data centres into orbit.

Meanwhile, Trump unveiled Project Vault: a $12 billion critical minerals stockpile designed to insulate American manufacturers from supply shocks.

GM, Boeing, Google and others are signing up to secure gallium, cobalt, lithium and rare earths. The minerals that make SpaceX’s ambitions possible.

Let’s connect the dots.

You can’t build AI infrastructure in space without massive amounts of minerals.

And you can’t secure those minerals without acknowledging that China controls ~60-70% of global supply and over ~90% of processing.

Is my thesis about the commodity-tech nexus playing out in real time?

Two competing market themes can co-exist

For months, investors have been forced to pick sides. Either you’re betting on the AI infrastructure boom, or you’re rotating into commodities as a hedge against tech valuations.

The SpaceX-xAI merger and Project Vault suggest both themes can run simultaneously.

Think about it.

SpaceX is targeting a ~US$1.5 trillion valuation for its IPO, planning orbital data centres that need constant power, cooling, and materials.

This is a commodity story presented as a tech story.

Meanwhile, the US government is stockpiling the exact minerals required to make this vision work.

Gallium for semiconductors. Lithium for batteries. Rare earths for advanced electronics.

The market is starting to price in a world where high-growth tech companies and resource-intensive infrastructure investments are interdependent.

Yesterday I wrote to you about how Kevin Warsh’s nomination as Fed Chair adds fuel to this dynamic.

His stance suggests lower short-term rates to support AI productivity gains, but balance sheet reduction that could steepen the yield curve.

That creates a bizarre environment where growth stocks with forward-dated cashflows could rally alongside productive commodities like copper and lithium.

It’s not either-or anymore. It’s both.

Is ASX tech deep value?

Here’s the kicker.

While US tech appeared to melt up before the rough end of 2025 and commodities then had their turn before a sharp correction last week before appearing to find a floor…

ASX tech has been left in the dust relative to both.

The irony? ASX tech stocks may be one of the last bastions of genuine value if things like the SpaceX IPO or a potential OpenAI listing create another wave of euphoria in high-growth names.

(Now, I am aware of critiques of the quality of ASX tech names…)

And really good ASX tech names should be listed on the NASDAQ right?

But investors have largely ignored Australian tech over the past 6-12 months.

Capital fled to US mega-caps or rotated defensively into resources.

But if Warsh’s Fed delivers more dovish policy and retail floods back into growth stories with the SpaceX IPO as the catalyst, ASX tech could suddenly rev up.

Think of companies like WiseTech, Xero, and NextDC which have been beaten down aggressively.

If the market decides it wants exposure to high-growth businesses again, Australian tech could be there waiting to lap it up.

The Playbook From Here

So where does this leave Australian investors?

First, recognise the commodity-tech nexus is real.

SpaceX needs minerals. Those minerals need funding. That funding is coming from governments desperate to break China’s stranglehold on supply chains.

Second, watch how the SpaceX IPO trades.

If retail goes nuts and we see another wave of momentum into growth stories, ASX tech suddenly becomes interesting. Very interesting.

Meanwhile, critical minerals stocks with real potential remain worth the time digging into them.

Provided they have real substance behind them.

The next few months could see both themes rip higher together. Tech and commodities. Growth and resources.

It’s not often the market gives you permission to play both sides. This might be one of those rare moments.

Warm regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

Comments