Australia’s largest fruit and vegetable giant, Costa Group [ASX:CGC], has given the nod to a takeover offer of $1.5 billion from a consortium led by private equity firm Paine Schwartz Partners.

This strategic move comes as Costa Group navigates the unpredictable terrain of the agricultural sector, which has seen tough growing seasons in recent years.

The offer of $3.20 per share represents a reduction from the initial bid of $3.50 per share made by Paine Schwartz Partners in May. It’s been cut after extensive due diligence, which has highlighted Costa’s slightly dimmer profit outlook and a $30 million setback due to adverse weather conditions.

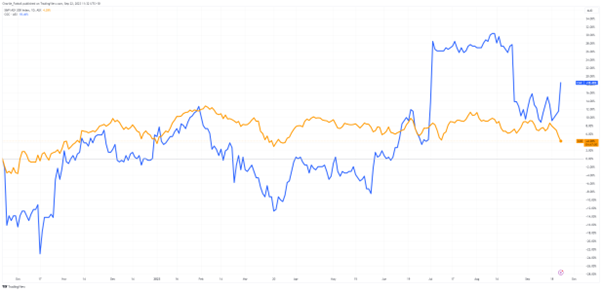

Costa Group boasts an extensive growing portfolio encompassing berries, mushrooms, citrus fruit, tomatoes, and avocados. With 7,200 hectares of farmland in Australia and a presence in Morocco and China, Costa has been a fixture on the ASX since 2015, with shares reaching as high as $6.90 in late 2018.

Shares of the company are up by 6.21% today, trading at $3.08 this morning after the news.

Source: TradingView

A fair price for all

The board of directors of Costa Group, Australia’s largest fruit and vegetable company, has agreed to a reduced-price takeover offer of $1.5 billion from a consortium led by private equity firm Paine Schwartz Partners.

Paine Schwartz Partners, the same firm that took Costa public in 2015, initially acquired a 13.8% stake in Costa at $2.60 per share last October.

Since then, they initiated discussions in April about a takeover bid ranging from $3.20 to $3.30 per share. This culminated in a non-binding proposal in May, valuing Costa at $1.6 billion with an offer of $3.50 per share on the provision of due diligence.

Since then, the company has faced challenges from adverse weather conditions, cost inflation pressures, and labour availability issues.

Costa’s net profit dipped from $40.3 million to $37.8 million compared to the prior-year period, and earnings before interest, tax, depreciation, and amortisation increased to $150.2 million from $140.1 million.

After disappointing results in its last earnings report saw shares drop nearly 14% overnight and left Costa shareholders in the lurch about the deal, the revised deal will probably be seen as a fair price for all parties.

Despite the belief in Costa’s solid fundamentals, the Costa board is inclined towards the cash offer, given the current uncertain operating environment.

Neil Chatfield, the Chairman of Costa, emphasised this in a statement today, saying:

‘While the Costa board has confidence in the long-term fundamentals of the company, the scheme provides certainty for shareholders in an uncertain operating environment by delivering cash proceeds to shareholders at an attractive premium.’

The deal puts a price tag of $1.5 billion on Costa’s equity and represents a 43% premium over the closing price on 25 October, 2022, prior to Paine Schwartz’s initial stake acquisition.

Costa shareholders will cast their votes on this proposal at a scheme meeting, with an independent expert also to be assigned to assess the offer’s fairness.

Paine Schwartz Partners specialises in agribusiness and food chain buyouts. In addition to Paine Schwartz, the consortium includes prominent entities like Californian berry group Driscoll’s Inc, and the British Columbian Investment Management Corp.

Outlook for Costa

Moving forward, Costa will be hoping for a stronger growing season across its operations.

Costa’s recent interim results as of 31 August revealed that the citrus season started late, causing most earnings to be deferred to the second half of the fiscal year.

This meant a forecasted $30 million revenue impact as fruit sizes fell short of expectations in its citrus farming across central QLD and northern Victoria.

Thanks to Costa’s Moroccan and Chinese holdings, the company benefited from its geographic diversity in experiencing the worst of this weather. But at least now, Australian growers can expect a better season with a strong El Niño officially here.

Along with more favourable growing conditions, Costa has also signalled that some of the cost pressures— such as labour shortages— have begun to ease.

Their continued program of insourcing Pacific seasonal workers should allow them to capitalise on the bumper crop and return a more robust cashflow next season.

For CY24–25, the business will see many of its large-scale planting projects mature, especially from its 2PH Citrus acquisition in QLD and its premium berry patches in China and Morocco.

Those lucrative berries could eventually be spun-off by Driscoll’s, one of the consortium members and a global berry heavyweight.

Overall, Costa’s acceptance of the $1.5 billion takeover offer is a sound strategic move aimed at providing shareholders with a premium in the face of ongoing market uncertainty.

While the offer represents a reduction from the original bid, it should be considered fair, given Costa’s challenges.

The decision now rests in the hands of Costa’s shareholders as they cast their votes on this crucial proposal.

Why you can’t rely on nature for everything

Costa’s recent performance shows that the sun can make or break a company’s profits.

It can also play havoc on our power systems.

Renewable energy sources tend to fluctuate in generation as they rely on natural forces we can’t control.

The sun doesn’t always shine, and the wind doesn’t always blow.

Similarly, the demand for power changes throughout seasons and times of day. Often, these requirements can be at direct odds with renewable power sources.

With the flawed intermittent nature of renewable energy, many expensive solutions are required to fill the gaps so that heavy industry, manufacturing, or homes can get reliable power when needed.

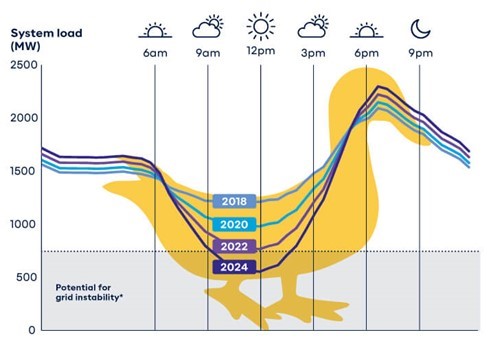

This gap is known in the solar industry as the ‘duck bill curve ‘.

Source: Synergy (WA Estimates)

During the day, when demand is lowest, and the sun is shining the brightest, solar can overload transmission lines designed for one-way electrical flows, leading to instability in grids.

At the head of the duck, these grids are again put under stress as demand rises and solar output falls to nil.

To make up for these shortcomings, expensive solutions are touted for new battery storage solutions and over 10,000 kilometres of new transmission lines to carry these renewables.

That’s a nine-fold increase in transmission lines that will also require batteries and new infrastructure to manage the needs of renewables.

And all of this is supposed to come in the next seven years.

Our Editorial Director Greg Canavan has been looking into the cost and implications of Australia’s energy transition to renewables from an economic perspective.

He thinks he’s found a gap in the market where Australians can follow hedge fund investors and billionaires like Warren Buffett into smart investments before the market realises.

If you want to learn more about how you can position yourself in the coming Net Zero changes and the potential U-turn governments will have to make, then…

Regards,

Charles Ormond

For Money Morning