Roy Wenzlick is possibly the greatest housing market forecaster of all time.

He did an immense amount of research on the real estate cycle and is renowned for his forecasting abilities.

However, unlike Homer Hoyt (who is credited for ‘discovering’ the 18-year boom/bust pattern as it applied to land in his 1933 book One hundred years of land values in Chicago), Wenzlick doesn’t get a mention on Wikipedia.

In fact, it’s incredibly difficult to find Wenzlick’s publications — or for that matter, any information about his life and work online.

Still, knowledge of Wenzlick is important for students of the cycle.

Wenzlick wasn’t the only towering yet somewhat forgotten figure to research the cycle as it applied to US real estate.

Another that flies under the radar is Clarence Long, also referred to as Doc Long.

Long was a US economist and politician.

He did his Masters and PhD in economics at Princeton University in the mid-1930s. His doctoral dissertation was titled ‘Long cycles in the building industry business, public, and residential building in United States cities, 1856–1935’.

The ‘long cycle’ he referred to, of course, is the 18-year real estate cycle.

Long uncovered four major waves and defined the ‘long cycle’ as being an ‘average’ of 18–19 years.

In fact, for some years following, the 18-year real estate cycle was referred to as the ‘Long Cycle’, due to Long’s extensive body of research.

Here’s what he had to say about it:

‘The average length of fluctuations in the two types of building since the Civil War has been eighteen or nineteen years, with close agreement between the various building types.

‘Although there has been little difference in length between one type of building and another within the same period, differences between one cycle and the next have been considerable.

‘The shortest fluctuation, the one following the Civil War, lasted only fourteen to sixteen years.

‘Only slightly longer than this was the cycle following the World War.

‘At the other extreme was the movement ending about 1900, which lasted twenty-one to twenty-three years.

‘Of the four cycles since the 1860’s, the cycle before the World War was the only one to agree in length with the average.’

Additionally, Long made the observation that since 1900, ‘cycles in building were about a third more severe than before’.

‘Four great waves in the construction of new buildings have occurred since the Civil War, and it is not too much to say that their turning points mark the most exciting and memorable episodes in the nation’s history…’

Because Long’s focus was on construction, his various insights give an additional layer of analysis to build on the research of Hoyt and Wenzlick.

For example, Long recognised that one of the leading indicators of a downturn approaching the economy was a peak and subsequent fall in building activity.

Of this he said:

‘In the case of severe depressions, building displays an unmistakable tendency to precede general business on the downturn…

‘The explanation of the lead of building on the downturn is to be found in the acceleration principle.

‘The volume of building tends to fluctuate, not with movements in total income or total consumption demand (which may be said to reflect the general level of business activity), but rather with the movements in the increase of these factors.

‘In as much as the decline in the rate of increase usually, although not necessarily, precedes the absolute decline, it is not surprising if the volume of building falls off before general business activity, therefore building seems to take the initiative on the decline, whereas that decline has actually been initiated by the failure of business to keep on increasing as fast as it started out to do…’

This goes some way towards explaining why we see a peak in building materials, construction, and housing companies PRIOR to the major stock market collapse at the end of the cycle.

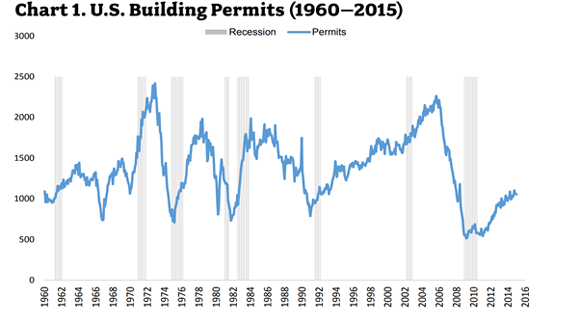

It’s also why an increase or decrease in building permits is often cited as one of the key leading economic indicators of signalling a turn in the economy (Leamer 2007).

| |

| Source: Charles V Bilello, CMT, and Michael A Gayed — IFTA Journal 16 |

Needless to say, it’s something we’ll be watching closely both in the US and Australia as we approach the forecast peak of this cycle in 2026.

