The Douugh Ltd [ASX:DOU] reported a strong finish in Q1 FY22, doubling its US customer base with growth continuing to accelerate.

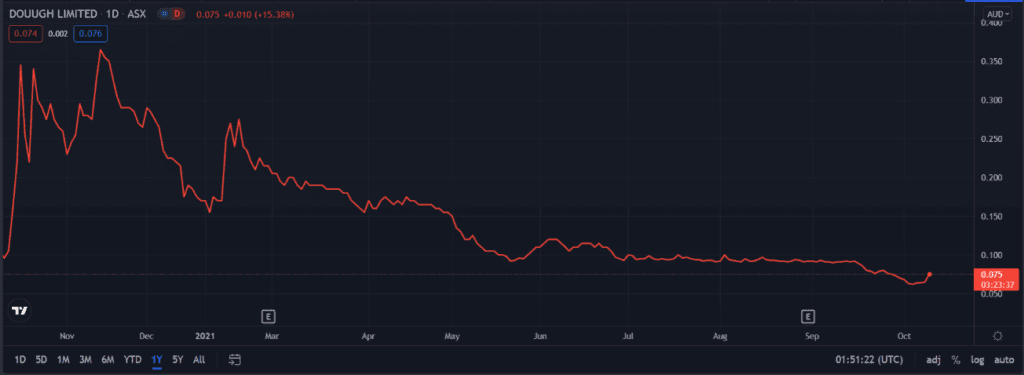

Customer growth is an important metric for emerging fintechs, and the market responded well to the quarterly update. Douugh Ltd [ASX:DOU] share price is currently up 15%.

Despite today’s spike, the DOU share price is still down 55% year to date.

Could today’s growth in US customers see the market reassess DOU’s prospects?

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Douugh Q1 FY22 overview

Today, financial ‘super app’ Douugh released an update on its customer take-up. DOU said it’s showing strong growth across all key metrics following the resumption of marketing activities in Q1 FY22.

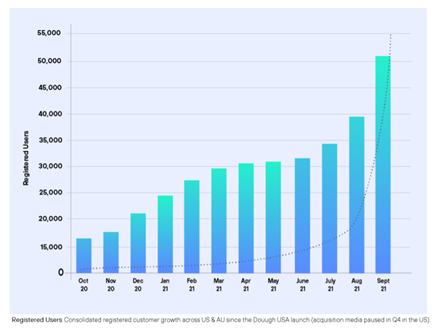

Total customers on DOU’s platform across Australia and the US stand at 55,321, up 53% from Q4.

DOU was pleased with the growth as it came during a transition from a freemium model to a US$4.99 monthly membership fee model for new users in the US.

Accumulated customer deposits rose to $11.6 million — up 76% on the previous quarter.

DOU’s collective debit card spend rose to over $4.8 million, up a significant 94%.

And the fintech’s funds under management grew to over $4.5 million, up 11% from Q4.

Douugh founder and CEO Andy Taylor said:

‘We are seeing strong month-on-month momentum building now, which has accelerated following the launch of the integrated robo-advisory service and with the dialling up of growth marketing initiatives.

‘As expected, we are demonstrating exponential growth on all key metrics, suggesting strong product market fit.

‘We see a window of opportunity to become the responsible financial super app for a large sector of underserved customers in the emerging gen-z segment, which we are well positioned to capture.’

Douugh outlook and US customer growth

DOU said it will release more features to its Douugh ecosystem soon, seeking to capture a greater share wallet and enhance its ability to win the salary deposit.

The key upcoming feature is Autopilot, an automation feature DOU said it will continue to invest in heavily.

Revealing its target demographic, DOU also said its marketing initiatives have been focused on digital initiatives across Google and Facebook advertising networks, as well as social platforms TikTok and Snapchat.

An interesting factor in today’s announcement was DOU’s lack of detail on the US customer numbers, despite leading its update with the fact the US customer base doubled.

Today’s announcement did not indicate what the US customer base was. It should also be mentioned that US customer acquisition was paused in Q4 FY21.

We do know that Douugh reported 32,172 customers in Q4 FY21 across the Australian and US segments, but in neither quarterly update was the customer total separated by segment.

If fintech has you excited, then I recommend reading this report on three small-cap fintechs.

Each offers a niche product that could help reorder the current financial system.

You can get the full rundown on these companies here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here