Creso Pharma Ltd [ASX:CPH] share price is down today after releasing details of a capital raise to fund clinical trials and expand offerings.

Creso, the cannabis and hemp-derived product developer, saw its share price slide 6.5% at noon after receiving commitments to raise $18 million.

The news marked a busy month for the company with product, acquisition and dual-listing announcements.

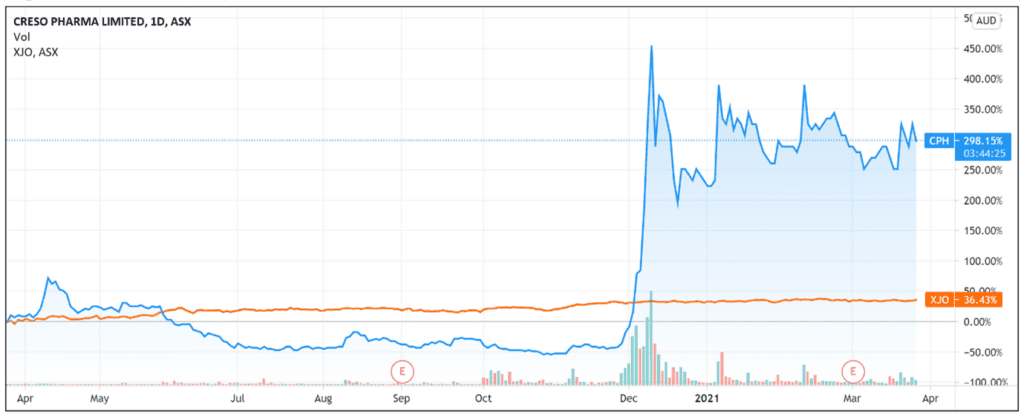

While the CPH share price is down 2% this month, the stock is still up 19% YTD and up 250% over the last 12 months.

Creso receives commitments to raise $18 million

This Wednesday, Creso requested a trading halt so the company could consider a capital raising.

Creso did request that its securities remain in pre-open until the completion and announcement of the capital raise or the commencement of trade today.

Four Innovative Aussie Small-Cap Stocks That Could Shoot Up

Today, Creso announced that it secured firm commitments from institutional, professional, and sophisticated investors to raise up to AU$18 million before costs by issuing approximately 94.7 million new fully paid ordinary shares.

The issue price was 19 cents per share, which was a 13.5% discount to Creso’s 30-day volume weighted average price.

According to reports from the Australian Financial Review, the placement was initially meant for $10 million but grew to $18 million ‘on the back of strong demand.’

Creso’s release noted that the placement was ‘heavily’ oversubscribed and ‘strongly supported by a range of local and international groups’, including John Langley Hancock and global fund manager L1 Global Master Opportunities Fund.

Creso is also seeking shareholder approval to issue placement participants one option for every four shares issued.

These options will be exercisable at 38 cents each on or before a date that is 12 months after the date of issue.

What will Creso do with the new funds?

Creso explained that it is now ‘well-funded to progress a number of value accretive opportunities.’

Some of these include Phase II and Phase III clinical trials initiatives with Halucenex.

The clinical trials in question test the efficacy of psychedelic molecules on a range of mental health conditions like depression and post-traumatic stress disorder.

The fresh capital will also fund the expansion of Creso’s nutraceutical offerings and scale operations at the company’s Canadian subsidiary Mernova based on rising demand for Mernova’s products.

Finally, a portion of the placement will go towards Creso’s upcoming dual-listing on the OTCQB.

Creso believes the listing will open it up to the big North American investment community.

Creso acquires Halucenex

Today’s announcement comes after Creso recently acquired Canada-based Halucenex Life Sciences.

Halucenex researches, develops, and licenses psychedelic molecules for global pharmaceutical and nutraceutical markets.

As we’ve covered here in Money Morning, Creso announced on Tuesday that Halucenex secured an additional 700mg of pharmaceutical grade psilocybin from a manufacturing partner who is also Canada’s only pharmaceutical grade synthetic psilocybin manufacturer.

Labelling it a ‘major development’ Creso notified the ASX that Halucenex’s additional psilocybin stock allows the company to increase the number of clinical trial participants in Phase II of its trial.

Creso believes the Halucenex acquisition is important as Halucenex’s manufacturing partners can help overcome what Creso describes as a ‘bottleneck developing in the supply chain for synthetic psilocybin as more companies enter the research domain.’

According to Creso, Halucenex’s relationship with manufacturers also lowers the risk of clinical trial delays.

CPH share price outlook

As we’ve said this week, Creso’s string of announcements this month suggests it is well-organised and heading in the right direction.

But with a sector contingent on government regulations and regulatory bodies like the FDA, the path forward is never certain.

On top of that, Creso itself seems to recognise that there is also a flood of competition lately.

As I’ve mentioned earlier, Creso admitted that there are already bottlenecks in the supply chain for key material like synthetic psilocybin due to more companies entering the research space.

Its acquisition of well-connected Halucenex may therefore be a smart strategic move but there’s no doubt a long way to go for Creso and its peers.

Pot stocks are can be volatile but the wider cannabis and psychedelic trend is one worth following.

If you’re looking for more insights into the sector and pot stocks in particular, then check out our latest free report, which discusses three pot stocks worth looking at investing in right now.

Get your free copy here.

Regards,

Lachlann Tierney,

For Money Morning