Core Lithium Ltd’s [ASX:CXO] share price rose 4% today on news of a lithium exploration breakthrough.

CXO shares were up as much as 8% in early trade before pulling back to trade at 26.5 cents per share at time of writing.

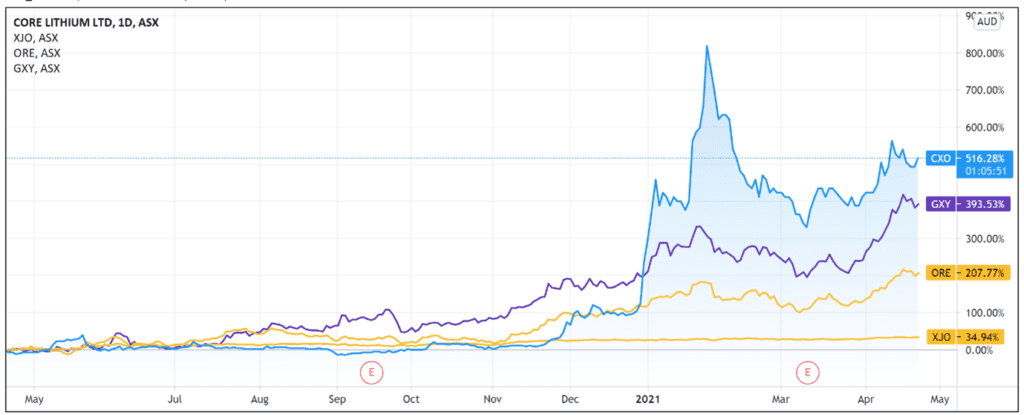

Year-to-date, the CXO share price is up 80% and a substantial 560% over the last 12 months.

ASX lithium stocks back in the limelight

As we’ve covered recently, ASX lithium stocks are benefiting from renewed attention as governments the world over shift to green energy solutions and automakers scramble to get EV models off assembly lines.

The renewed interest has led to surging lithium prices and two big ASX lithium players announcing a mammoth merger.

I am of course referring to Galaxy Resources Ltd [ASX:GXY] and Orocobre Ltd [ASX:ORE] joining forces to create a $4 billion global lithium chemicals firm, the fifth largest in the world.

But with Australia accounting for 52.9% of global lithium production in 2019, it is not just the likes of Galaxy and Orocobre contributing to the white metal supply chain.

Core Lithium’s NT breakthrough

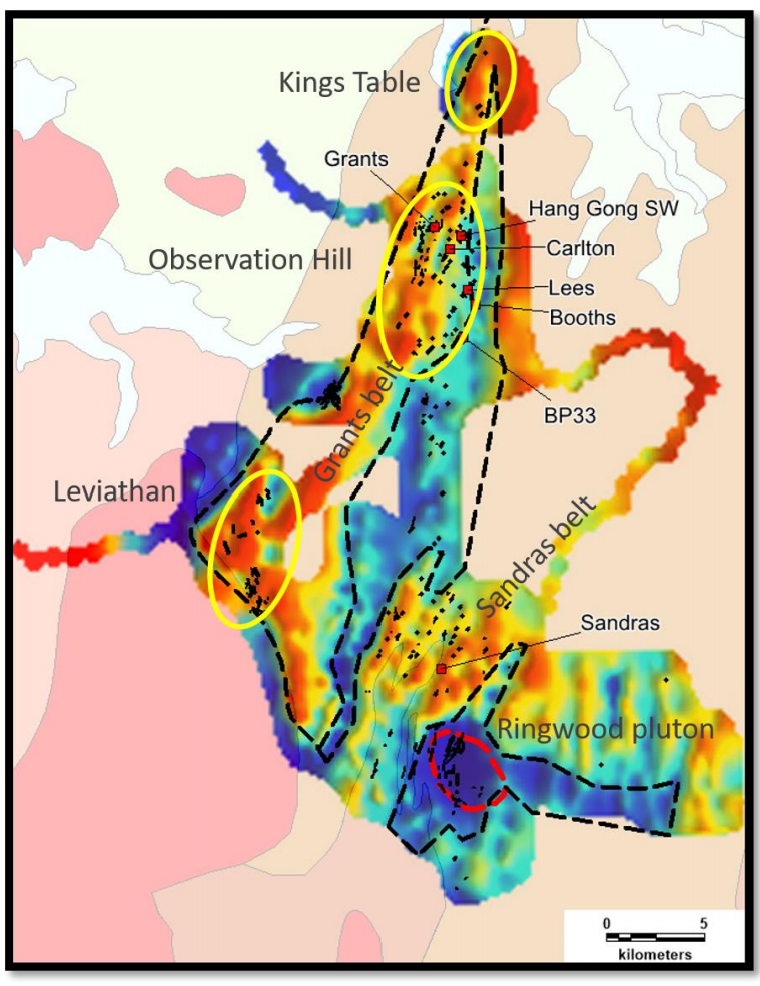

Today, CXO announced that a geophysical survey co-funded by the company and the Northern Territory government successfully defined lithium pegmatite.

Geophysical surveys showed a ‘strong correlation with lithium pegmatite distribution’ within CXO’s Finniss Lithium Project, located near Darwin.

Survey data was collected over a 500x500m and 500×1,000m grid of gravity stations through the majority of Core’s Finniss tenements.

The survey identified a potential lithium-pegmatite corridor that extends from the King Table Group in the north to the Leviathan Group in the south and includes the lithium-rich Observation Hill Group.

Core does not believe that the identified pegmatite groups are unique clusters.

In its view, the currently defined distribution of pegmatites is due to ‘large tracts of prospective ground between Grants and Leviathan.’

Core Lithium Managing Director Stephen Biggins thought the gravity survey ‘has shown to be a real gamechanger for lithium exploration in the NT.’

What next for Core Lithium Share Price?

CXO revealed it will commence follow-up gravity surveys this quarter at its Finniss project.

The gravity surveys will have the potential to ‘directly identify pegmatite drill targets and focus Core’s upcoming exploration and drilling campaigns.’

CXO also announced it is finalising drilling contracts and is planning to mobile field crews in the ‘coming weeks’ to commence a ‘huge exploration and resource push this year.’

Additionally, Biggins flagged that the company is also finalising its key commercial and financial milestones.

The milestones will enable the lithium developer to reach a final investment decision next quarter.

Anticipating strong lithium demand for the foreseeable future, investors were pleased by the positive survey results today.

But it should be noted that CXO has a long way to go and more boxes to tick off before it can begin producing at scale.

No doubt, the market will be eagerly watching Core’s exploration push later this year.

As I’ve mentioned, ASX lithium stocks are riding a strong wave of interest recently.

Therefore, if you want more information on a sector enjoying a resurgence, I recommend reading our free lithium 2021 report.

The report analyses the sector as well as three Aussie lithium stocks with the potential to shoot up as demand for lithium bounces back.

Regards,

Lachlann Tierney,

For Money Morning

Comments