The Core Lithium Ltd [ASX:CXO] announced today that construction has started on its 100%-owned Finniss Lithium Project.

Today’s update follows the announcement of a Final Investment Decision (FID) on 30 September 2021.

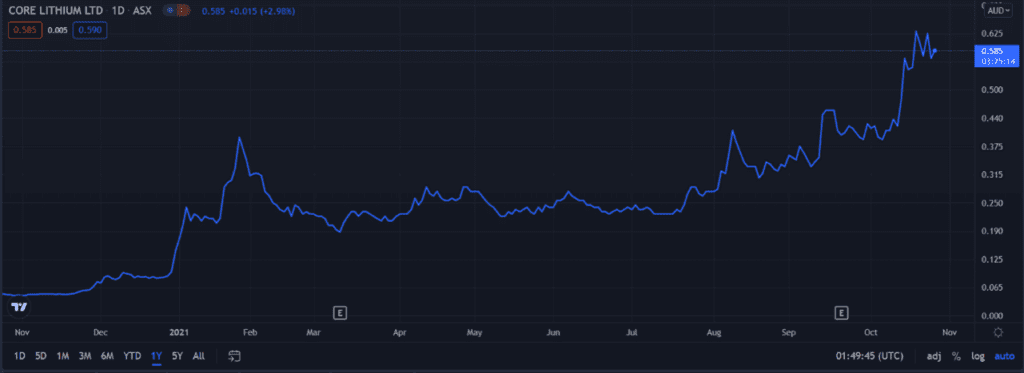

Core Lithium Ltd [ASX:CXO] share price was up 3% at time of writing.

The rising interest in lithium as a key material in the looming EV boom has seen ASX lithium stocks like CXO rise in value quickly.

Over the last 12 months, the CXO share price rose 1,100%.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Construction commences at Finniss

Finniss is the newest lithium mine in Australia, located in the Northern Territory.

CXO describes Finniss as the only new Australian company set to start lithium production in 2022.

Of course, Australia is already home to established lithium producers like Mineral Resources Ltd [ASX:MIN] and Pilbara Minerals Ltd [ASX:PLS].

Core updated the market today, relaying that site construction and establishment works are now underway in preparation for mining activity later this year.

Road access works, construction of communications, fuel, and water supply infrastructure have also been initiated.

CXO expects first production of lithium concentrate in Q4 2022.

Finniss is fully funded following the successful raising of $150 million from institutional investors and shareholders, including a $34 million placement to Ganfeng coupled with a four-year offtake agreement.

Ganfeng is one of the world’s largest lithium producers by production capacity.

Approximately 80% of Finniss’ initial output is now covered under offtake agreements with Ganfeng and Yahua, a key lithium supplier to Tesla.

What next for CXO?

Core Lithium described Finniss as ‘Australia’s lowest capital intensity lithium project.’

CXO thinks the project’s ‘modest’ project capex and strong cash flows (outlined in the recent DFS), will enable ‘rapid payback from the sale of the first concentrate.’

Core Lithium Managing Director Stephen Biggins today offered his thoughts:

‘At a time when Australia is firmly focused on both the generation of renewable resources and future job prospects for the regions, Core is incredibly proud of this milestone we’ve reached in the Northern Territory today.

‘This next phase of the Company will be transformational, and we are excited to see construction milestones met at Finniss over the coming 12 months, ahead of first production before the end of 2022.’

CXO rounded off its update by flagging its intention to invest in plans to expand production at Finniss.

If you’re looking for more opportunities within the lithium theme, then you need to read our latest report. It’s a detailed overview of what is happening in this extremely exciting sector right now.

Plus, the report profiles three stocks that our team believes could offer investors the best shot at capitalising on this lithium resurgence.

Check out the full report, for free, right here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here