We should see some big moves in individual stocks on the ASX this week.

Whether the ASX 200 moves up or down is yet to be seen.

I suspect it will be another sideways week.

A lot of earnings are due and some will surely disappoint.

Others will exceed expectations…and remember it is all about expectations, not the headline numbers.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

ASX earnings this week and commentary

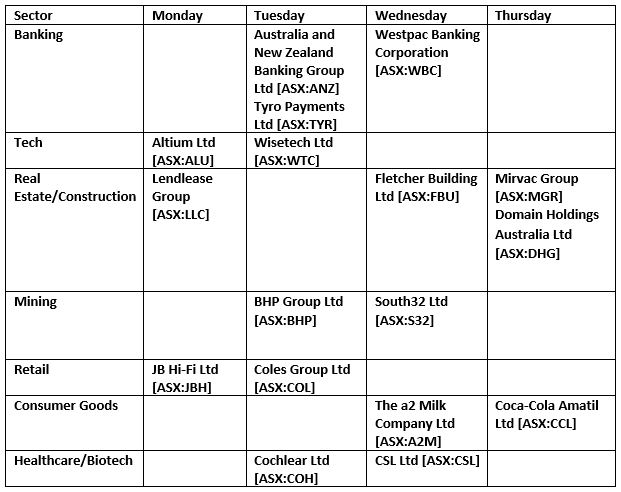

I’ve broken down the big ones to watch by sector and the date:

|

|

With the NAB and CBA results already out, you can expect another hit to ANZ and WBC profits, though maybe not as bad as once thought.

ALU and WTC will provide a barometer for how the ASX’s versions of the FAANG stocks are doing.

With LLC, FBU, MGR, and DHG you will get a sense for the state of the Australian property market.

BHP could post some good headline numbers as many of their operations avoided COVID-19 disruptions.

Likewise, S32 could be the beneficiary of improving commodity prices, as resources are outperforming banks.

The JBH share price is performing strongly in the charts as their online presence and the need for tech in lockdown helped them recover from the March market lows.

Likewise, the COL share price is on a tear on the back of panic buying and the fact that they are essential. Captive audience stuff, indeed.

A2M is a cash machine and their product is a staple, so more good numbers could be in store for the company.

CCL is the interesting one here, as its sales were hit by about 30% during the onset of the pandemic.

Its products rely heavily on the movement of people and better than expected numbers could hint at a stronger economy.

As for COH you may see COH’s results crimped by the fact that both government and citizens’ priorities lie elsewhere during the pandemic.

The CSL share price is stuck in a downtrend at the moment, and the company expects plasma collections will be hampered.

This is an immensely profitable company though and has a P/E of around 44.

Some investors may think this growth company is now value, despite the still lofty multiple.

Dreams about shorts and why the ASX is lagging the US market

It’s natural for work to impact your subconscious.

And I’ve had recurring dreams about people putting shorts on the ASX.

A lot of people may be thinking or dreaming about the same thing.

It’s part of the appeal of BetaShares Australian Equities Strong Bear Hedge Fund [ASX:BBOZ].

But I’m still very hesitant to say the end is nigh for the ASX or to call a top.

There are green shoots appearing in Australia, at least, everywhere except for Victoria.

