As you may know, copper, gold, silver and crude oil have been on a tear lately.

Here’s the latest Year to Date performance;

| |

| Source: ProRealTime |

And it’s this broad lift across different resources that’s creating an air of ‘commodity super cycle’.

Rumblings of the 2003 to 2011 upswing years are starting to stir.

Back then, everything swelled — from rare earths to iron ore to wheat. The list of commodities that experienced exponential rises in value over that time is extensive.

That includes high-profile commodities like gold. Back in 2003, it sold for just US$360/ounce.

By the end of the boom years in 2011, it had surged 400% reaching a high of more than US$1,900/ ounce.

And just like today, copper followed in gold’s wake.

Despite having different demand drivers, the last commodity boom witnessed a 528% gain for copper.

It went from a low of US$0.70/pound to a peak of more than $4.40/pound by 2011.

Gearing up for the NEXT commodity Supercycle

Now, there’s plenty of options for investors looking to invest in the resource sector.

You might like to keep it simple with a broad mining ETF.

But as members of my paid resource publications would know, we loaded up on stocks holding deposits known as porphyries.

Across our two resource-dedicated publications, we hold five stocks leveraged to this deposit style.

So, why the focus?

Investing in companies that can push beyond junior mining status means they need to have the potential of finding something big.

Porphyries are amongst the largest deposit styles for copper, but they’re also endowed with gold and silver.

That’s ideal in this current market.

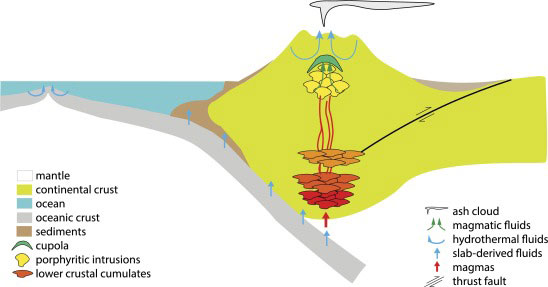

While we do have opportunities in Australia, these commodity motherlodes are much more common along the west coast of South and North America.

Here, dense oceanic plates collide and subduct below the continental crust.

This slow-motion collision compresses the crust, forming a long north-south chain of mountains from Patagonia all the way up to Alaska.

But this subduction zone also gives birth to gigantic porphyry deposits; where rich mineralised fluids combine with plumes of rising magmatic rock.

| |

| Source: Science Direct |

While gold and silver are typically considered ‘by-products’ at these mines, at times, the quantity can be so large that it exceeds the total ounces at a standalone precious metal mine.

For example, one of our Diggers & Drillers picks has a ‘byproduct’ totalling 4 million ounces of gold within its resource.

Assets like this sit high among the majors as potential takeover targets, which is another bonus for investors.

So how’s this playing out for members so far?

Riding early momentum across copper, gold, and silver prices in 2024, one of our porphyry hunters is up more than 60% since we recommended it in November.

Of course, I am cherry-picking one of the bigger winners here; others have barely moved.

But that’s the opportunity you have as a new investor.

The mood for commodities is lifting,

but are we in a SUPERCYCLE?

With gold breaking into all-time new highs and silver destined to catch up, there’s a strong case for precious metals right now.

But the commodity story is much bigger than this.

Now, I cringe when I hear the term ‘super-cycle’.

It gets bandied about whenever commodity prices start to move. No doubt, 2024 is looking promising but there are some key hurdles to overcome.

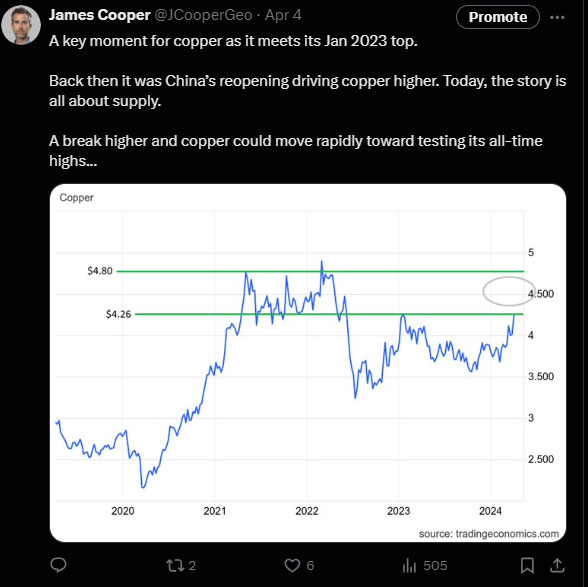

Last week, I ‘tweeted’ a possible resistance level for copper that could result in a temporary pullback, here it is below:

| |

| Source: Science Direct |

Like gold, a strengthening copper market bodes well for a broad lift across the resource sector. A clear bellwether.

But right now, copper is retesting the January 2023 highs, at around $4.26.

This is a critical juncture for the copper market and something investors should be watching closely.

Now if copper does break through, we could see a rapid move toward the next level, around $4.80.

That would mean a retesting of its all-time highs from early-2022.

And if that breaks, well, the doors will be wide open for the start of a new super cycle in commodities.

This is shaping up as a pivotal moment for the resource sector and copper is the key metal to watch.

Your opportunity to take a position ahead

of the crowd

The resource market is notorious for doing very little for years then exploding rapidly with little warning.

As famous mining legend Rick Rule would say…‘Commodity bull markets move a little, at first, then all at once!’

What we’re seeing right now could be the ‘little’, it pays to start preparing now in case we enter the ‘all at once’ phase.

How can you capitalise on the potential commodity boom ahead?

Remain selective; focus on companies with high quality geological assets. That includes porphyry deposits.

There’s still plenty of value in this market, especially at the junior end. But as I’ve shown you, this could change very quickly.

To find out more about the stocks I’m recommending to subscribers, you can do so here.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments