When most people think of drones, they picture either a small toy annoying their peace or an expensive military aircraft. But the future of drones could be in a third sphere where investors could thrive.

We’ll get to that third option soon, but first, let’s understand the catchall term ‘drone’.

Simply put, a drone is a vehicle without a human pilot onboard. Most mentions of drones refer to unmanned aerial vehicles (UAV), but there is also a growing field of marine uses.

In recent weeks, we have seen just how impactful (and disruptive) these drones can be on our global economy.

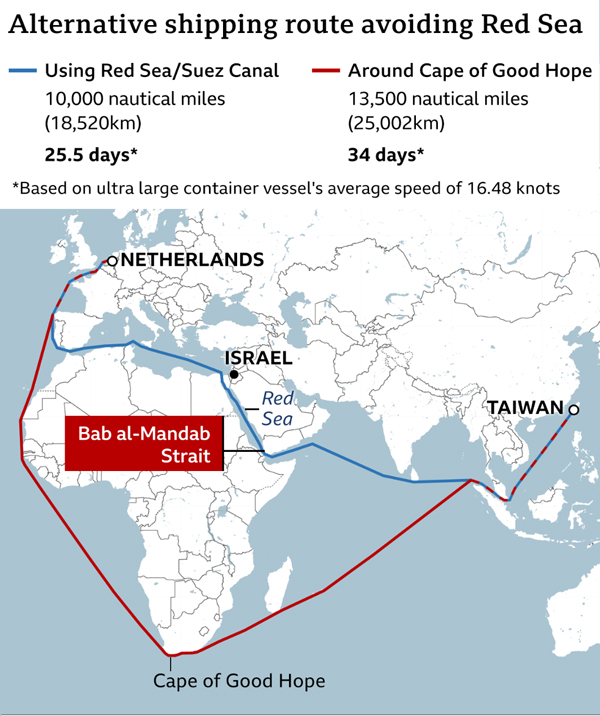

Houthi air and sea drone attacks on commercial shipping passing through the Red Sea have threatened global trade. These attacks mean many ships are opting for the long route around Africa.

| |

| Source: Veson Nautical |

That’s affecting approximately one-third of all global trade. Adding fuel to the fire, Israel sent drone strikes into Beirut last week, killing Hamas’s deputy leader.

These attacks have spiked oil prices as markets worry about the Middle East falling into broader conflict.

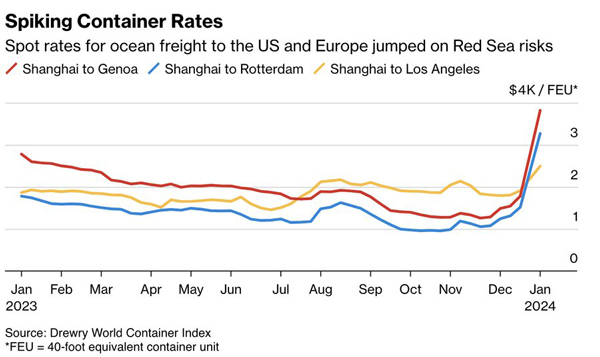

The cost of shipping goods has increased by 178% since mid-December due to the diversion around Africa and rising fuel prices.

| |

| Source: Drewry World Container Index |

These sea and sky drone attacks highlight the potency of the technology. Allowing smaller nations to project power far outside their usual borders.

Similar stories are occurring in other conflicts, such as the war in Ukraine, where drone strikes are hitting Russian cities.

Estimates from the British military think tank RUSI have Ukraine losing an astonishing 10,000 drones a month.

In the realm of aviation technology, drones are clearly altering the military landscape.

For investors looking for an angle to this space that doesn’t involve funding lethal drones, Droneshield [ASX:DRO] could be worth a look.

The Sydney-based company focuses on counter-drone technology. Its gear is already in the field and securing government contracts.

Its shares made an impressive 69% gain in 2023, and it has a solid pipeline of contracts with Western partners.

Remember, this is still a small, risky, and speculative company, and past performance is no indication of future results. Just something to consider adding to your watchlist.

Turbulence in takeoff

Moving away from the military, the next place where drones could become a disruptor is within the commercial realm.

Much of the early 2010s hype around this technology focused on the sexy ideas of flying taxis and packages delivered from on high in an instant.

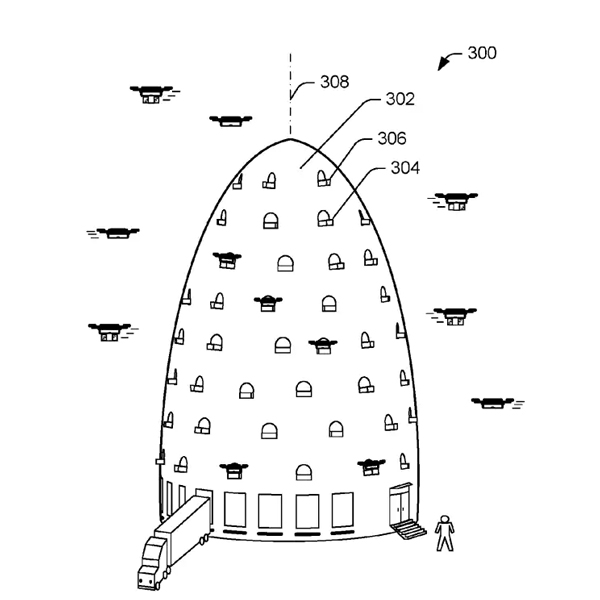

Amazon led the charge with hilarious patents, such as its airborne and underwater drone warehouses.