Right now, the cost of construction materials, labour shortages, rising interest rates, and supply chain disruptions have impacted the industry severely.

It’s challenging Labor’s big election spruik of building one million ‘well-located’ homes over the next five years.

(Not that this is an outlandish number compared to what has previously been constructed through the boom phases of the real estate cycle.)

The issue is that new home sales are lower than they were at the start of the pandemic.

And yet, we have record-high permanent migration following the lift in the cap for 2022–23 from 160,000 to 195,000 places.

Forecasting forward, it could see Australia’s population hitting 29 million over the next 10 years.

Through the remainder of this cycle there’s going to be huge demand for new housing…and that should trigger a building boom.

In the shorter term at least, it’s going to increase demand for the established market with rental prices going higher.

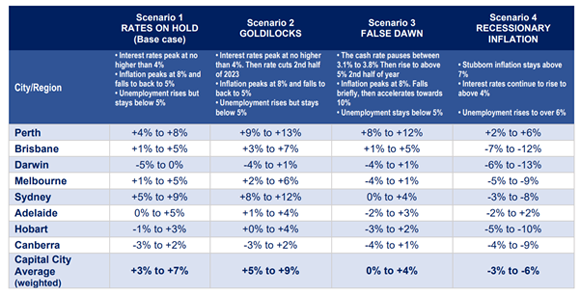

In fact, the lift in immigration is one of the key reasons Louis Christopher of SQM Research has forecast a modest recovery in the housing market next year led by Sydney, which captures the lion’s share of overseas migrants:

| |

| Source: SQM Research |

In fact, it wouldn’t be surprising to see a new batch of government incentives offered to stimulate the construction sector so Labor can meet — and perhaps even exceed — its election promise.

Maybe a return of policies to encourage foreign investors back into the market, for example, without the stamp duty surcharges currently in place?

Foreign investors are limited to purchasing new construction, and they’ve certainly been an influential factor in residential building activity in previous years.

As it is, there’s been little competition around residential sites prime for development over recent months.

I’m talking about the sites with the older suburban homes that are prime for subdivision, in need of extensive renovation, or a build in the backyard.

Conditions have been great for negotiation.

But with the uptick in immigration, along with the cost and supply of construction materials reducing, it’s fair to say that sites like this are likely to generate a lot more competition through the latter half of 2023.

A bit of a spruiky article I came across in The Sydney Morning Herald gives further insight:

‘Builder Zaki Chalouhi bought an empty block of land for about the same price as another he purchased earlier when the property market was red-hot.

‘But his latest purchase was on a bigger parcel of land and in a better pocket.

‘He believes property prices have fallen enough that he can build a new home, sell it in 12 to 15 months amid an improving market, and profit, and he’s not alone.

‘More builders have entered the market in recent weeks, buying rundown properties and empty blocks of land that are worth less than six to 12 months ago.

‘Many builders are putting their money on the property market nearing the bottom and have their sights set on a recovery of sorts in a year’s time when their construction projects near completion…’

A few comments from Tim Reardon from the HIA (Housing Industry Association) go some way to supporting the outlook.:

‘Housing Industry Association chief economist Tim Reardon said while interest rate rises since May were yet to have their full impact on building approvals, builders would be quick to jump on the downturn.

‘As is typical in slowing cycles, builders invest themselves and construct new homes knowing by the time they reach the end of the construction phase that prices will be on the rise again, and they hope to catch those customers who missed out on buying at the bottom of the cycle.’

Does it indicate we could be at the bottom of this market downturn?

Not quite…but I don’t think we’re far away from seeing improved conditions in both turnover and median price data.

Back to Reardon:

‘We expect 2023 to be the year of knock down rebuild. Land prices are so high and it’s so hard to get good blocks of land given the short supply. Those who own a block of land, we are likely to see more starts in that market than previously…’

For more on what next year may bring, you can get access to my recent interview with Louis Christopher, as well as all other interviews exclusive to my Cycles, Trends and Forecasts subscribers, by going here.

Best wishes,

|

Catherine Cashmore,

Editor, Land Cycle Investor and Cycles, Trends & Forecasts

Comments