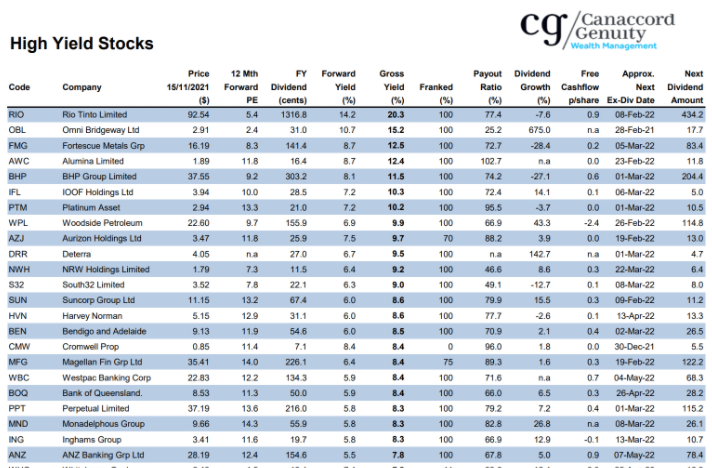

How does a 20% grossed-up yield sound?

Canaccord Genuity says that Rio Tinto Ltd [ASX:RIO] is yielding that right now.

I discovered that after coming across this nifty chart yesterday.

Dividend lovers, check it out…

|

|

|

Source: Cannacord Genuity |

I cut the list off halfway. You can see the full list here.

Why would the market leave so much income on the table?

We don’t have to think too hard. Iron ore is down 60%.

China has put the brakes on steel production and emissions.

Their property market looks as wobbly as Tim Paine’s future Weet-Bix appearances.

Point being: the market is saying that Rio’s yield is unsustainable and going down. Iron ore is finished.

I beg to differ here.

For 20 years iron ore has been a ‘China’ story.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Indeed, you can see the correlation between the iron ore price and China residential investment here:

|

|

|

Source: Market Index |

However, there is a vast shift happening around the world.

It’s called decarbonisation.

What’s this got to do with it?

Iron ore is used to make steel. Steel is hugely polluting. The name of the game is to bring those emissions down.

One way to do that is with high-grade iron ore. This is not so common as iron ore itself. It’s a tighter market than many presuppose.

That’s the first point.

The second is that the steel market is NOT just a China story.

Demand roughly splits into two sectors: China and the Rest of the World (RoW).

It’s the ‘RoW’ that’s now interesting. Why so?

Look at what’s happening around us.

US President Joe Biden, when he’s not asleep or mumbling incoherently, wants to upgrade American infrastructure. The bill is going through the American legislature right now.

Then we have the ongoing rise of India and Southeast Asia.

An Indian Tata steel man captured this sentiment in an interview recently:

‘And for “the first time in many years,” steel demand is not being driven by China, said Narendran. He noted the World Steel Association expects growth in steel consumption this year will come from countries other than China.

‘“With the Western world investing [in] infrastructure, that’s positive for demand as well,” he added.’

You can see that link here. Our Tata steel man cited here sees iron ore staying in a range of US$100–120.

If correct, that’s enough to keep Rio Tinto pumping out dividends.

Rio is trading on a P/E of five. That’s not high, and it will stay that way until the company finds a way to add further growth prospects to its business.

But what I like about Rio — besides the big yield — is you get copper and uranium exposure as well without dicking around with some of the piddly explorers and juniors.

I also wonder: is it possible that iron ore around US$100 is too conservative?

The world needs to replace the fossil fuel infrastructure with EV cars and charging stations. All this demands steel.

Then we have the massive issue literally hanging over our heads. It’s called space!

Yes…the race is on now to dominate the above…and the private sector is leading the charge.

There are minerals up there…satellite coverage to secure…base stations to establish…

I don’t believe any of this is factored into share prices when it comes to iron ore.

I also don’t think China property is as weak as all of us presuppose.

Do you know there are builders going broke in Queensland right now?

Probably not, I gather. No one is screaming here how Australian real estate is going to collapse because of it.

But a few wobbly developers in China are being extrapolated to crush the financial system.

Maybe. Maybe not.

I’ve seen very few people call China correctly over the years.

We can debate why that is, but the fact doesn’t change: China was supposed to collapse 10 years ago and never did.

There’s one final thought I have for you on iron ore. Right now, there is very little momentum in the Aussie market.

The only strategy that makes sense to me — until something changes — is a deep value one.

That’s not to say it will work. But I want to kick over stocks that have been smashed up already.

Iron ore shares fit that bill if nothing else.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.