In today’s Money Morning…we’ve heard it all before…I swear you like central bankers!…all roads lead to DeFi…and more…

Whoever said the transition to an alternative financial system would be smooth?

There’s a certain mindset out there, whether that’s Peter Schiff or others, that simply don’t get the crypto ethos.

Fad, bubble, Dutch tulip craze, etc.

We’ve heard it all before.

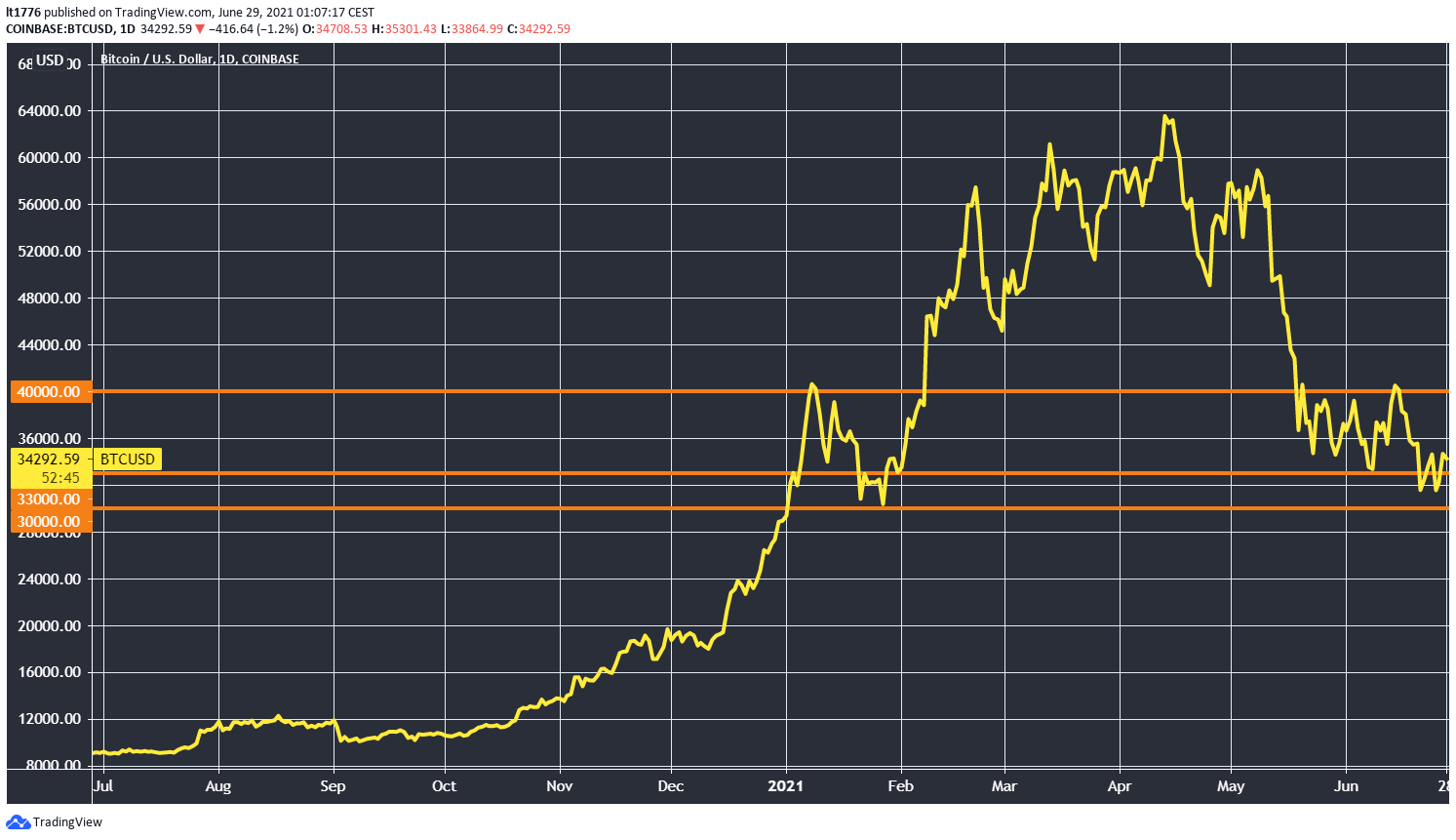

But hey, if Dutch tulips could rework a broken financial system that is entirely based on swathes of phoney money and bad debt, I’d say Dutch tulips should be worth at least US$34,000 a pop.

Which is exactly where the price of Bitcoin [BTC] currently sits:

|

|

|

Source: Tradingview.com |

What’s at work here is a clash of theory and practice.

Let me explain…

I swear you like central bankers!

There’s some debate as to the origins of the quote, but here it is again:

‘When the facts change, I change my mind. What do you do, sir?’

John Maynard Keynes (supposedly)

I don’t particularly care for Mr Keynes, but that doesn’t matter.

The point is that as an investor, theory should have little to do with your choices.

You should simply do whatever makes you better off. Facts change — change your mind.

In this sense, investing is a ‘thin’ concept that should be entirely centred on what works best in practice.

Don’t get me wrong I’m no moral relativist — the idea that there is no real right and wrong.

But when it comes to money and your investments, right and wrong is entirely played out on the charts and your P+L columns.

Whoever has the most profit wins the game.

Which brings me to the ever-changing narrative around bitcoin and crypto generally.

You see, there’s a certain cloistered mindset in the financial advice game that is in love with theory.

These are the same people who clip tickets and get a cut for delivering the tried and tested approach.

These are also the same people that cry ‘Scam!’, ‘Fake internet money’, and my favourite objection, ‘Well, they will just ban it anyway!’

Here’s a big revelation — it’s essentially been ‘fake internet money’ ever since Nixon took us off the gold standard and probably even since the Fedwire started operation in 1915–18.

So after decades of watching central bankers torch the value of fiat, how can the reasoned response be, ‘Well hoard that fiat in a cash savings account’?

Central bankers aren’t meant to be frenemies, just enemies.

I swear the same people recommending that you stick in cash, actually love central bankers.

And here’s where I think the crypto movement is heading…

Three Innovative Fintech Stocks to Watch Now. Discover more.

All roads lead to DeFi

Tyler Cowen, who is a professor of economics (you poor thing) at George Mason University, recently made a really interesting point:

‘You could say that crypto is a Trojan horse of a new and quite different financial system. If you have ever dealt with U.S. banks, and suffered through their bureaucracy and mediocre software, you might conclude that they are ripe for disruption. Banks in other countries may be even more vulnerable.

‘Obviously, as DeFi grows, questions of government oversight and control will come to the fore. Still, it seems unlikely that DeFi institutions will be regulated out of existence. DeFi can be run on platforms outside of the U.S., and American and European regulators cannot shut it down any more than they can prevent me from placing an online bet on a Mexican soccer game.

‘Keep in mind that significant swaths of the developing world currently use micro-credit, where borrowing rates of interest are often 50% or 100% on an annualized basis. It is likely that some of those countries will experiment with DeFi as an alternative method of credit allocation, regardless of whether those new institutions satisfy U.S. regulators in every regard.’

I think the Trojan horse analogy is pretty apt.

If crypto started as a way to exit the broken fiat system, then DeFi is a natural extension of that.

Get out, and then gut the thing by completely reimagining it.

This is the only choice available at this stage, and all roads lead to DeFi.

You could call it TINA (there is no alternative), but it’s a lot more than that.

At a really fundamental level, it’s about doing what works in practice, not theory.

So, I look forward to looking back in 10 years and seeing who was right about the monetary system.

The theorists or those who did what works best in practice.

I’m quietly confident.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.