They then took the word drone to its logical conclusion and even patented beehive-style warehouses.

| |

| Source: PopSci.com |

These early hopes and hype left the technology underserved beyond its military uses.

With hindsight, we can see that many drone ideas failed due to safety risks and regulations on flying drones over cities.

Now, a decade after Jeff Bezos promised us all delivery drones, we have seen the first real movement by the company.

It unveiled its newest MK30 drone in October last year, which it hopes to launch in the US, UK, and Italy by late 2024.

| |

| Source: Amazon |

Drone design is still hindered by battery power versus weight issues, but with every passing year, we are seeing progress.

Looking beyond delivering packages, the latest generation of drones has found wider use.

Drones in Australia

Australia’s vast and sparsely populated landscape makes it a natural choice for drone technology. The abundance of open space eases concerns about safety and privacy, which usually hinder their use.

With these advantages, industries like agriculture and mining have already been early adopters.

However, the current level of investment has been low, meaning that drones found on sites have not kept up with the technology on offer today.

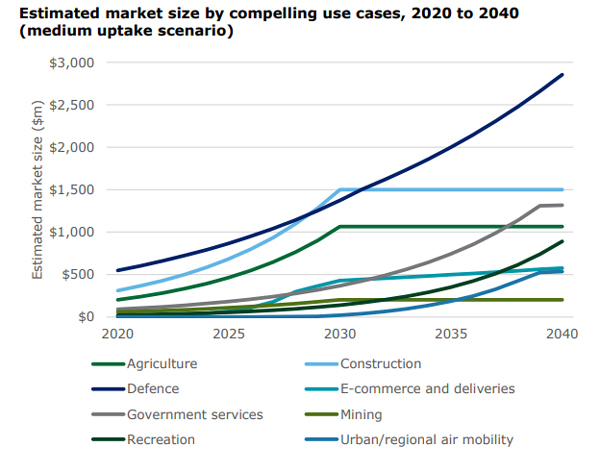

Deloitte’s market growth estimates within Australia show clear interest, but it’s still early.

| |

| Source: Deloitte — Economic Benefit Analysis of Drones in Australia |

So what are some of the industries that can benefit from adoption, and where can investors look?

Drones transforming industries

Agriculture, forestry, and fishing: Drones can help workers in the field in stock monitoring, mapping, and spraying.

Labour and fuel are the major costs to access remote areas. Farmers can instead check water levels or herd numbers with drones while staying safely at home.

The use of drones like the Agras T16 for pesticide spraying in agriculture is niche but growing.

Research from the American Farm Bureau Federation estimated a return on investment of US$12 per acre for corn. While soybeans and wheat had an ROI of US$2–3 per acre from drone sprayers.

Infrastructure monitoring: Drones can also service rural areas for telecom, construction, and mining sectors. Australia’s sparse assets mean drones have become a no-brainer for efficiency and cost savings.

Mining and exploration: Site inspections, asset management, and surveying have already seen drone adoption by the industry.

But most of that has been with older drone sensors and types. Newer generations of drones are capable of navigating tight spaces.

Combined with advanced LiDAR sensors, drones are now capable of surveying below ground. The push towards cost savings, safety, and lower emissions will likely push further adoption here.

Sadly, most of the leading names in this space are privately held companies. Thankfully, more Australian startups are entering the fray.

Emesent is one to watch with its advanced sensor packages for exploration, while private players like AuAV stand as Australia’s oldest drone services company.

Emergency Management: The ability to map escape routes or direct relief has meant more groups have adopted drones as a first response.

Disaster Relief Australia has flown more than 3,000 drone missions over the Asia-Pacific to support relief activities.

Insurance companies have also moved into the space for quick assessments post-disaster.

Delivery Services: Startups like Zipline began using drones for essential medical deliveries in remote areas.

They are now worth more than US$4.2 billion and are challenging giants like Amazon in exploring drones for consumer goods delivery.

If they can get past regulators, it could massively reduce delivery times and costs. Once that is ironed out, Australia will likely see similar services.

The sky is the limit

Drones may have seemed like a passing trend a decade ago, but thanks to research, they have found their footing and are here to stay.

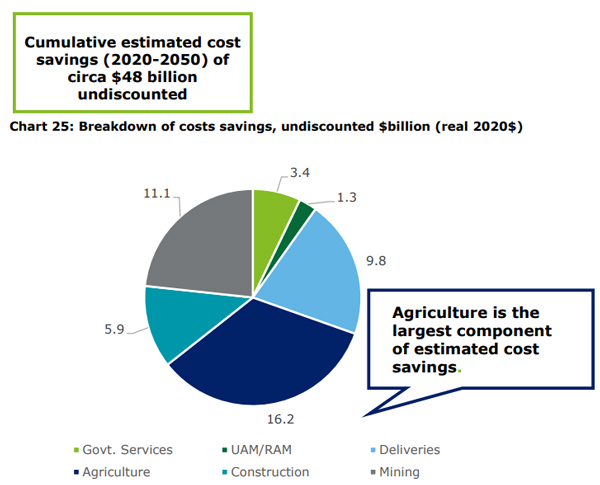

Their varied uses and low capital costs make them a natural fit for Australia’s landscape and industries. Plus, their potential cost-savings will be too good to ignore for much longer.

| |

| Source: Deloitte — Economic Benefit Analysis of Drones |

As drone capabilities expand along with AI, their reach into more industries is likely to surprise many who forgot about them after the 2010s.

The use of drones this decade is poised to be one of the big disruptors, leading to a new era in aviation.

Their ability to transform operations across so many industries in Australia should mean they should be on your radar in the years to come.

Regards,

|

Charlie Ormond,

For Fat Tail Daily

Comments