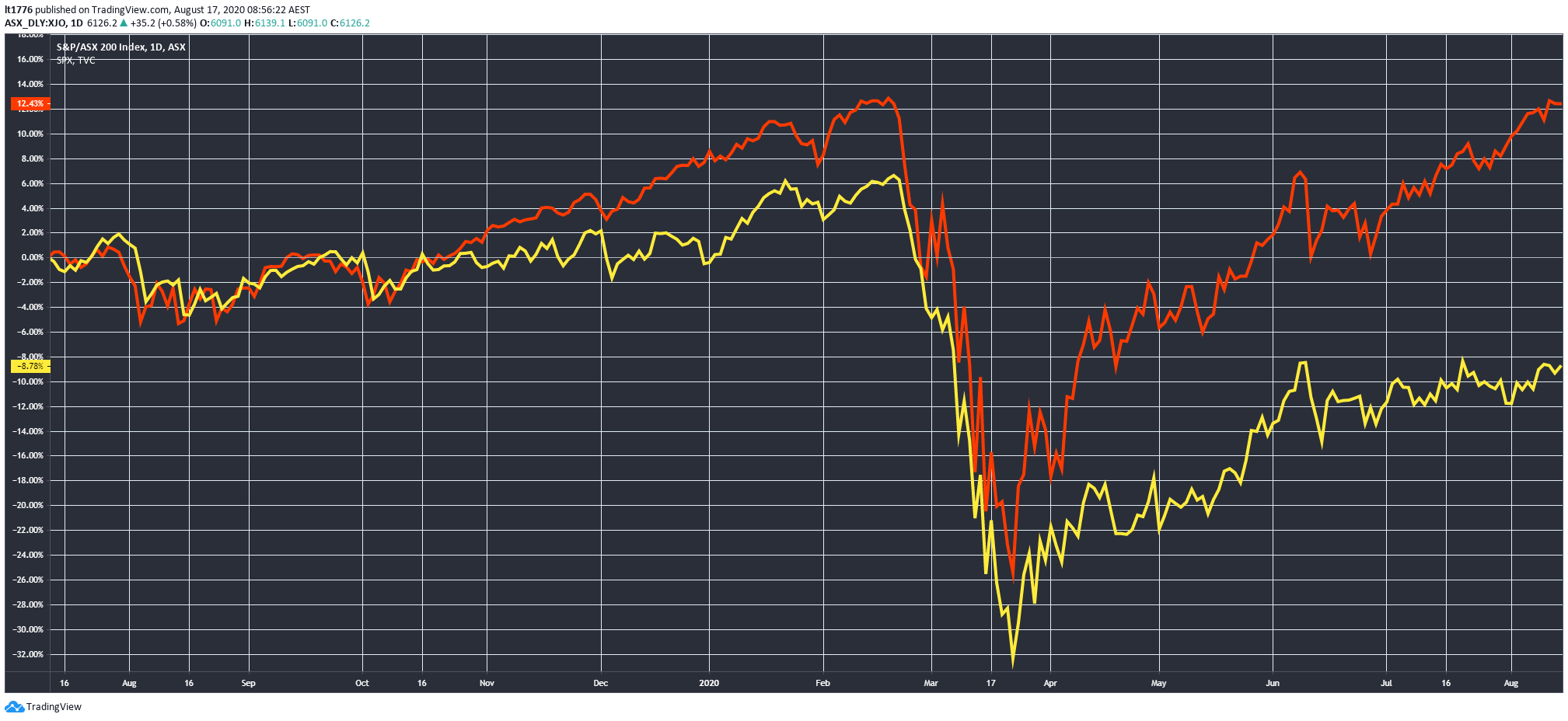

The ASX 200 [XJO] (yellow line) is heavily weighted towards mining and financials and it is clearly lagging the now tech-heavy S&P 500 [SPX] (orange line):

|

|

|

Source: tradingview.com |

So the big banks in Australia are clearly weighing the index down — and I recently explained why I think the Big Four are not cheap.

Which brings me to a last point — why can’t Australia have its own FAANG or FAMGA type renaissance?

Why Aussie Tech Stocks Could Fuel the Recovery

You’ve likely heard of the WAAX stocks and maybe even the new BetaShares S&P/ASX Australian Technology ETF [ASX:ATEC].

WAAX includes WTC, APT, ALU and XRO — the big tech players in this country.

I suspect the policy measures the federal government will put in place to aid the recovery will be heavily geared towards the sacred cows, mining, and finance.

Protect the value of residential property and keep digging things out of the ground will be the modus operandi.

Now, this may work for the moment.

But if Australia is to have a sustained recovery, we need to rapidly change the way we go about things.

The Australia–China relationship may not be around forever, and the bloated property/financial complex in this country could be an Achilles’ heel.

Germany is pushing ahead with a ‘green’ recovery, so why can’t we have a ‘tech’ recovery?

We’ve got the educated workforce.

At the moment, I am looking for companies in Australia’s tech landscape the most.

Tech stocks are often viewed as risky, but they could be a safer bet than the two pillars of Australia’s traditional economy.

Less exposure to souring political ties and a housing market downturn.

Either the tech works, or it doesn’t — and I believe this binary outcome can be better than trying to pick the lesser of two evils.

So, when you see earnings come out this week, keep in mind these are largely earnings for the legacy Australian economy, not the future Australian economy.

The mainstream financial press will ‘um and ah’ over what to think, while the smaller tech-oriented companies go unnoticed.

In my next piece I will highlight some of the companies in Australia which I believe are doing tech well.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Download your free report now and discover Ryan Dinse’s three small-cap tech stock picks that could be set to boom in 2020. Get the free report now.